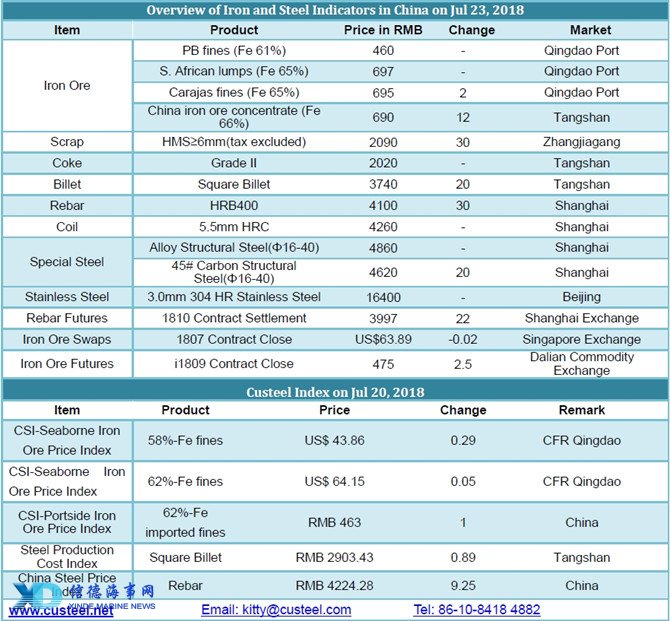

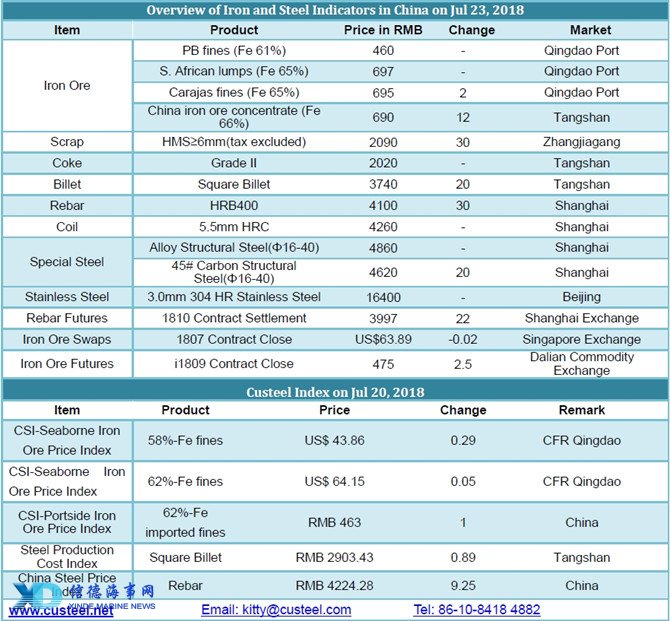

China’s imported iron ore market remained robust with slight price hike for iron ore pellet, lumps and concentrates in light of higher buying interests. Traders focused on sales on weak fundamentals, and the production control and environmental factors continued to weigh on price. According to a trader, the slight increase in futures market boosted their activity to sell, while traders were cautious in trading alumina resources unless the prices were acceptable. While steel mills showed different attitude towards the price hike, some began to stock up mainstream resources while those with high inventories were not in a hurry to purchase. Transaction continued to improve, with both price and volume on the rise. PB fines were traded at RMB460/tonne or so and Newman lumps (screened) traded at RMB465/tonne in Shandong; Newman lumps (screened) in Tangshan were traded at RMB473/tonne with more transactions.

Seaborne iron ore market was also in steadiness, with PB fines sold by Rio Tinto concluded at US$63.06/dmt, against US$63.17/dmt yesterday. The ongoing production control in Wu’an and Tangshan regions made market insiders bearish about the upcoming market; moreover, the continuing depreciation of Chinese yuan weighed down seaborne iron ore prices, making it hard to move up in the near term.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in