China’s imported iron ore market inched upwards in tandem with upswing futures market. Traders focused on sales while steel mills sustained normal procurement due to ample stocks at ports. Their demand was concentrated on mainstream iron ore resources and slight carajas fines; steel mills tended to improve productivity owing to good profits.

In light of stricter environmental protection measures and market uncertainties, traders preferred the fast-in and fast-out trading mode along with slight profits, as it was hard to tell the coming market trend.

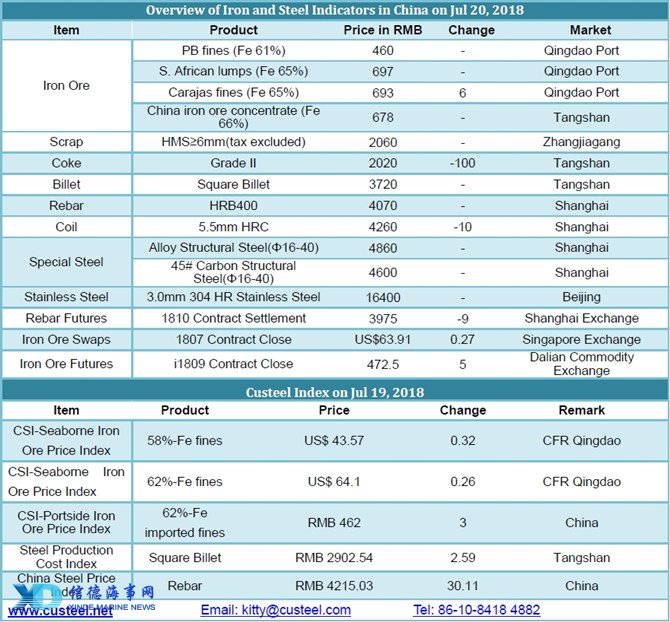

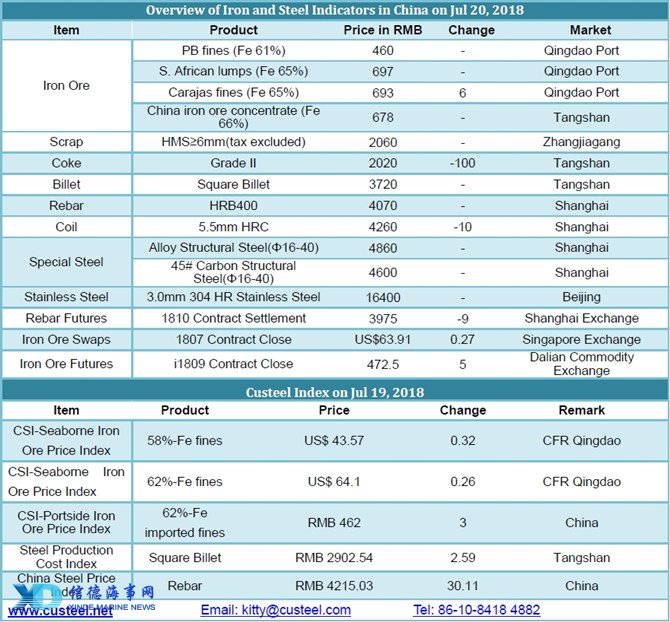

Overall transaction turned out better than yesterday, with PB fines traded at RMB460/tonne, MAC fines at RMB455/tonne, SSF and Carajas fines at RMB283/tonne and RMB695/tonne in Shandong, reflecting a rise of RMB2-5/tonne. The growth for low alumina Brazilian fines remains larger.

Demand from steel market remains unstable coupled with the influence from potential production restriction and environmental inspection, whilst the profitability in steel market was hard to drive up iron ore prices. If steel profits shrink in later period, iron ore prices may face downside risks.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in