LNG spot prices in Asian markets have fallen further, but China may cut LNG imports in the third quarter due to sluggish demand. The price decline also hit domestic LNG producers.

According to data released by Shanghai Petroleum and Natural Gas Exchange (SHPGX) on Wednesday, China's comprehensive import price index for liquefied natural gas (LNG) rose to 2,647 yuan ($373.5) per ton, up 587 yuan, or 28.5 percent from the previous week. However, the average price in June is still lower than levels a year earlier, said analysts.

Although the comprehensive LNG import index rose in the week, pushed up mainly by long-term contracts, the spot price went down further, reflecting sluggish demand in the Chinese LNG market with the arrival of the LNG consumption off-season, Guo Jian, an LNG analyst at market information provider Sublime China Information Co, told the Global Times on Wednesday.

The JKM LNG spot price, the benchmark in Northeast Asia, dipped to $2.10/MMBtu for June delivery, on a DES basis, down $0.7/MMBtu compared to the price for May delivery, according to market information provider S&P Global Platts.

The LNG spot price fell, linked with sluggish LNG demand in the Chinese market as well as high inventories at storage facilities, an industry insider said.

She said LNG imports in the third quarter of this year are expected to drop compared to the second quarter due to a gas glut in the Chinese market. She also noted that new COVID-19 cases will drag LNG demand down in the Chinese market.

In the first five months of this year, China imported 40.12 million tons of natural gas including LNG and pipe gas, up 1.9 percent from a year earlier. In May, China imported 7.84 million tons of natural gas, an increase of 3.7 percent year-on-year, according to recent data released by the National Bureau of Statistics.

Notably, China has purchased LNG from the US again this year. China imported 17,699 million cubic feet of LNG from the US with an average price of $4.83 per thousand cubic feet from February 20 to March 20, according to data from the US Energy Information Administration.

Analysts think there are still some uncertainties about Chinese LNG imports from the US due to friction between the two sides as well as sluggish demand amid the COVID-19 pandemic and the economic downturn.

In addition, cheap spot LNG hit domestic natural gas producers. Some domestic gas producers and LNG plants have shut some capacity or maintained low utilization rates, as prices become unattractive, sources said.

Source:Global Times

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

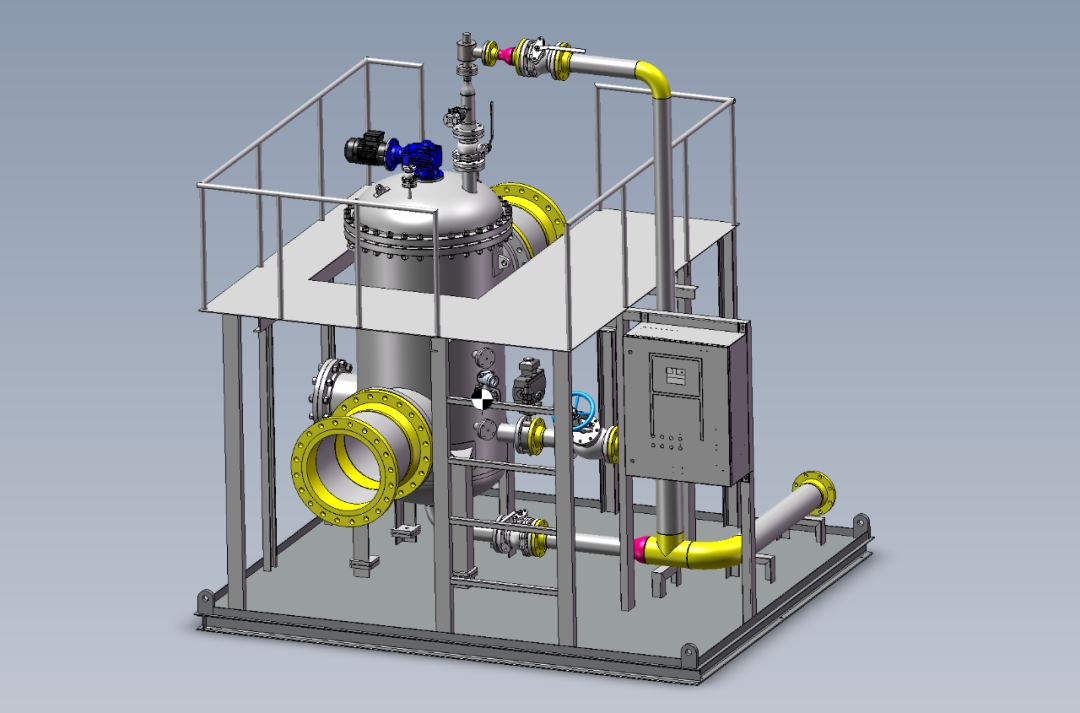

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship