China on Tuesday said it will start accepting applications for tariff exemptions on 696 US-origin goods, including crude oil, LNG and refined products, from March 2, in a move that will allow it to meet purchase targets under the recent US-China trade deal.

The exemptions will enable Chinese companies to avoid tariffs on US imports that were imposed by Beijing over 2018 and 2019 in retaliation for US tariffs on Chinese goods, in the ongoing trade dispute between the two countries.

Other commodities that will be eligible are petrochemicals, agricultural products like soybeans, coal and metals, according to a statement by the State Council’s Tariff Commission published Tuesday on the Ministry of Finance website.

The exemptions will last for one year, starting from the date of approval, and will be granted on the basis of market value instead of volume, the ministry said. It said the annual limit will remain fixed although monthly imports may fluctuate, and imports in excess of approved levels will not be eligible.

The long-awaited announcement was widely welcomed by Chinese refiners and traders but they said it would take time for purchases to begin due to the coronavirus outbreak that has severely hit economic activity and depressed oil and gas demand in the country.

The finance ministry also said that tariff exemptions would only be granted for purchases that are economically and commercially viable, indicating that US commodity imports would still be subject to market restrictions.

CRUDE OIL AND LNG

Under Phase 1 of the latest trade deal, China pledged to buy $50 billion more in US energy supplies, a commitment that will depend heavily on crude sales to Beijing as it is a high value commodity and US crude is competitive in Asian markets.

A US crude supplier, who did not want to be named, said some Chinese importers have already been looking around for US crudes recently, but were unlikely to fix a deal until end-February.

“We will apply, and buy US crude. But to be honest, with high stock levels and weak demand, it is not a good time for shopping,” a Beijing-based source with state refiner Sinopec said.

Market constraints are much more likely to constrain US LNG sales in Asia.

State-owned CNOOC, China’s top LNG importer, is likely to apply for tariff exemptions, but it hasn’t done so yet, a company source said.

CNOOC, which has term contracts for US LNG supply, has been forced to swap US cargoes for non-US cargoes to avoid tariffs of 25%, sometimes at high premiums, because of uneconomical US-Asia arbitrage.

China imported 1.53 million mt and 1.64 million mt of US LNG in 2017 and 2018, respectively, customs data showed. This dropped sharply to 258,955 mt in 2019, which accounted for less than 1% of China’s total LNG imports of around 60 million mt last year, customs data showed.

“There’s not much of an impact on LNG. Firstly, because demand is weak in China, and secondly, the arbitrage from US to North Asia will not support US LNG coming over,” a Singapore-based trader said.

A Chinese LNG importer said that, if national oil companies were to start purchasing large amounts of US goods, there might be reduced demand for Australian and Southeast Asian spot volumes.

US-CHINA PROPANE SUPPLY

Chinese PDH plant operator Oriental Energy was preparing to apply for the tariff exemption, a trader said, adding that other LPG importers were expected to follow suit.

Chinese LPG importers have to pay around $10/mt more for spot cargoes from the Middle East, over US LPG, or swap US cargoes to avoid high tariffs, which are currently 26% for propane and 28.5% for butane, trade sources said.

One trader said that the Saudi Contract Price propane swap — which indicates the FOB Middle East market — is likely to weaken, as Chinese buyers could shift away from costlier Middle Eastern LPG.

Meanwhile, other market participants said it was a tough call to say whether the exemptions would encourage more imports of US LPG. A Chinese trader said they expected leniency in application approvals, as it was a “top-down approach” towards concluding the trade deal with the US.

The US was the second-biggest supplier of LPG to China in 2017, totaling 3.54 million mt, comprising 3.37 million mt of propane and 162,668 mt of butane. The volume dropped by 54% to 1.62 million mt in 2018 due to trade tensions and in 2019 only 2,443 mt of US propane was imported, customs data showed.

Source:Platts

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

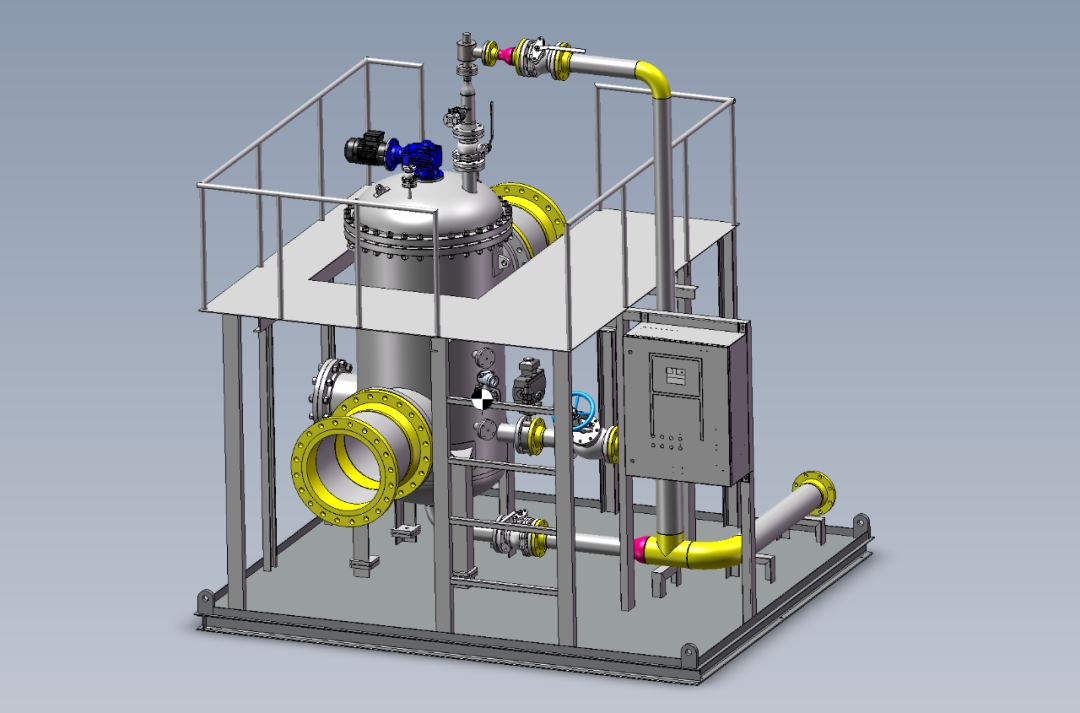

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship