[Photo: Xinhua]

Chinese shipyards have accumulated their largest number of LNG newbuild orders till date, positioning them in coming years as an alternative to South Korean yards who currently dominate the LNG ship construction space.

While Chinese yards have been successful in expanding the market share in other ship types such as crude and refined product tankers, and dry bulk vessels, the LNG carrier space has been elusive due to the need for more technological and shipbuilding expertise.

The main Korean yards such as Samsung Heavy Industries, Hyundai Heavy Industries and Daewoo Shipbuilding & Marine Engineering collectively have the largest market share in LNG shipping, with a reputation for high-quality construction and delivering ships on schedule, sometimes well ahead of the LNG projects they may be linked to.

However, in recent years, the rush for long-term LNG contracts after the Ukraine crisis resulted in new LNG ship orders that pushed yard capacity in South Korea to its limit, opening the door for Chinese yards to expand their presence.

One shipbuilder has accounted for the bulk of China’s LNG newbuild orders — China State Shipbuilding Corp., or CSSC — whose orderbook stood at around 60 ships at the time of writing, with deliveries expected up to 2028, according to company officials.

In the first half of 2023, Chinese yards received 14 large LNG carrier orders, accounting for 35% of global orders for the period, state-owned media Xinhua News Agency reported Aug. 17. CSSC said in January that it had received 49 LNG newbuild in 2022, taking China’s share of carrier orders for the year to around 30% from less than 7% in 2021.

In addition to CSSC, two more Chinese shipbuilders — Jiangsu Yangzijiang Shipbuilding and China Merchants Heavy Industry — received their first LNG newbuild orders in October and December 2022, respectively, Xinhua reported in February. These took total Chinese newbuild orders to 55 in 2022, Xinhua said.

CSSC executives said that its main LNG carrier has a capacity of around 174,000-175,000 cu m, while the ones from China Merchants Heavy Industry is around 180,000 cu m.

CSSC yards

CSSC currently has three shipyards to build large LNG carriers — Hudong-Zhonghua Shipbuilding Co., Jiangnan Shipyard (Group) Co. and Dalian Shipbuilding Industry Co. (DSIC) — out of which Shanghai-based Hudong-Zhonghua has the largest orderbook of around 40 ships.

Hudong-Zhonghua started building large LNG carriers in 2008, but Jiangnan Shipyard and DSIC both received their first LNG orders in March 2022, CSSC said.

The ballpark price for a newbuild from South Korea is roughly $285 million, and rising due to yard capacity running out as well as higher raw material and financing costs, according to industry participants.

CSSC executives said its LNG carrier prices have risen from around $230 million to $250 million due to strong demand. This is still a steep discount to prevailing industry prices and gives Chinese yards an advantage if they can maintain high-quality specifications and delivery schedules, executives said at the recent Gastech conference in Singapore.

In early September, CSSC launched a new model — Hudong-Zhonghua’s 271,000 cu m — LNG carrier that received approval in principle (AiP) certificates from four major classification societies, making it the largest LNG carrier in the world. If constructed, CSSC’s ship would be the world’s largest, and bigger than Qatar’s Q-Flex ships at 210,000 cu m and Q-Max ships at 266,000 cu m.

Demand for LNG carriers

A large number of Chinese long-term LNG contracts on an FOB delivery basis has driven up the LNG newbuild demand.

Chinese shipping companies like state-owned COSCO, Chinese national oil and gas companies and second-tier gas companies are expected to control a growing share of the global LNG fleet. This bolsters their energy security and gives trading firms like PetroChina International, the LNG trading arm of PetroChina, more optionality in managing its growing LNG portfolio.

Chinese importers holding FOB contracts include state-owned Sinopec, CNOOC, CNPC, and private-owned ENN and China Gas, who have joined hands with ship operating companies to order newbuilds at domestic yards in the past two years.

China has signed about 40 LNG term contracts, equivalent to around 54 million mt/year of LNG, since 2021, nearly half of which were FOB delivery from the US, according to data from S&P Global Commodity Insights. In comparison, China signed only 17 LNG term contracts, equivalent to around 14 million mt/year during 2016-2020, mostly for destination ex-ship (DES) delivery, the data showed.

Hudong-Zhonghua also won orders for twelve 174,000 cu m LNG carriers from Qatar Energy in 2022, and Jiangnan Shipyard won orders six 175,000 cu m LNG carriers from the UAE’s ADNOC last year, which are likely for DES supply.

US FOB cargoes boost LNG carrier demand

Following is a table of major US LNG contracts underpinning LNG newbuild orders:

Sinopec Kantons Holdings, Cosco Shipping Energy and DSIC signed a contract for three LNG newbuilds on Aug. 31, which will be used to ship US LNG under Sinopec’s two 20-year contracts with Venture Global for 4 million mt/year.

On Aug. 21, China Gas’ joint venture signed a contract with DSIC for two LNG carriers. China Gas holds four US FOB LNG contracts — two for 2 million mt/year over 20 years from Venture Global, one for buying 700,000 mt/year for 25 years from Energy Transfer and one for 1 million mt/year for 20 years from NextDecade.

PetroChina International and COSCO Shipping Energy ordered two newbuilds from Hudong-Zhonghua in July, adding to six existing orders. PetroChina has an FOB contract with Cheniere Energy for 1.8 million mt/year of LNG for 25 years.

Gas distributor ENN signed long-term charters with Japan’s Mitsui O.S.K. Lines and China’s Tianjin Southwest Maritime in 2022 for six LNG carriers built by Hudong-Zhonghua. ENN holds five US FOB LNG contracts — two for 2.7 million mt/year from Cheniere, two for 2.7 million mt/year over 20 years from Energy Transfer and one for 2 million mt/year for 20 years from NextDecade.

CNOOC awarded contracts for construction of 12 LNG carriers to Hudong-Zhonghua in 2022. CNOOC holds two FOB contracts with Venture Global for 2 million mt/year for 20 years and 0.5 million mt/year of LNG for three years.

Source:

Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

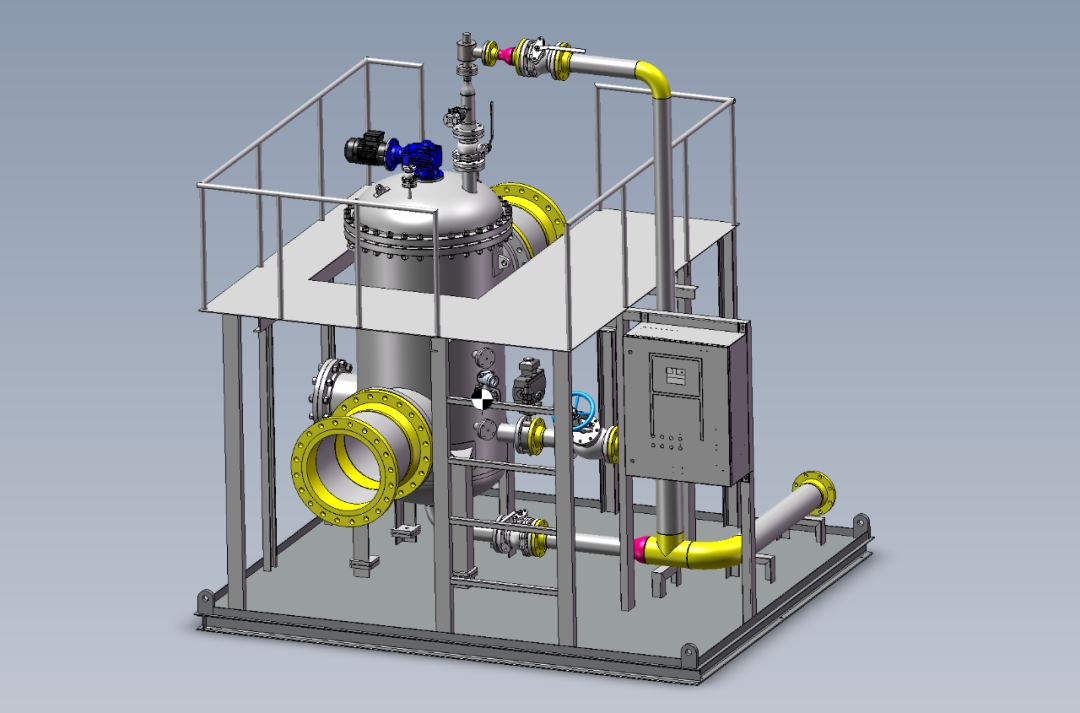

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship