The spot price of liquefied natural gas (LNG) is poised for another surge with the global market tightening as Russia turns the screws on Europe’s supplies of pipeline natural gas.

New York-traded contracts, based on S&P Global Commodity Insights Asian benchmark JKM price, ended at $55.25 per million British thermal units (mmBtu) on Sept. 2, prior to Russia’s announcement that it won’t be restarting the Nord Stream 1 pipeline as planned, citing an oil leak.

Such is the fog now surrounding Russia’s pipeline supplies to Europe that it wasn’t immediately clear whether the failure to resume shipments on the pipeline, which runs under the Baltic Sea to Germany, was a genuine technical issue that can be resolved, or part of a wider pressure campaign by Moscow in retaliation to Europe’s support of Ukraine, which was invaded by Russia on Feb. 24.

A fresh record high above the all-time peak of $69.955 per mmBtu is definitely possible for spot LNG prices, as European utilities will likely be desperate to ensure sufficient natural gas for the upcoming winter peak demand period.

In effect, Russian pipeline supplies to Europe are now likely to be viewed by market participants as inherently unreliable, even though some gas is still flowing through pipelines through Ukraine and to Turkey.

While any surge in spot LNG prices in Asia as European buyers seek to draw cargoes away from the top-importing region of the super-chilled fuel is likely to grab the media headlines, it masks important shifts in the overall market dynamics.

In Asia, only about one-third of LNG volumes are traded at spot prices, with the majority of LNG being priced against crude oil in long-term contracts.

Notwithstanding a surge in crude oil prices in the aftermath of Russia’s attack on Ukraine, the cost of LNG priced against oil is now substantially below the spot price, and the discount is the widest ever in Refinitiv data going back to 2012.

Long-term LNG contracts tend not to be publicly disclosed, but most work on the basis of being priced as a percentage of a benchmark crude oil, known as the slope and a typical contract might be pegged at about 14.5% of the Japan Crude Cocktail (JCC), which is a price based on the customs cleared cost of crude oil in Japan.

As of the end of August, this LNG price was around $16.63 per mmBtu, or less than one third of the JKM spot price of $53.95 on Aug. 31.

So far this month crude prices have weakened amid concern of a global economic slowdown, while spot LNG prices have been volatile, tending to trade based on media headlines about the state of European storages and Russian pipeline supplies.

But the trend has been clear since the invasion of Ukraine, namely that spot prices are now at a substantial premium to long-term, oil-linked LNG contracts.

This is a reversal of the trend that has prevailed for most of the past decade, where spot prices tended to trade below the JCC, except for relatively brief periods during the peak LNG winter demand season.

In practical terms this means that buyers that had in the past been able to take advantage of lower spot prices on average, such as India and Pakistan, are now finding themselves priced out of the market.

Conversely, importers such as Japan and South Korea, the world’s second- and third-biggest LNG buyers, are relatively better placed given the bulk of their purchases are under long-term deals.

MIXED CHINA

China, which overtook Japan as the world’s top LNG importer last year but may surrender the title this year, is an interesting case, as it is maintaining imports under long-term contracts but seemingly cutting back on spot cargoes.

China imported 4.81 million tonnes of LNG in August, according to Refinitiv data, down from 5.11 million in July, while year-to-date arrivals were 41.0 million tonnes, down 22% from the 52.4 million tonnes in the first eight months of 2021.

India’s LNG imports are forecast at 1.47 million tonnes in August, the lowest since February, while year-to-date arrivals are estimated at 13.4 million tonnes, down 15.7% on the same period in 2021.

In contrast to China and India, Japan’s LNG imports are remarkably stable so far in 2022, with Refinitiv data showing arrivals of 51.3 million tonnes in the January-August period, down marginally from the 52.1 million over the same period in 2021.

With Europe’s LNG imports up some 63% in the first eight months of 2022 to 85.3 million tonnes, it’s clear that LNG cargoes are being drawn to the countries most able to pay high spot prices.

But the existence of the long-term, oil-linked contracts means that Europe probably won’t be able to draw as much LNG as it would probably want, no matter what price it is prepared to pay.

Source: Reuters

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

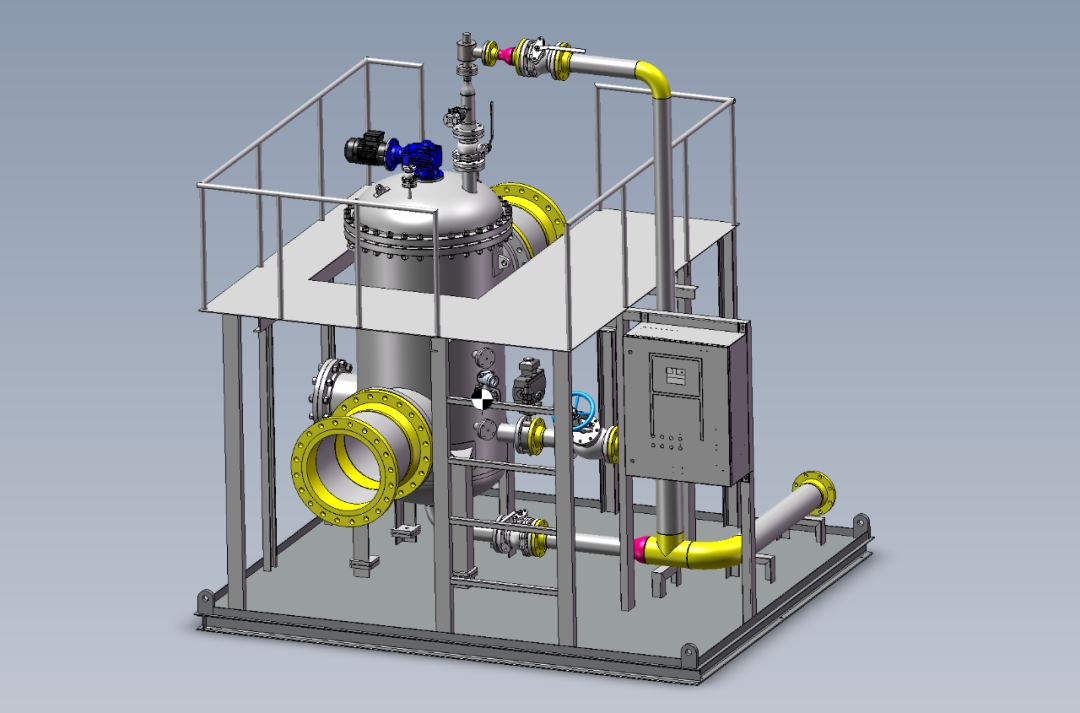

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship