Neither US nor China has imposed their proposed tariffs yet, but commodity trades are already being affected by growing tensions between the two countries. In a recent interview, the chief executive of Bunge said that he saw the US “making very little if any” soybean sales to China and that buyers are moving their purchases to Brazil and Canada.

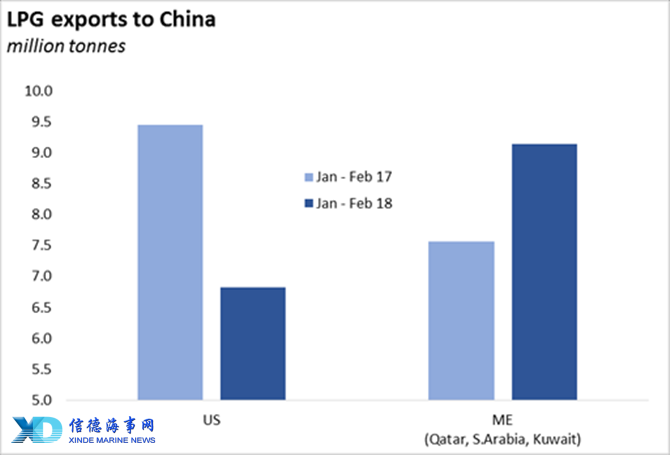

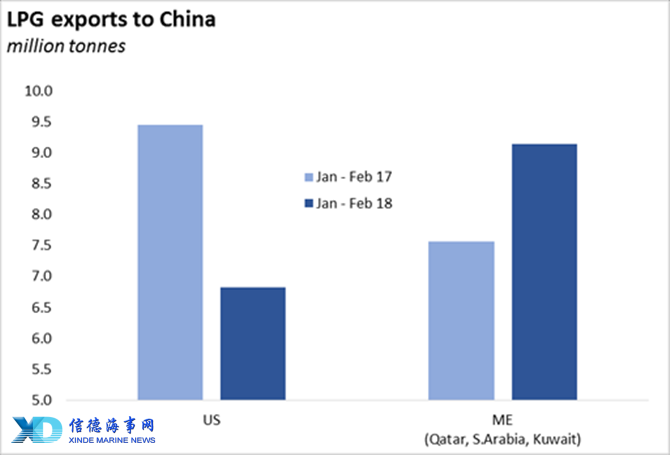

Official data is yet to show this shift in soybean volumes, however it is clearly evident in LPG trades. China’s imports from the US grew by an eye-watering 105% per annum on average over the last three years, but US exports plunged by 28% during the first two months of 2018. By contrast shipments out of the Middle East (Qatar, Saudi Arabia and Kuwait) rose by 21% during the same period.

The sharp drop in US exports can be attributed to the reluctance of Chinese buyers to commit purchases from the US. LPG exporters in the US usually sell their products on long-term contracts, and buyers pay high cancellation fees if they decide not to take the cargos. Given the uncertainty regarding the tariffs, buyers are believed to be shifting their purchases to the Middle East.

In the case of soybeans, the recent change in trading patterns is likely to have a negligible impact on ship demand as the net effect is likely to be tonne-mile neutral, if not slightly positive. However, in the LPG sector shorter haul trades from the ME to China is likely to put further pressure on the VLGC demand.

Sources:Arrow

Please Contact Us at:

admin@xindemarine.com

Baltic Exchange launches new Fuel Equivalence Conve

Baltic Exchange launches new Fuel Equivalence Conve  21 Consecutive Years of QUALSHIP 21 Recognition for

21 Consecutive Years of QUALSHIP 21 Recognition for  MPA and Wärtsilä Renew Partnership to Drive Marit

MPA and Wärtsilä Renew Partnership to Drive Marit  MPA and Dalian Maritime University Renew Partnershi

MPA and Dalian Maritime University Renew Partnershi  PSA INTERNATIONAL, DNV AND PACIFIC INTERNATIONAL LI

PSA INTERNATIONAL, DNV AND PACIFIC INTERNATIONAL LI  INTERCARGO Reaffirms Call for Simplicity as IMO Cli

INTERCARGO Reaffirms Call for Simplicity as IMO Cli