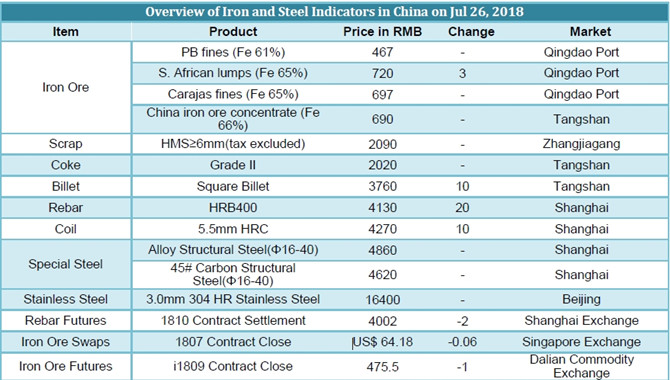

- Chinas imported iron ore market remains buoyant along with a RMB5/tonne rise in mainstream resources. Traders are bullish on the market thus tend to hold up prices as futures continue to strengthen this week. Steel mills show some buying inxinde marine news2018-07-26 16:37:21

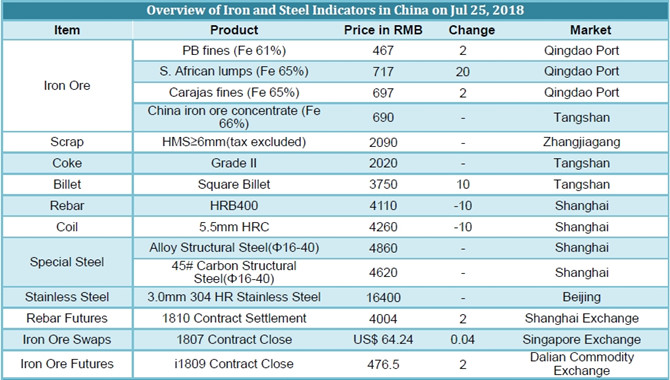

- Chinas imported iron ore market remains buoyant. After a downward fluctuation in futures market in early morning, iron ore futures show signs of moving upwards. Boosted by bullish steel market and shored up by production control, iron ore pxinde marine news2018-07-25 16:52:11

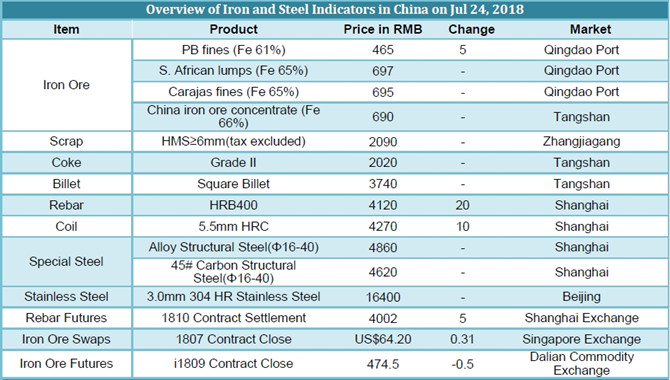

- Chinas imported iron ore market remains robust on Monday. Iron ore lumps and pellets will continue to find support due to restriction of production control in Tangshan, while PB fines demand in Tangshan is to remain weak on sintering cut. Hxinde marine news2018-07-24 16:05:36

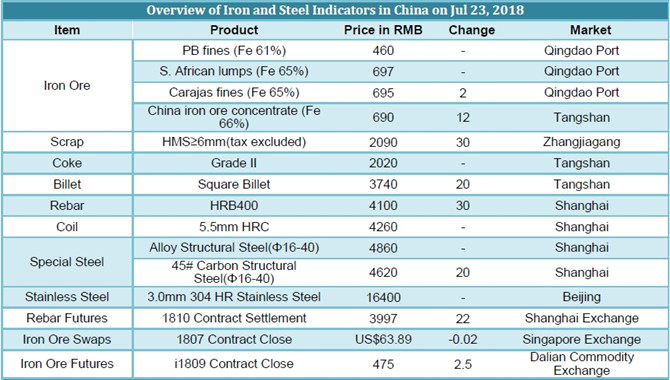

- Chinas imported iron ore market remained robust with slight price hike for iron ore pellet, lumps and concentrates in light of higher buying interests. Traders focused on sales on weak fundamentals, and the production control and environmenxinde marine news2018-07-23 16:03:09

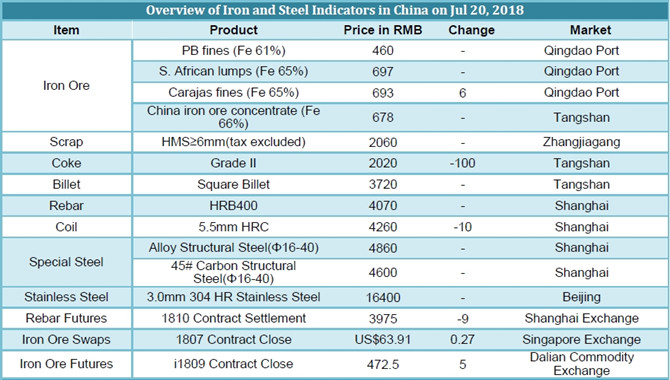

- Chinas imported iron ore market inched upwards in tandem with upswing futures market. Traders focused on sales while steel mills sustained normal procurement due to ample stocks at ports. Their demand was concentrated on mainstream iron orexinde marine news2018-07-20 16:27:21

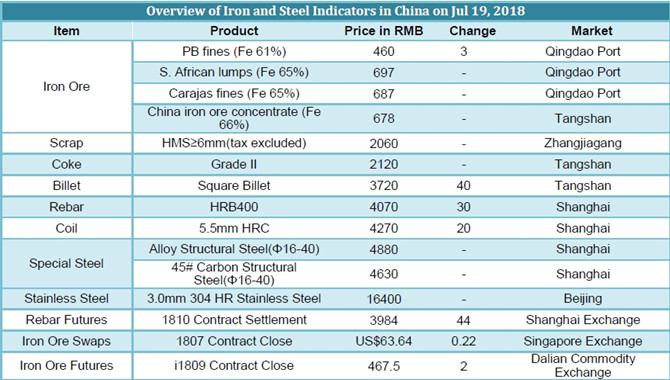

- Chinas imported iron ore market extended the narrow fluctuation. Traders were active in spot market while steel mills showed no strong buying interests. Mainstream iron ore resources were quoted firm and some Brazilian resources saw a slighxinde marine news2018-07-19 16:26:20

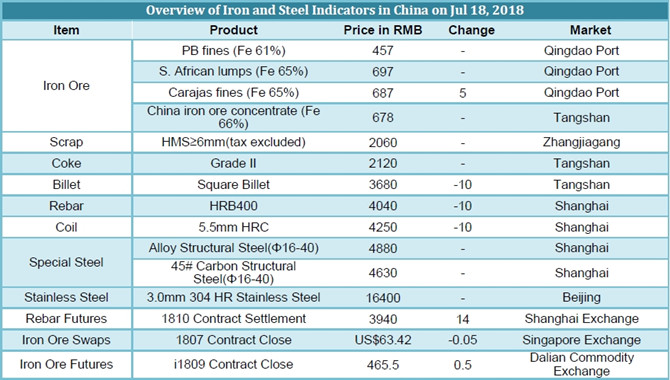

- Chinas imported iron ore market continued to see narrow fluctuation. Traders were eager to sell and held quotations firm; some Brazilian resources in tight supply saw a slight price hike of RMB3-5/tonne. Steel mills showed no active procurexinde marine news2018-07-18 16:41:15

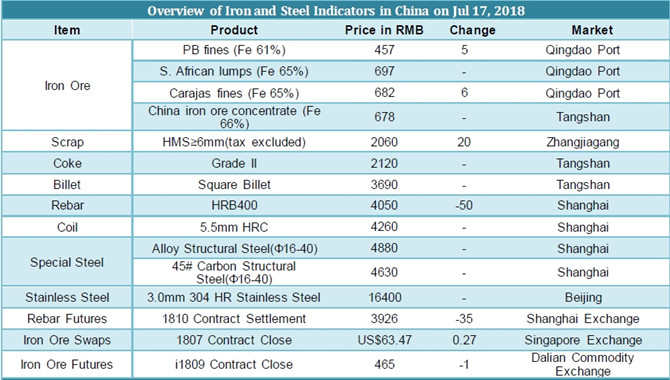

- Chinas imported iron ore market was stable in the morning along with narrow fluctuation in futures market. Currently, PB fines prices saw a narrow price gap with MAC fines due to high stocks. Traders expressed that most steel mills preferrexinde marine news2018-07-17 17:41:05

- An oil and gas field in northwest Chinas Xinjiang Uygur Autonomous Region built by Sinopec Group, the worlds largest oil refining, gas and petrochemical conglomerate, has been able to produce 500,000 tonnes of crude oil annually. As of Junexinde marine news2018-07-17 16:26:27

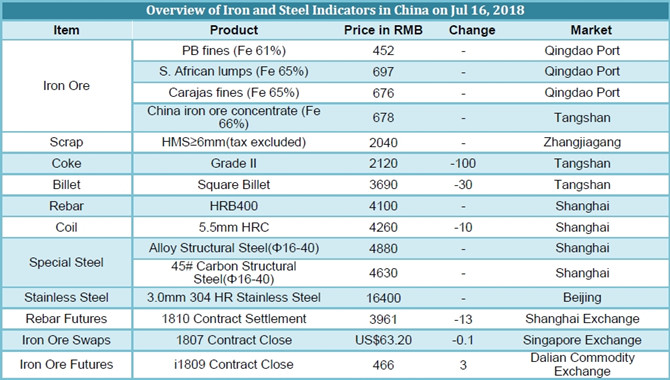

- The quotation of imported iron ore remains unchanged in the morning. Steel mills hold wait-and-see attitude after replenishment in this week. Currently, iron ore lump price in Shandong is higher than that of Tangshan with favorable demand axinde marine news2018-07-16 16:03:17

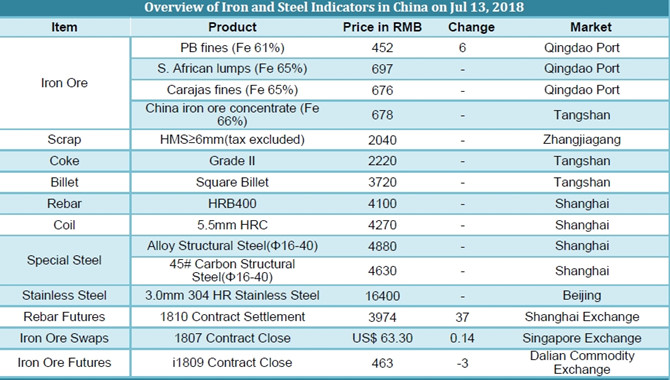

- Chinas iron ore futures market shocked in strong trend today. As a result, the spot price at port remained unchanged in the morning compared with that of yesterday and prices of partial specifications went up by RMB3-5/wmt. Quotes of Brazilxinde marine news2018-07-13 15:31:50

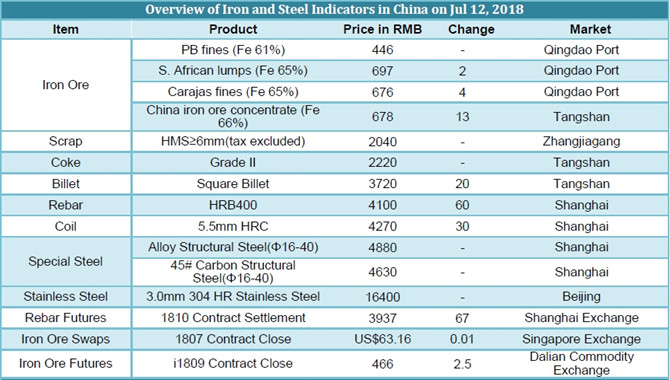

- Under the influence of fluctuated international market situation, the Chinas futures market of iron ore shocked in a narrow range. Traders quotations in the morning remained stable compared with that of previous day, while prices of partialxinde marine news2018-07-12 16:55:50

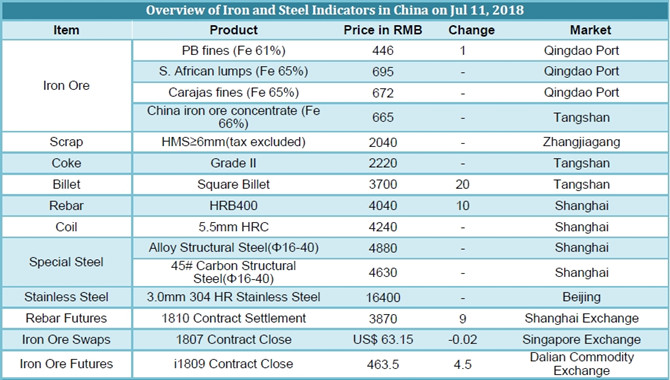

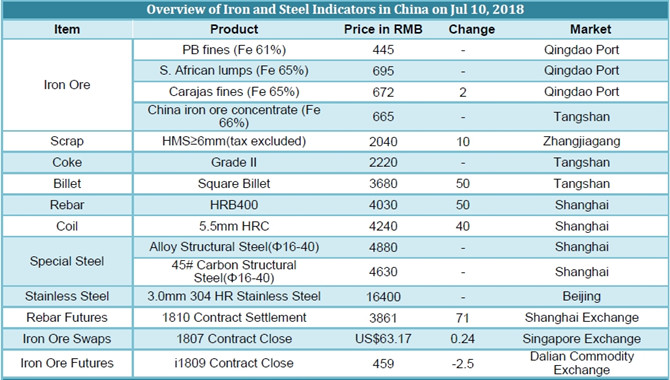

- Iron ore futures market remains unchanged today and the spot price at port stays stable compared with that of yesterday. PB fines quoted at RMB460-465/wmt at Tangshan region and that for Tianjin was RMB495-500/wmt. In Shandong, PB fines andxinde marine news2018-07-11 16:42:07

- Iron ore futures market extended narrow fluctuation, which dampened traders sentiment, resulting in a RMB3-5/tonne decline in quotation. Traders who traded mainstream iron ore resources were active in offers and showed strong desire to delixinde marine news2018-07-11 10:20:33

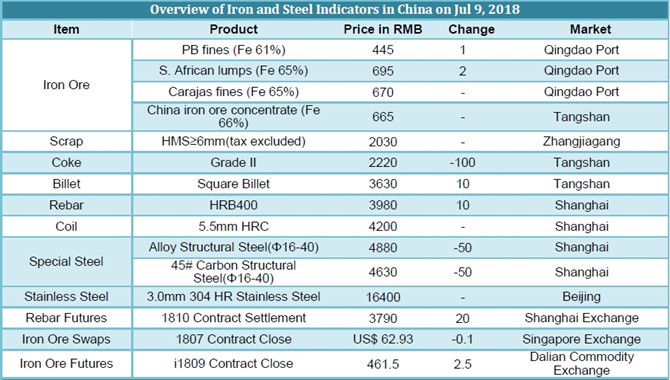

- Iron ore futures market at Dalian Commodity Exchange continued to run with narrow fluctuation and theres little impact from US tariff. Traders held quotations firm and tended to raise prices for Brazilian resources. Partial mills expressedxinde marine news2018-07-09 15:26:16