Chinese shipbuilders have secured growing orders for producing liquefied natural gas (LNG) vessels this year amid the deepening energy crisis in Europe, which enables the country to enter the race of top-caliber shipbuilders along with South Korea in the construction of LNG tankers.

On Saturday, China State Shipbuilding Corp’s (CSSC) Dalian Shipbuilding Industry and China Shipbuilding Trading Co landed an order of constructing two large-scale LNG vessels from China Merchants Energy Shipping Co.

Each measuring 295 meters in length and 46.4 meters in width, they are able to hold 175,000 cubic meters of LNG and are compatible with various types of LNG facilities at major ports worldwide, according to a press release on the group’s website. It’s worth noting that the vessels are the first set of LNG tankers which will be built by Dalian Shipyard.

As a matter of fact, the third LNG shipbuilder has come into existence in China. In April, CSSC’s Hudong-Zhonghua Shipbuilding Co – which broke foreign monopoly in 2008 to hand over the first China-made large-scale LNG tanker – won a contract for constructing four LNG tankers placed by Qatar Energy.

In March, Jiangnan Shipyard in Shanghai, also a unit of the world’s largest shipbuilder CSSC, signed a contract with Adnoc Logistics & Services, the shipping arm of Abu Dhabi National Oil Co, to manufacture two 175,000 cubic meter LNG carriers.

As of the end of July this year, Chinese shipbuilders had landed a total of 32 LNG vessels order, the most annual orders in the country’s history. Meanwhile, their market share has steadily risen to 25 percent now in the world, according to the Jiemian News.

The soaring demand for LNG vessels is primarily driven by Europe’s deepening energy crisis after the breakout of the Russia-Ukraine conflict, though it is hard to predict how long the energy crunch will last, said Zheng Ping, chief analyst of industry news chineseport.cn.

“After the EU’s sweeping sanctions imposed on Moscow, Russia has reduced the amount of gas it supplies to Europe through the Nord Stream 1 pipeline, and as a result, many European countries have shifted to importing LNG from other countries,” Dong Xiucheng, a professor at the University of International Business and Economics told the Global Times.

“Just one LNG tanker is available to be chartered for a single voyage in Asia two months from now,” said Jason Feer, head of business intelligence at Poten & Partners, a shipbroker. “None are available in the Atlantic Ocean,” he said, according to the company’s website.

The explosive demand, together with the dilemma of no LNG tankers being available, has prompted ship-owners to place new orders. In the first eight months of the year, the total number of orders for new LNG vessels reached a record high of 111 globally, the Jiemian News reported, citing statistics from Clarksons Research, a global shipping information provider.

Experts said the recent orders won by Chinese shipyards strongly reflects China’s growing global competitiveness in building LNG tankers, and the high-value manufacturing sector is both a challenge and opportunity for China to retain its No.1 position in shipbuilding.

Currently, the world’s shipbuilding center is in Asia, with China, South Korea and Japan holding the majority of the global shipbuilding market. China enjoys advantages in building container vessels and bulk carriers, whereas slightly falls behind South Korea in producing high-value LNG tankers.

Given the high tech requirements and construction challenges, building LNG tankers is generally considered a very complicated undertaking. Before 2022, only four shipbuilders in the world were able to build large-scale LNG tankers: Hudong-Zhonghua Shipbuilding in China and three South Korean shipyards, including Hyundai Heavy Industries, Daewoo Shipbuilding and Samsung Heavy Industries.

Now, China has already mastered LNG building technology, Zheng told the Global Times on Sunday. “As a leading shipbuilding player in the world, China has developed competitive technology in producing high-tech ships, including LNG ships, ultra-large container carriers, as well as luxury cruises,” Zheng said.

When it comes to LNG ship production, China does not lag behind others in terms of technology, and instead, the sector is more correlated with market factors that have impacted the performance of some Chinese shipbuilders, such as the exchange rates and shipyard competitiveness, he said.

Due to an explosion in orders for building LNG tankers, the top three South Korean shipbuilders all face production capacity issues, with their berth slots through 2025 reportedly booked.

Against this backdrop, Denmark’s Celsius Tankers has turned to Chinese shipyards to expand its LNG carrier fleet, global shipping news outlet tradewindnews.com reported in September. It said the company has set a plan to order 10 to 12 LNG tankers from Yangzijiang Shipbuilding and China Merchants Heavy Industry.

In the long run, it is believed that the competition between China and South Korea in shipbuilding will be fierce, Zheng said, adding that both have developed significant advantages, which makes difficult for other players to catch up.

Source: Global Times

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

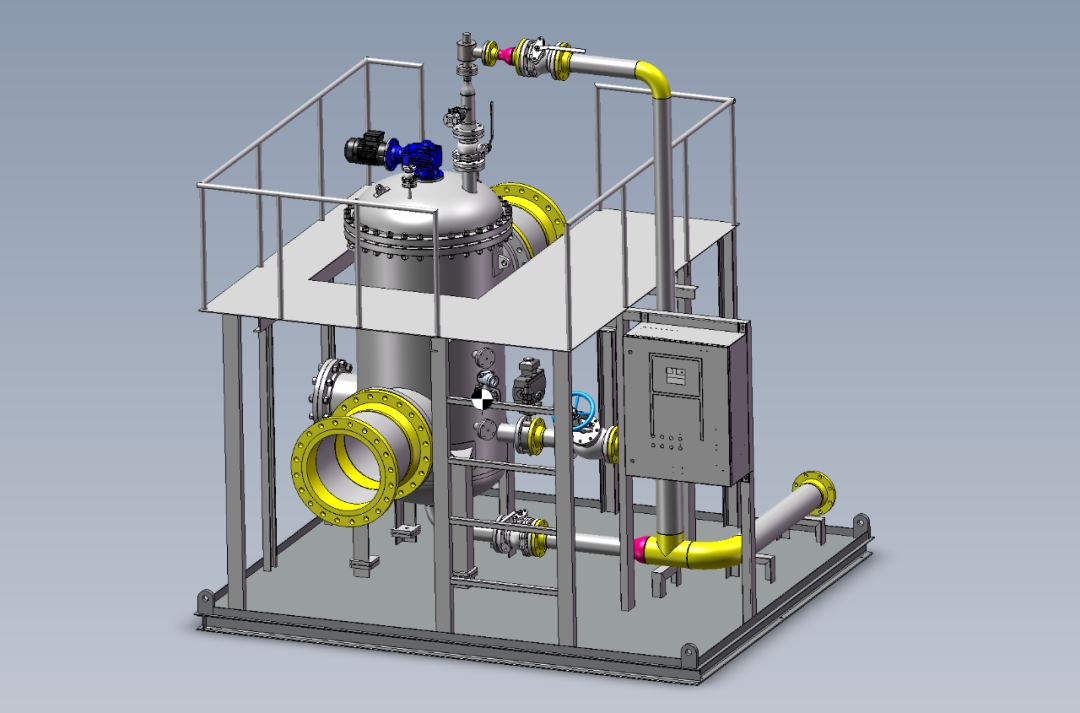

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship