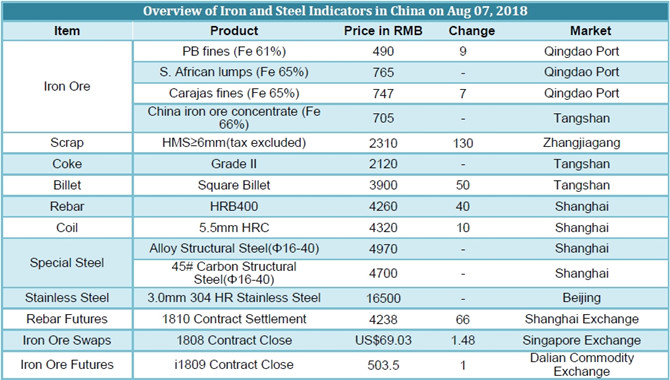

- Chinas imported iron ore market is in buoyancy in tandem with marked increase in iron ore futures market at Dalian Commodity Exchange. The production control albeit hinders some demand, while rumors about a decline of Rio Tintos shipment inxinde marine news2018-08-07 16:36:48

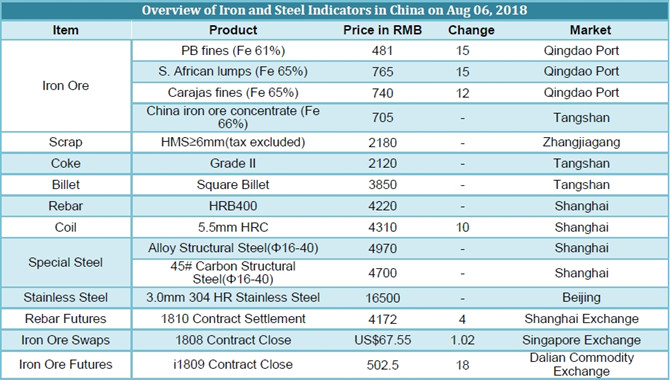

- Chinas imported iron ore market inches higher on expectation. Iron ore and steel futures market remains buoyant owing to bullish outlook among market participants following news about potential pollutant control measures in heating season.xinde marine news2018-08-06 16:39:27

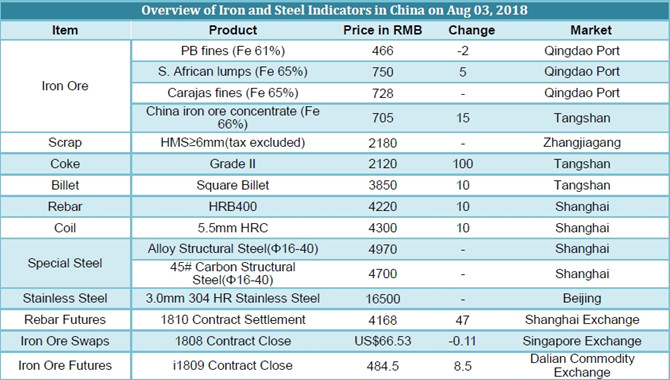

- Shanghai rebar steel futures climbed almost 2% on August 3 to near a 5-and-a-half-year high amid Chinas plans to impose industrial production curbs during winter for the second year in a row. Coke prices jumped more than 5% on the planned rxinde marine news2018-08-06 14:00:46

- Oil prices went down on Friday amid rising supplies from countries including Russia and Saudi Arabia. Russia and key OPEC (Organization of the Petroleum Exporting Countries) members such as Saudi Arabia and Kuwait have all increased productxinde marine news2018-08-06 13:59:41

- Chinas imported iron ore market extends weakness along with bleak trade and lower prices yesterday. Tangshan market saw a narrower decrease due to production restriction. Iron and steel futures markets continue to edge downwards today, whicxinde marine news2018-08-03 17:06:19

- Driven by governments environmental policies encouraging coal-to-gas switching,China contributed 32.6 percent of global gas consumption growth in 2017, becoming the single biggest factor fueling global gas consumption, according to new daxinde marine news2018-08-03 14:04:55

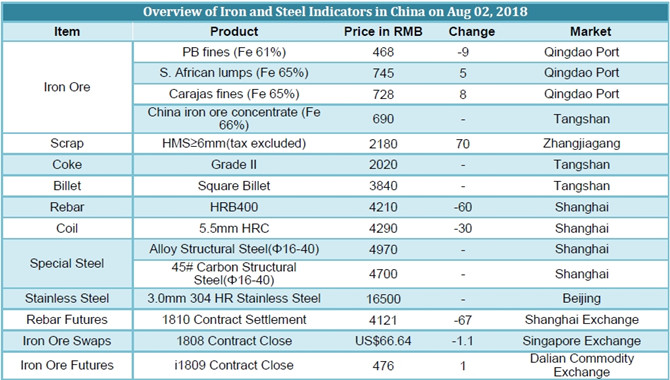

- Chinas imported iron ore market extended steadiness in the morning as spot trade yesterday showed signs of weakness. Iron ore demand continued to be hindered by sintering cut in Tangshan and local mills are not in a hurry to stock up. The uxinde marine news2018-08-02 15:40:00

- The Chicago Board of Trade (CBOT) agricultural futures closed mixed on Wednesday, with soybean prices falling nearly 2% amid flared up trade tensions. The most active soybean contract for the November delivery plunged 17.25 cents, or 1.88%xinde marine news2018-08-02 14:21:50

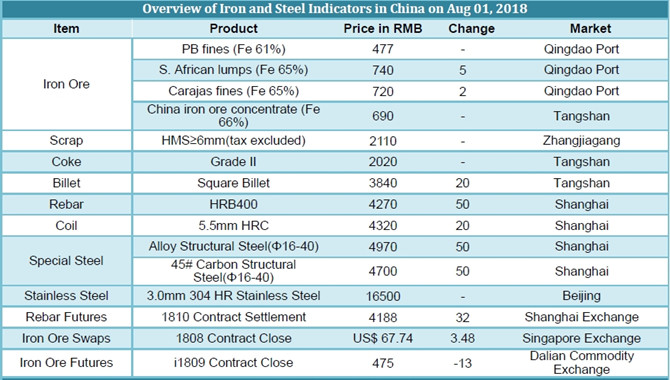

- Chinas imported iron ore market gradually entered a stalemate after last weeks marked price hike. Traders tend to quote and boost sales, while steel mills showed no eagerness to stock up. The price gap between PB fines and alternatives suchxinde marine news2018-08-01 16:05:06

- Chinas iron ore futures ended flat on Tuesday. The most active contract for September delivery remained unchanged at 488 yuan per ton. China has opened the domestically-traded iron ore futures to foreign investors since May 2018. Sources:ccxinde marine news2018-08-01 14:19:30

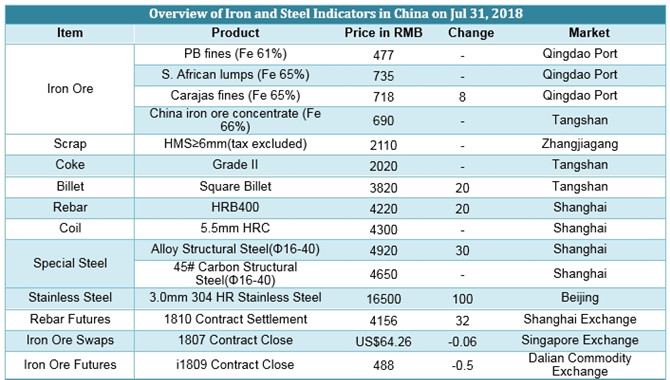

- Domestic spot steel prices inched up, as stocks declined much faster than previously expected amid a turnover in transaction. While iron ore market was on a roll as entire stocks remained high. The comprehensive index of domestic spot steelxinde marine news2018-07-31 16:17:07

- Chinas imported iron ore market was reined by wait-and-see attitude. Traders were cautious in quoting in spite of marked price hike last Friday, trading remained slim. Some traders in Shandong raised quotations by RMB10/tonne. The productioxinde marine news2018-07-31 16:04:36

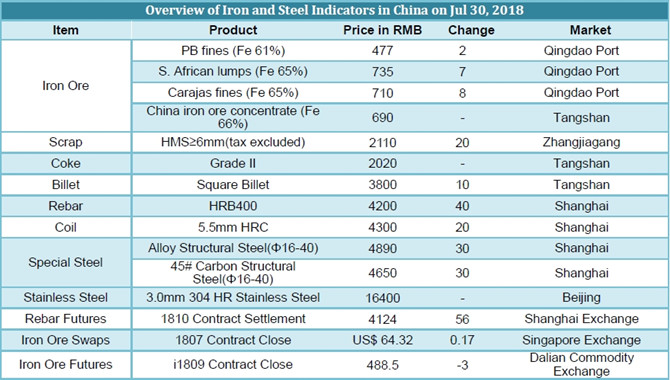

- Chinas imported iron ore market moves up to a larger extent as strengthening futures market at Dalian Commodity Exchange fuels confident. Traders quotations are generally increased by RMB3-8/tonne whilst steel mills are not eager to replenixinde marine news2018-07-30 16:37:44

- Severe natural gas shortfalls that occurred in parts of China last winter are still fresh in peoples memories, but officials from the countrys major energy companies recently assured the public they have taken various actions to ensure thexinde marine news2018-07-30 16:33:23

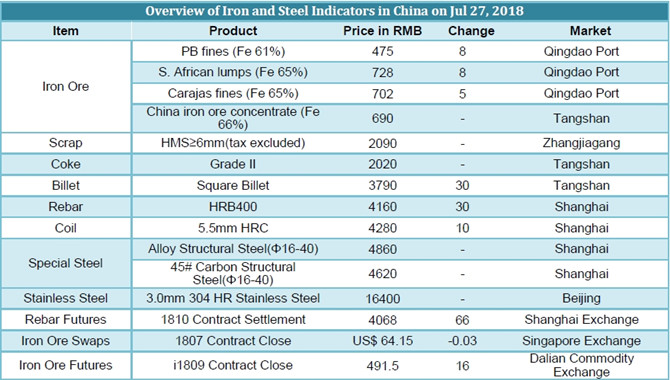

- Chinas iron ore futures market followed the fluctuated trend today with spot quotations of traders remaining unchanged from the previous day. While the transaction volume has dropped slightly today. Traders were active in offering, but inquxinde marine news2018-07-27 15:34:00