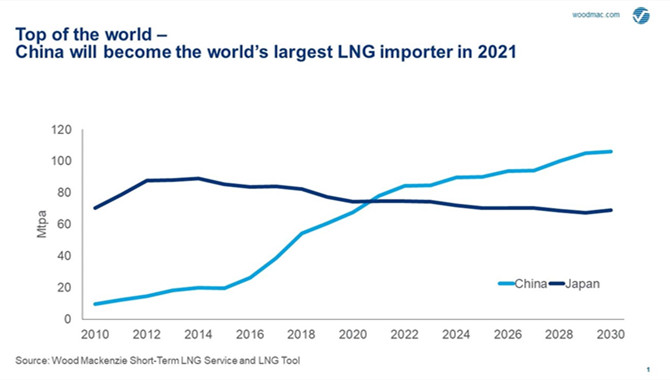

For as long as most can remember, Japan has been the world's largest LNG market. The country's utilities and trading houses underpinned decades of LNG supply growth, signing long-term contracts that formed the bedrock of the industry. But nothing lasts forever, and with Japan's LNG demand in long-term structural decline, China will this year become the world's largest LNG market.

After a lacklustre 2020, Asian LNG demand firmly returned to growth in the first five months of 2021, with China the single biggest contributor. We now expect 11 Mt of demand growth from the country this year, meaning China will account for over half of the 18 Mt of the increase in global LNG demand forecast for 2021 and a little over one-third of global LNG growth in 2022. With its LNG demand bolstered by clear policy support and strong gas market fundamentals, China's top spot looks assured for years to come.

What is driving this continued strong LNG demand outlook? Is it sustainable? And what are the downside risks? I spoke to Xueke Wang from our Asia Pacific gas research team to understand why all eyes are on China's surging LNG market.

Has the strength of China's LNG demand surprised you?

I think it has taken the entire industry by surprise. Before looking at which sectors are behind this, it's worth pointing out that the resilient gas demand growth we're currently seeing is in large part driven by China's overall economic performance. With Q1 2021 GDP growth coming in above 18% year-on-year, although from a low base in 2020, clearly a rising tide is lifting all ships.

But LNG demand is also supported by strong growth within key sectors, which are accelerating China's long-anticipated climb to the top of the global LNG import table. Solid Q1 imports, increasing by 30% over the same period last year, show no signs of slowing: our ship-tracking data for May indicates China imported more than 7 Mt of LNG that month, up 35% year-on-year.

What sectors are underpinning demand growth?

Space heating and industrial gas demand have been key parts of the story, but let's focus on the power sector. Rising electricity consumption has been in the spotlight since the start of 2021, driven by China's economic recovery. In the first four months of this year, gas-fired power generation jumped 14% year-on-year. Strong electricity demand has been a key driver for increased LNG imports in southern China in particular, as gas provides the critical peak-shaving supply into that market.

With hydro generation in southwest China curtailed by lower rainfall and solar power output below expectation, Guangdong province has experienced a shortage of electricity imports. Tightening power supply options in China's industrial heartland have come as power demand continues to rise on the back of solid export-led industrial growth and the early arrival of higher summer temperatures.

Are rising LNG prices starting to impact Chinese LNG demand?

To keep up with demand, power plants have purchased more gas and are running gas-fired units for longer. But with the Asian spot LNG price above US$10/mmbtu, users have an increasing preference for lower-cost pipeline gas when available. However, pipeline gas supply remains constrained, and for power generators under political pressure to ensure electricity supply, this has encouraged more LNG imports, even at higher cost.

Spot LNG has been the most competitive gas import option into China for the past two years. But rising prices have now brought this competitive advantage to an end, and LNG may well become a cost-disadvantaged supply option versus pipeline imports over the next two years. We will be watching closely how Chinese demand responds to these price movements.

How have tensions with a few exporting countries been impacting China's sources of LNG supply?

LNG has remained largely above the fray – so far. Australia is still China's largest LNG trading partner, despite a fall in volume from April that translated into a slight decrease in Australia's market share to 43% from the previous 45% of total LNG imports. Interestingly, US LNG further expanded its market share to 8%, with more gas flowing into CNOOC and Sinopec terminals.

With power supply tightness expected to continue through June and high coal prices resulting in coal-fired output slipping, China will try to increase gas supplies from all sources. As such, we can expect Chinese buyers to remain busy in the spot market and China's NOCs and second-tier players continue to import Australian LNG, despite unconfirmed media reports that smaller buyers had been advised not to purchase spot from Australia. A recent slight decline in volume has more likely been caused by cargo rescheduling or diversions; either way, this has not changed Australia's role as China's largest supplier of LNG.

What are the key risks to our China LNG demand outlook?

As always, any unforeseen economic slowdown or a resurgence in Covid restrictions could reverse the positive outlook. But we also need to consider the potential for an increase in supply from domestic production and more rapid growth in Russian pipeline imports. Domestic production achieved 12% year-on-year growth in Q1 2021 to ensure supplies during the heating season, while piped gas imports also increased, rising by 5% year-on-year.

That said, with Russian piped gas currently the lowest-cost import option at the Chinese border we expect continued strong growth in Russian gas as cost-competitive supply increases and domestic pipelines expand. But this still won't be enough to meet anticipated demand, and China requires significant further imported LNG to sustain domestic demand growth. Given the country's gas market fundamentals, China looks certain to remain the world's top LNG importer for many years to come.

Source: Wood Mackenzie

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

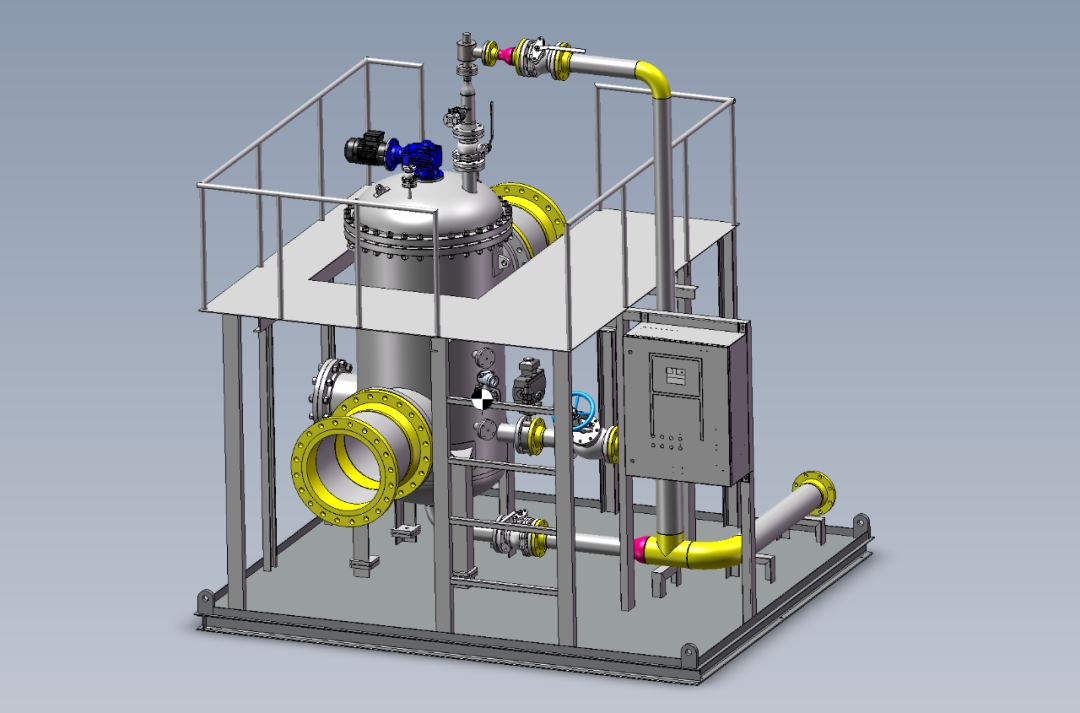

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship