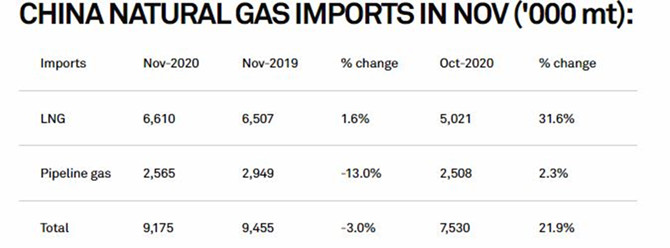

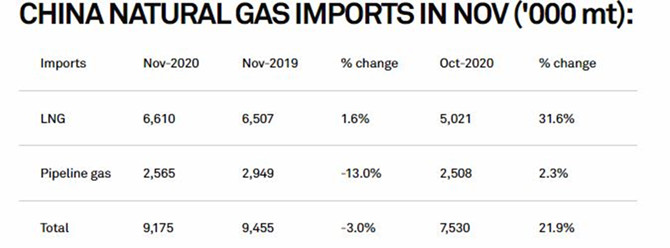

China imported 6.61 million mt of LNG in November, up 31.6% month on month and 1.6% higher year on year on rising domestic demand despite higher prices, according to data released Dec. 26 by the country’s General Administration of Customs.

Lower temperatures stimulated higher consumption from household users and demand from industrial users rose due to more orders in the Christmas season, market sources said.

The average price of LNG imported by China in November, comprising both term and spot cargoes, was about $6.28/MMBtu on a delivered basis, up 15.3% from about $5.44/MMBtu a month earlier, according to S&P Global Platts calculations based on customs data.

JKM, the benchmark price for spot LNG in northeast Asia, averaged $5.146/MMBtu in Sept. 16-Oct. 15, for November-delivery cargoes on a DES basis, up 20% from a month ago, Platts data showed.

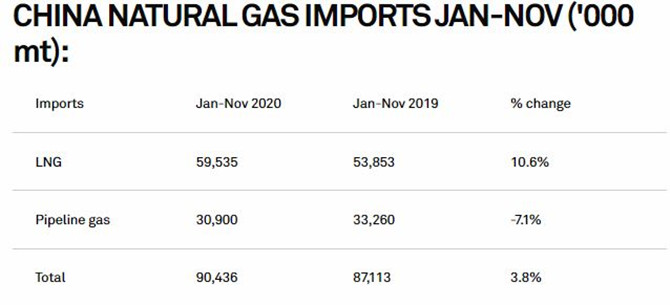

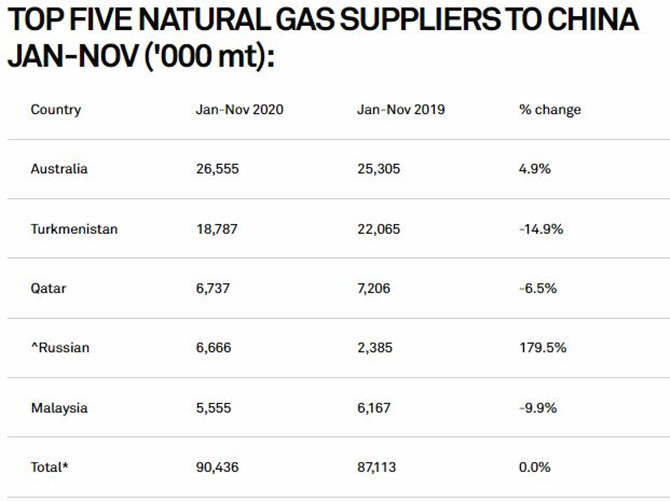

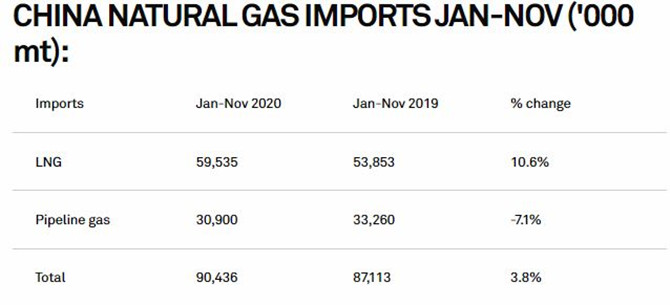

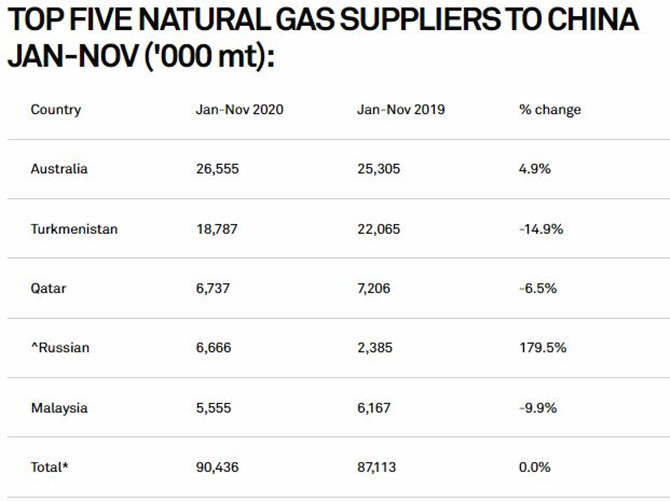

Through January-November, China imported 59.54 million mt of LNG, up 10.6% year on year, the data showed. This was marginally slower than a 13.4% growth seen in the same period last year. LNG accounted for 65.8% of the country’s total natural gas imports in the first 11 months of 2020, compared with 61.8% in January-November 2019, Platts calculations based on customs data showed.

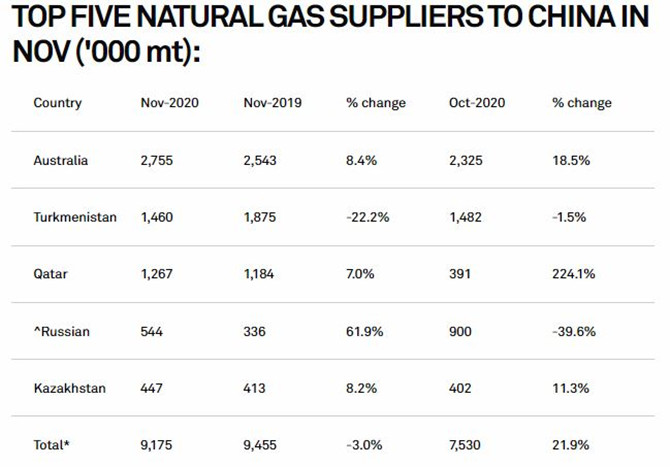

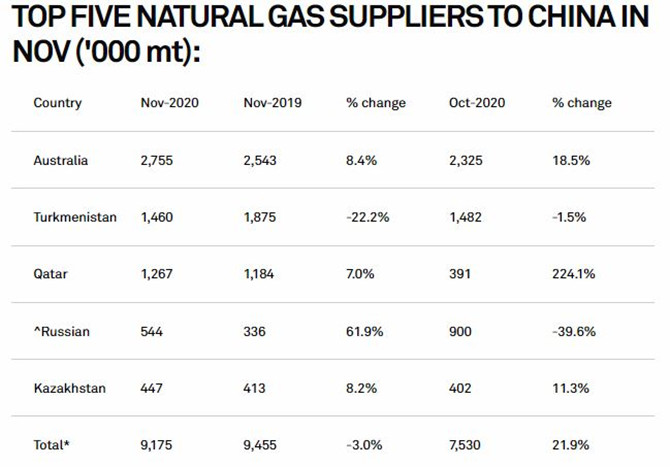

LNG imports from the US surged 47.7% month on month at 419,054 mt in November, compared with nil in the same month of last year, the data showed, in line with commitments to buy more US gas.

China imported 2.57 million mt of natural gas via pipelines in November, up 2.3% month on month, but down 13% on the year, customs data showed.

Lackluster pipeline gas imports failed to ease supply constraints amid surging winter demand, leading to higher prices in December, especially in the northern regions that mostly rely on pipeline gas supply, market sources noted.

No pipeline gas imports from Russia were posted in November data by Chinese customs, but it was unclear if this data has been omitted as market sources have not reported Russian piped gas falling to zero. Customs officials could not be reached for comments.

In addition, China’s pipeline gas imports from its biggest supplier Turkmenistan fell 1.5% month on month in November, and dropped by 22.2% year on year, according to the customs data. This decline contributed to the tight gas supply in the Chinese market in recent weeks, especially trucked gas prices, market sources said.

China’s pipeline gas imports from Turkmenistan have been mostly maintained about 2 million mt/month in 2019, but the volume dropped to 1.45 million-1.75 million mt/month in 2020, customs historical data showed.

Turkmenistan sent 18.79 million mt of gas to China via pipeline in January-November, down 14.9% year on year, the data showed.

China’s pipeline gas imports from Kazakhstan, Uzbekistan and Myanmar all increased month on month in November, according to the data. The imports partially compensated for the supply cut from Turkmenistan last month.

Source:Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

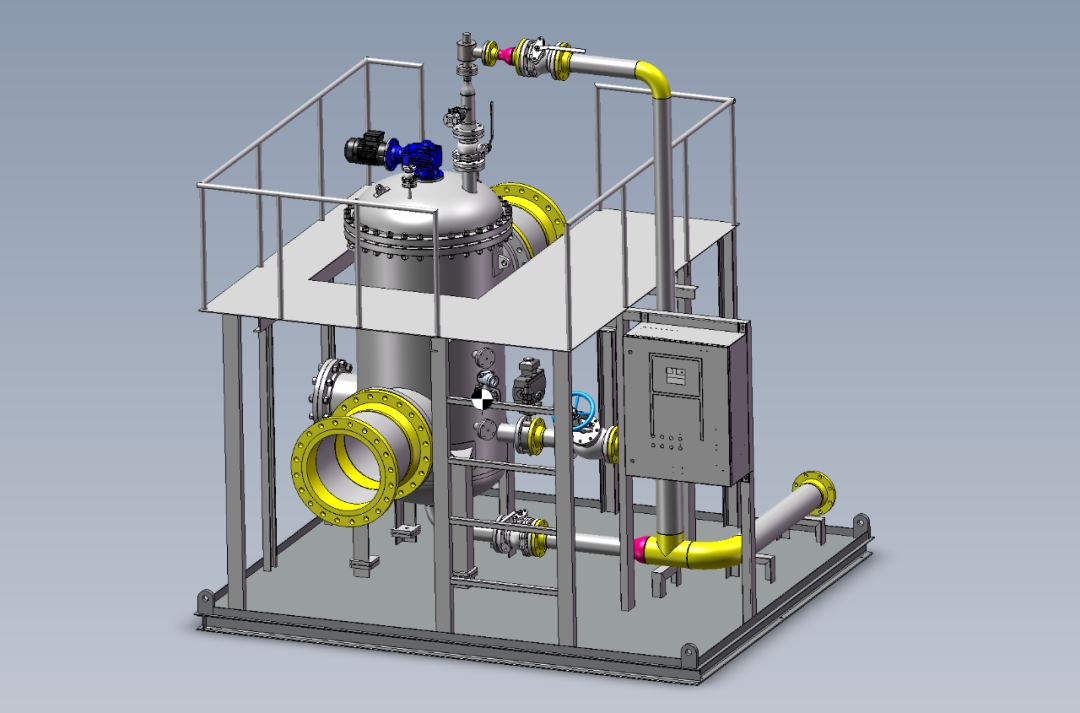

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship