We feel that the market sentiment has deteriorated somewhat in recent weeks as the anticipated pick-up in Chinese dry bulk demand has not materialised yet. Like many, we expected a sharp recovery following the Chinese New Year holidays which ended on 26 February. Although market worries are warranted to some extent, we believe that they are overdone. The latest batch of macro data released over the last two weeks suggests that activity should pick up soon.

We believe there are a two main reasons behind this delay in demand recovery;

1)National People’s Congress (NPC): NPC is a major annual gathering in China during when the main decision-makers decide on the economic policy among others. Traditionally industry and construction activity remains subdued throughout the event to keep pollution to a minimum and reduce the risk of safety accidents.

NPC is typically a week-long event; however, this year it was carried out over two weeks due to the extended agenda (i.e. changes in the constitution to lift the presidential term limits). The timing of the Congress also had an impact as it began almost immediately after the CNY holidays (CNY holidays ended on 26 Feb the NPC started on 5 Mar).

Effectively, the industry had the brakes on for almost four weeks, first due to the CNY holidays which started on 16 Feb and then due to the two-week long NPC event which began on 5 Mar and ended today.

2)Strong restocking in 4Q17 and January: Chinese traders and producers restocked more aggressively than usual over the past few months in anticipation of a strong market post-holidays. In the case of iron ore, imports during December-January were 12% higher than the 12-month rolling average. The industry is now working through that material, not just at ports but also in the supply chain.

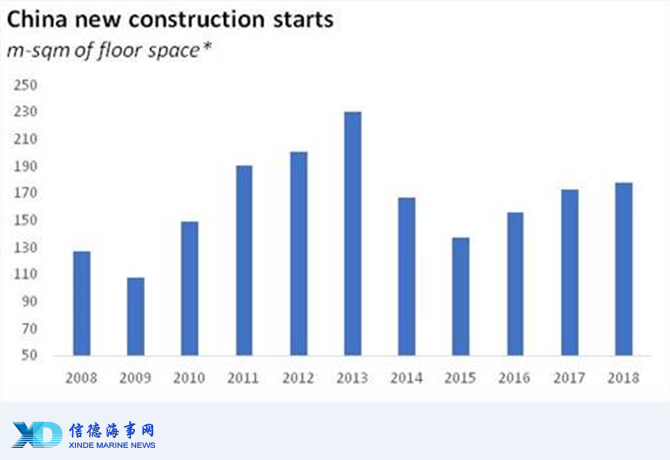

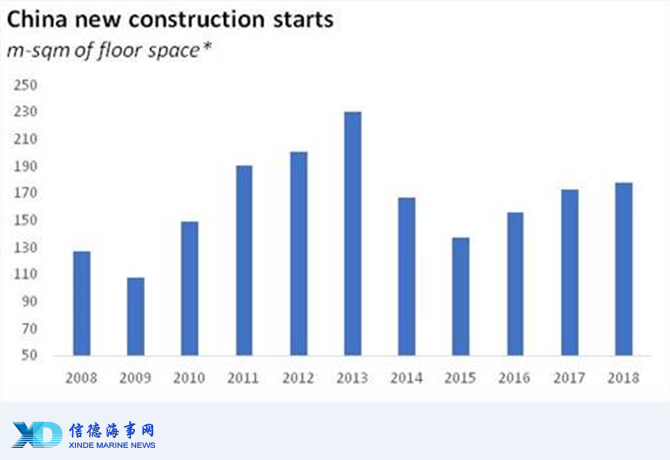

In the meantime, the National Bureau of Statistics released a new batch of macro data over the past two weeks and it shows that the underlying demand remains intact; real estate investments during the first two months grew by 9.9% year on year, up from 7% in December, whereas new construction starts were up by 2.9%. Steel output during the same period also grew by 5.9% or by 7.6 million tonnes. New construction starts measured by floor space is an interesting one; although 2.9% growth does not sound too much, in real terms, it was the largest number since 2013.

Overall, we believe the current softness in Chinese demand is temporary and that the delay is mainly caused by the NPC event which ended. Given the robust macro data, we believe demand will pick up materially in coming months.

Sources:Arrow

Please Contact Us at:

admin@xindemarine.com

Baltic Exchange launches new Fuel Equivalence Conve

Baltic Exchange launches new Fuel Equivalence Conve  21 Consecutive Years of QUALSHIP 21 Recognition for

21 Consecutive Years of QUALSHIP 21 Recognition for  MPA and Wärtsilä Renew Partnership to Drive Marit

MPA and Wärtsilä Renew Partnership to Drive Marit  MPA and Dalian Maritime University Renew Partnershi

MPA and Dalian Maritime University Renew Partnershi  PSA INTERNATIONAL, DNV AND PACIFIC INTERNATIONAL LI

PSA INTERNATIONAL, DNV AND PACIFIC INTERNATIONAL LI  INTERCARGO Reaffirms Call for Simplicity as IMO Cli

INTERCARGO Reaffirms Call for Simplicity as IMO Cli