Asian spot prices for liquefied natural gas (LNG) slipped last week amid thin trading due to Christmas holidays.

The average LNG price for February delivery into northeast Asia LNG-AS was estimated at around $5.10 per million British thermal units (mmBtu), $0.35/mmbtu down from a week earlier.

"Technically (prices fall) because there is less demand and lots of people are on holidays," one LNG trader said.

Demand came only from a couple of buyers.

India's Gujarat State Petroleum Corp (GSPC) is in the market for a late January cargo. The tender will close on December 30, one source said.

Colombia's Calamari LNG import project also issued a buy tender for a small cargo, the source added. The project is looking to buy 25,000 cubic meters of LNG for delivery between January 6-15 in a tender that closed on December 27.

On the supply side, Cameron plant in the United States has started producing LNG at its Train 2 facility, Sempra LNG said last week, adding commercial operations on the train will start in the first quarter 2020.

However, the availability of cargoes on the global market was seen limited for January and February supply over the past three weeks, several traders said, adding sellers likely preferred to agree deals for most cargoes earlier, expecting prices to keep falling.

Asian prices also reacted to a drop in European gas prices that were pressured by a new deal between Russia and Ukraine ensuring that the transit of Russian gas to Europe will continue after the current deal expires on December 31.

The Dutch front-month contract, a benchmark for LNG arriving to Europe, has dropped by almost 50 cents in the past week to around $4.17/mmBtu late last week.

Cargoes for delivery into northwest Europe in February have been priced at a more than a 40 cent discount to the Dutch gas price.

Source:sxcoal

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

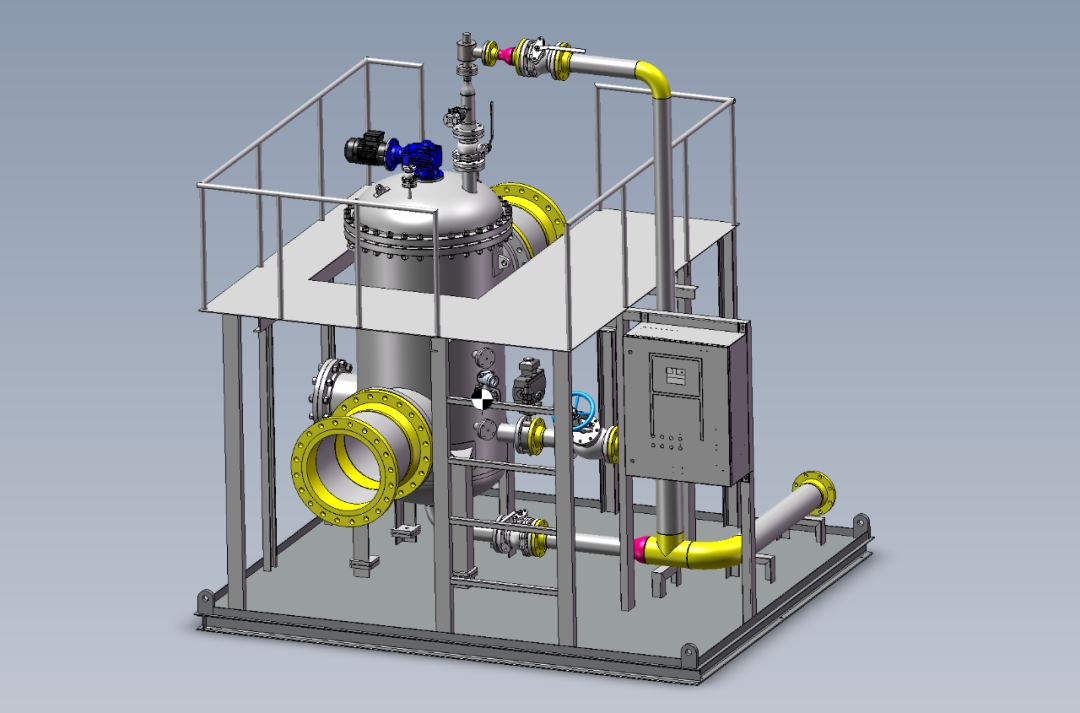

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship