【编者按】全球最大航运组织BIMCO罕见发声,直指美国对华海运制裁恐成"回旋镖"。本文披露BIMCO致美国贸易代表的警告信函:拟议的"中国造"船舶港口费政策或将引爆美国通胀炸弹,LNG出口恐遭"锁喉",大豆等民生商品首当其冲。更值得警惕的是,美国自诩的"造船业复兴"面临残酷现实——同型船舶建造成本竟达韩国5倍。当保护主义撞上全球化供应链,这份报告揭示了怎样的经济悖论?看航运业如何用数据预言政策风暴的连锁反应。

原文如下,中文翻译在原文下方:

HE Mr Jamieson Greer

United States Trade Representative

600 17th Street NW

20508 Washington

District of Columbia

United States of America

17 March 2025

Dear Ambassador

BIMCO, the largest direct entry membership organisation in the shipping industry representing almost 2,100 members and 63% of the global merchant fleet, measured by deadweight tonnage (DWT), would like to thank you for allowing us to comment on your proposed actions aimed to tackle China’s dominance in the maritime, logistics and shipbuilding sectors.

For context, BIMCO has members in 130 countries, including the United States of America and the People’s Republic of China, who own, manage, operate or charter ships of all sizes in all sectors of merchant trade.

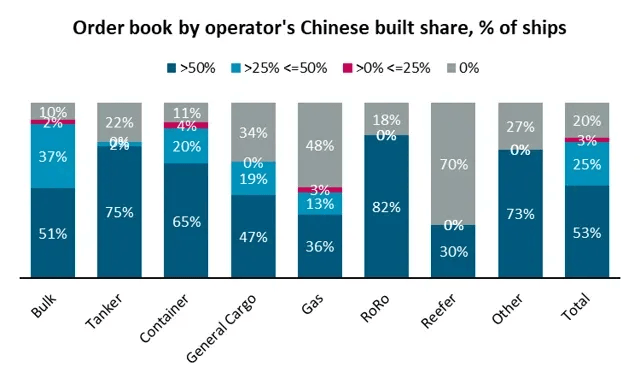

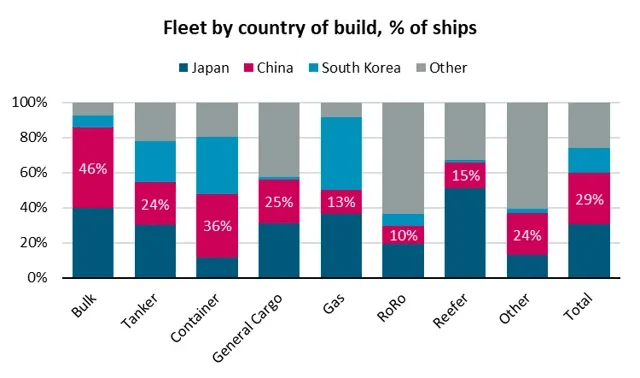

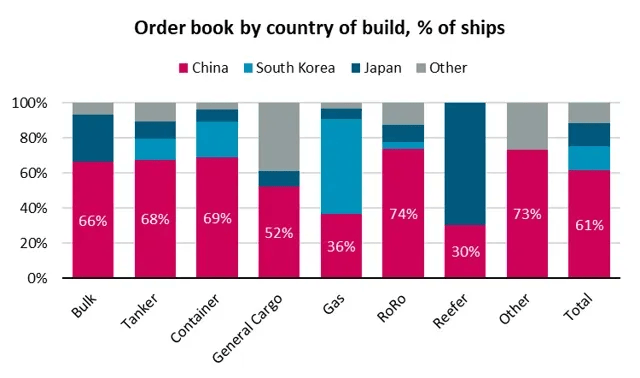

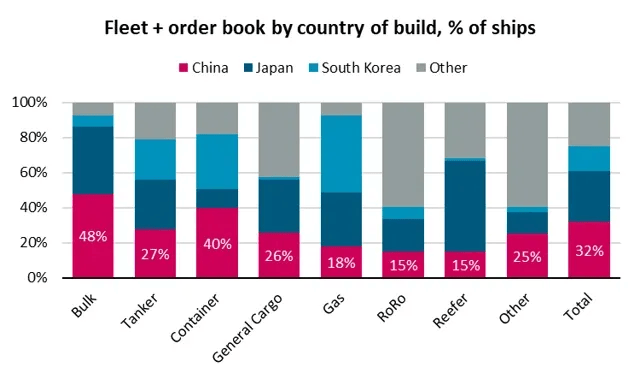

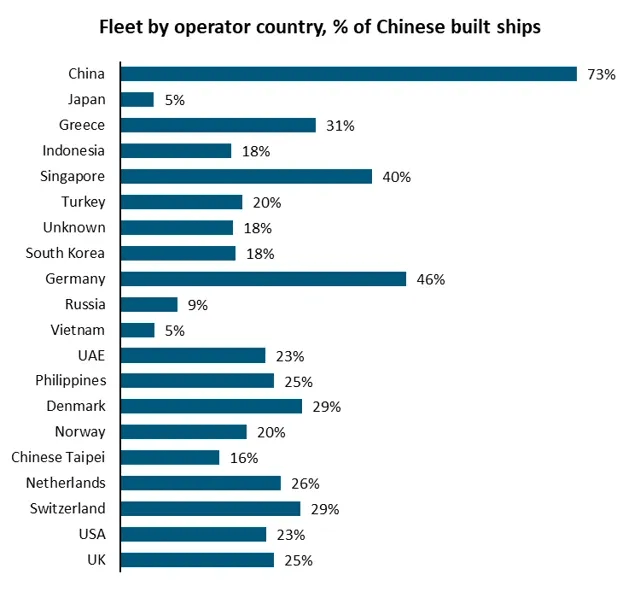

For decades BIMCO members have contracted the construction of new ships in a competitive international market where Asian shipyards have taken an increasing market share, particularly in China in recent years. The share of Chinese built tonnage1 of international operators’ fleets has increased in the last decade with less complex ship types being procured initially, followed by more complex ship-types.

Due to the very competitive nature of the international shipping market, the increase in cost-effective ships of Chinese origin has resulted in comparatively lower costs for maritime transport positively supporting world trade and global economies, including the United States of America.

The ships already built of Chinese origin will not disappear from the world fleet if the proposed port fees are introduced. If they had, it would have created a global shortage of tonnage serving the world’s transport needs and hyper-inflated shipping costs2. Rather, the shipping industry will seek to avoid paying fees.

Charging fees on ships calling at US ports due to Chinese origin of the calling ships, Chinese domestication of the operator, the operator’s fleet’s percentage of Chinese origin ships and the operator’s order book’s percentage of Chinese contracts, will significantly increase the cost of seaborne transport to and from the United States of America – even if operators are pursuing avoidance strategies.

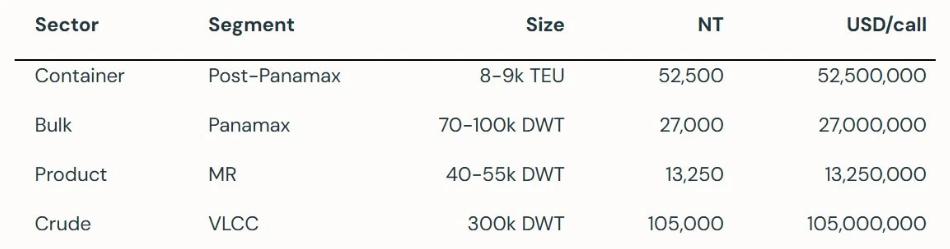

We expect operators will react and seek to avoid the negative effects of such port fees on their business. Most operators in the world have in their fleet3 one or more ship(s) of Chinese origin meaning that when calling at a US port, they would be subject to a port fee. Port fees are passed on in the supply chain so the costs would be passed on to the US importers of foreign goods and, ultimately, the US consumer. We note that the second option of port fees for ships operated by Chinese operators is likely prohibitive for continued trading to US ports. A fee of USD 1,000 per net tonnage on, for example, a 300,000 DWT super tanker is more than USD 100 million per port call4.

If the proposed fee structure is implemented as drafted, seaborne trade to and from the United States of America will become less efficient and less economically viable. It is likely that some operators would shy away from having Chinese tonnage in their fleets and dedicate their maritime operations towards the US market. Other operators might do the opposite, increasing their share of Chinese tonnage and dedicating their maritime operations to non-US trade. The totality of the world fleet would not change, but the overall cost of maritime trade would increase due to less competition in the now segregated US market. In this regard it is worth keeping in mind that US import/export is about 12% of global seaborne trade so the consequences of re-organising maritime trade will have a much bigger impact on US import/export than on trade in the rest of the world.

While a macro analysis points towards avoidance, some sectors are more adaptive than others. In this regard the container shipping sector with relatively few, very large operators may be less prone to market segmentation and rather seek to minimise the number of port calls in the US per ship. This will inevitably lead to port congestion, trade flow chocking and increased inland re-distribution need. Fewer port calls will also have negative impact on port jobs with some ports becoming potentially unattractive for foreign trade.

Higher transport cost for US imports of raw materials will, due to such commodities’ relative low value, be impacted much more than higher value import goods. This effect runs counter to other stated objectives of the US Administration, such as increasing production domestically with its associated need for more raw materials.

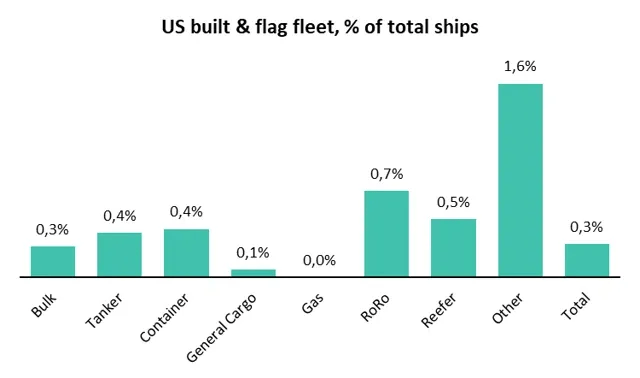

A section of the proposed actions pertains to US export. In this regard we note the desire to stimulate the construction and operation of US built, US flagged ships. So far, such activity has been limited, primarily serving domestic US transport as required under the Jones Act.

We note, however, that the tonnage5 presently available to fulfil the proposed export requirements are limited in numbers, size and types. Few maritime operators, if any, will be able to document that their annual, per calendar year, share of US export will meet the required 20% to be carried on US built, US flagged ships. This effectively means that little, if any, US export could be undertaken post implementation, not least energy export, specifically liquid natural gas (LNG) as no US built, US flagged LNG carriers are in operation nor on order. The US chemical industry’s access to vital export markets will also be severely impeded.

Whether or not a requirement to carry US export on US built, US flagged ships in the future is realistic is beyond the scope of these comments. US shipbuilding has not been competitive6 for a long time, witnessed by the lack of US built tonnage in the world fleet. However, we note that if it is required to carry US export on US built, US flagged tonnage, and that such tonnage is becoming available, the transport cost would increase significantly and impact US export’s competitiveness on the world market. This is especially true for low value commodities such as grain and soy.

In summary, the proposed actions will impose much increased transport costs on US imports and exports and have negative effects on the wider US economy; their impact on Chinese dominance is much less certain.

Yours truly

Lars Robert Pedersen

Deputy Secretary General & Director of Regulatory Affairs

BIMCO

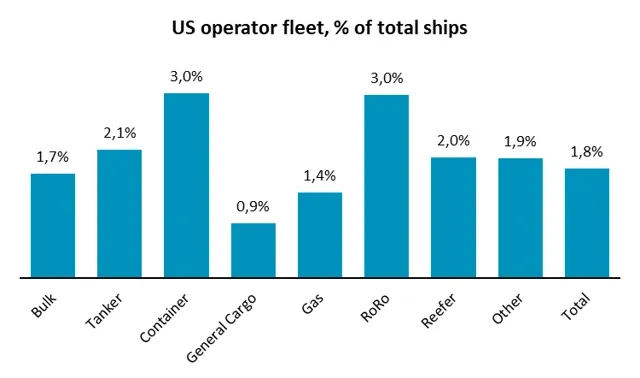

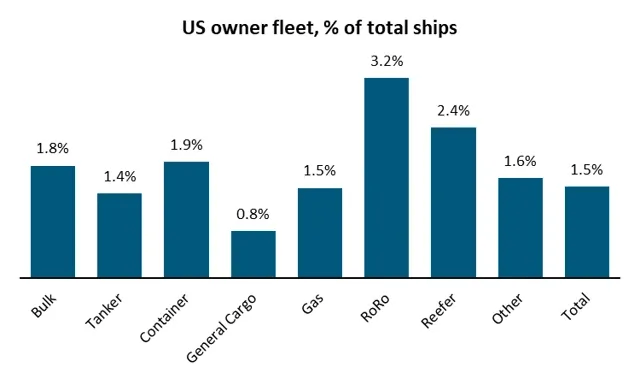

[1] See Appendix (A) for data on operators’ fleet composition in different sectors

[2] This is evidenced in recent years with the Houthi attacks in the Red Sea: diversion of ships around the Cape of Good Hope created a tonnage shortage and shipping rates jumped significantly.

[3] See appendix (B) for data on Chinese origin ships in each sector

[4] See appendix (C) for additional data on proposed net tonnage fee on different ship types and sizes

[5] See appendix (D) for data on current US fleet

[6] See appendix (E) for data on indicative price levels for US built tonnage

Appendix

(A)

(B)

(C)

(D)

(E)

MR tanker built in Korea is $50 million - US around $250 million

3600 TEU Container ship built in Korea is around $50 million - US around $ 333 million

BIMCO已提交意见正文,请点击下述附件

以下为中文翻译参考件

HE Mr Jamieson Greer

美国贸易代表

美国华盛顿特区17街600号

邮政编码:20508

华盛顿哥伦比亚特区

美国

关于根据301调查法案对中国针对海事、物流和造船领域主导地位的行为采取行动的征求意见稿

尊敬的大使,

BIMCO(波罗的海国际航运公会)是全球最大的直接会员制航运组织,我们代表近2,100个会员以及63%的全球商业船队(按载重吨位计算),衷心感谢您允许我们就您提出的旨在应对中国在航运、物流和造船领域主导地位的措施提出意见。

作为简要的背景介绍,BIMCO在约130个国家拥有会员,其中包括美利坚合众国(“美国”)和中华人民共和国(“中国”),BIMCO的会员拥有、管理、运营或租赁所有吨位和所有类型的船舶,业务范围涵盖所有商业贸易领域。

几十年来,BIMCO的会员一直在竞争激烈的国际市场中签订新船建造合同。在此期间,亚洲船厂,尤其是中国船厂的市场份额不断增加。过去十年中,中国造船舶在国际运营商船队中的份额 有所增加,最初是较为简单的船型,随后逐步转向更为复杂的船型。

由于国际航运市场具有高度竞争性,因此高性价比的中国造船舶的份额增加,导致海上运输的成本下降,这对包括美国在内的世界贸易和全球经济起到了积极的支撑作用。

已建成的中国造船舶不会因征收拟议的港口费用而退出全球船队,因为这会导致全球船舶运力短缺,无法满足全球运输需求,最终导致航运成本急剧上升 。相反,航运业将寻找规避费用的方法。

即使运营商将寻找规避费用的策略,但对挂靠的中国造船舶、中国背景的船舶运营商,或根据运营商船队中中国造船舶的比例、及运营商手持订单中中国造船合同的比例收取港口费用,都将显著增加进出美国的海运成本。

我们预计运营商将对此做出反应,并寻求规避此类港口费用对其经营的负面影响。世界上大多数运营商在其船队 中都拥有一艘或多艘中国造船舶,这意味着当它们挂靠美国港口时,将面临港口费用。港口费用产生的成本会通过供应链转移,因此前述成本将转移给美国的外国商品进口商,并最终由美国消费者承担。我们注意到,第二种针对中国运营商船舶的港口费用选项可能会使其继续向美国港口贸易变得不再可行。例如,对于一艘30万吨DWT的超级油轮,每净吨位 1,000 美元的费用将使其在每个港口挂靠的费用将超过1亿美元 。

如果实施草案拟议的费用结构,进出美国的海运贸易变得低效,并且经济可行性将会降低。部分运营商可能会移除其船队中的中国造船舶,并将其航运业务集中在美国市场,而其他运营商则可能会采取相反的做法:增加中国造船舶的比例,并将其航运业务集中在非美国市场。全球船队的总量不会改变,但由于市场被分割、竞争性降低,航运贸易的总体成本将增加。值得重视的是,美国的进出口大约占全球海运贸易的12%,因此重塑海运贸易的后果将对美国的进出口产生比非美国市场更大的影响。

虽然宏观分析指向规避港口费,但某些细分领域的适应性要强于其他细分市场。在这方面,集装箱航运行业由于运营商数量相对少而体量相对大,因此不易受到市场分割的影响,但是运营商可能考虑将每艘船在美国港口挂靠的数量降至最低。这将不可避免地导致港口拥堵、贸易流动受阻和内陆的二次分拨需求增加。减少港口停靠次数也会对港口就业产生负面影响,一些港口可能对外贸失去吸引力。

由于大宗商品的价值相对较低,因此美国进口运输成本升高对大宗商品产生的影响,将比高价值进口商品更大。而这种影响将与美国政府提出的其他目标产生冲突,例如需要更多原材料去发展国内制造业产能。

提案中的一部分涉及美国出口贸易。我们注意到希望通过提案促进建造和运营美国造、悬挂美国国旗船舶的意向。但目前为止此类活动仍然规模有限,主要用于《琼斯法案》(Jones Act)所规定的美国国内运输。

然而,我们注意到目前能够满足提案的出口要求的船舶数量、吨位 和类型均有限。极少数、甚至没有船舶运营商能够证明其每个自然年运输的美国出口产品中,通过美国建造、悬挂美国旗帜的船舶进行运输的比例能达到所需的20%。这实际上意味着,提案实施后美国出口贸易将几乎无法进行,特别是液化天然气(LNG)出口,因为目前并没有美国建造、悬挂美国旗帜的LNG运输船的手持订单,或正在运营的此种船舶。美国化工业进入关键出口市场也将严重受阻。

是否要求未来的美国出口产品必须由美国建造、悬挂美国旗帜的船舶来运输,事实上已经超出了本次意见征求的范围。从世界船队中缺乏美国造吨位的现象反映出,美国造船业正处于长期缺乏竞争力 的情况下。然而,我们注意到,如果需要由美国造、悬挂美国国旗的吨位运输美国出口产品,并且这些吨位可用的情况下,那么美国出口产品的运输成本将显著上升,并可能影响美国出口产品在全球市场上的竞争力。上述影响对低附加值的货物,如粮食或大豆等会尤为明显。

综上所述,拟议的措施将大幅增加美国进出口贸易的运输成本,并对更广泛的美国经济产生负面影响;但它们对中国主导地位的影响则不甚确定。

[1] 有关不同领域的船队组成数据,请参见附录(A)

[2] 近年来胡塞武装在红海的袭击事件能够证明这一观点:船舶绕航好望角造成了运力缺口,运价随即大幅跃升

[3] 中国造船舶在每个细分部门中的数据,请参阅附录(B)

[4] 有关不同船型和尺寸的拟议净吨位费的更多数据,请参阅附录(C)

[5] 当前美国船队数据,请参阅附录(D)

[6] 关于美国造吨位的指示性价格水平的数据,请参阅附录(E)

此致,

Lars Robert Pedersen

04-02 来源:信德海事网

05-09 来源:信德海事网

10-12 来源: Drewry德路里

01-16 来源:信德海事网

10-18 来源:信德海事

05-29 来源:信德海事网

07-12 来源:SinorigOffshore

01-01 来源:信德海事网

10-20 来源:信德海事网 马琳

02-12 来源:信德海事网