The coronavirus has not impacted US LNG exporter Cheniere Energy's long-term contract with PetroChina, a Cheniere official said today.

China has not imported any US LNG since April because it has imposed a 25pc tariff on US LNG. PetroChina has nevertheless taken its full volumes from Cheniere and delivered those cargoes to other countries, Najla Jamoussi, Cheniere's director of global LNG market fundamentals, said at the Platts LNG Conference in Houston.

State-controlled PetroChina has a deal with Cheniere that started in 2018 for 1.2mn t/yr of LNG, equivalent to about 154mn cf/d (1.6bn m³/yr) of gas. The supplies could come from Cheniere's Corpus Christi LNG plant in Texas or its Sabine Pass LNG facility in Louisiana.

The Chinese tariffs, combined with two consecutive warm Asian winters and the recent coronavirus outbreak, have contributed to recent record low spot LNG prices for delivery to northeast Asia. The Argus Northeast Asia (ANEA) spot price was assessed today at $2.815/mmBtu and $2.840/mmBtu for delivery in the first- and second-half of April, respectively. First- and second-half March were assessed at $2.730/mmBtu and $2.740/mmBtu, respectively. The ANEA price has fallen by around 22pc since the start of last week.

PetroChina pays Cheniere a flat liquefaction fee for all its capacity whether it takes LNG or not, and if it wants LNG it pays Cheniere an additional feed gas fee of 115pc of the Nymex settlement price for the month in which the cargo is loaded. With a liquefaction fee estimated to be in the range of $2.50-$3.00/mmBtu, current Henry Hub prices in the range of $1.80-$1.90/mmBtu and transport costs from the US Gulf coast to China of about $1.60/mm/Btu, the costs of delivering US LNG to China would be significantly higher than spot prices, even before the 25pc tariff.

Force majeure concerns

The LNG industry has become increasingly concerned that Chinese LNG importers may declare force majeure to try to get out of contractual obligations to buy LNG, because of workforce and logistics constraints caused by the coronavirus outbreak. There are also concerns that Chinese buyers may try to renegotiate long-term LNG deals under which they are paying significantly more than current spot prices.

France's Total said earlier this month it had rejected a force majeure claim from a Chinese buyers, as it believes some Chinese buyers are attempting to use the coronavirus outbreak to cancel long term cargoes and buy much cheaper spot cargoes.

Jamoussi declined to say if PetroChina has attempted to file a force majeure claim against Cheniere or renegotiate its contract, saying Cheniere would not discuss such details of customer contracts.

"We've known that the market was going to soften," she said. "More than 100mn t/yr from 2017 to 2019 was added to the market."

The Chinese tariffs and low spot prices have made it more difficult to sign long-term customer deals, but China is not the only potential market for Cheniere, Jamoussi said. Europe is also a potential market for future deals because of its dwindling indigenous natural gas production and expected retirement of nuclear power plants, she said.

Source:Argus

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

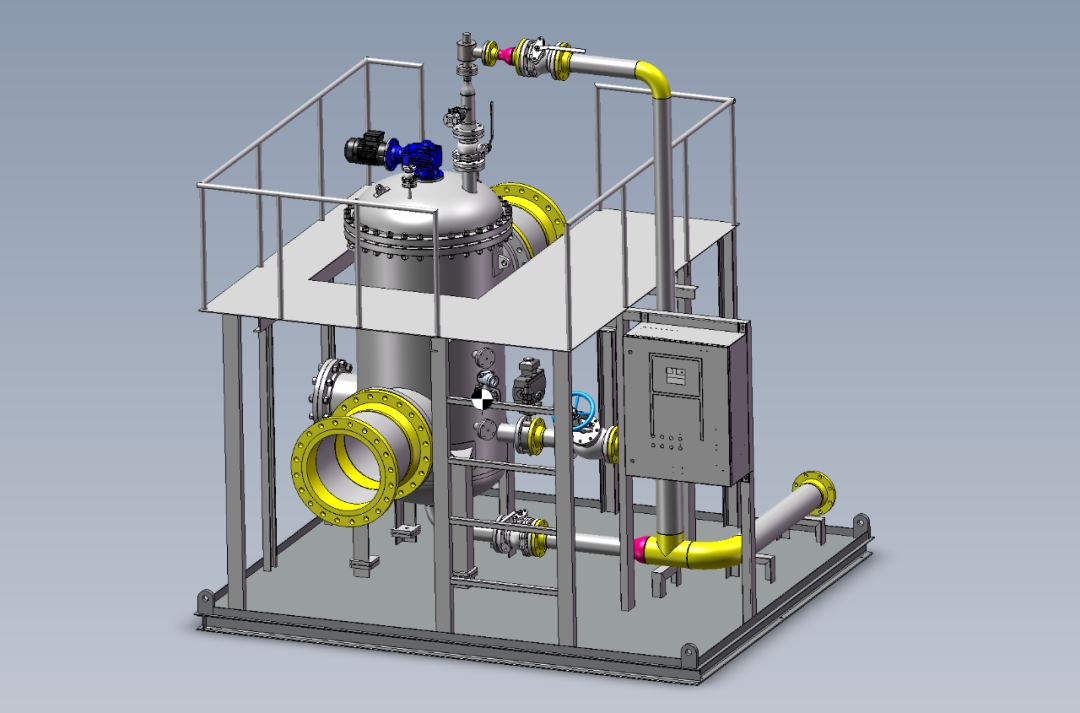

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship