Chinese domestic prices of liquefied natural gas (LNG) have surged recently from LNG plants to storage ports, leading to a 53.33% surge from the beginning of October.

On October 30, PetroChina awarded natural gas tenders for LNG plants in Shaanxi and Inner Mongolia, with the highest at 2.75 yuan per cubic meter. This sparked a tide of price rise among inland suppliers, to 1,780 yuan/t at highest.

Sources said at least 83 LNG suppliers across the country raised their prices, 15 of which raised prices by 1,000 yuan/t. LNG prices rose by 100-350 yuan/t at coastal ports from east to south.

"With northern cities entering winter heating season, urban gas restocking has begun, driving up the demand for LNG," said a source.

While LNG and thermal coal don't compete with each other in China as fiercely as in Japan and South Korea, as gas-fueled power output only takes a tiny share of China's energy mix, resilient LNG price surge can still have positive effect on the domestic coal market.

With more flexible winter heating policies this year, northern cities will choose much cheaper coal as heating fuels.

Chinese thermal coal market has been falling for three weeks due to weak demand from utilities. On November 1, Fenwei assessed domestic 5,500 Kcal/kg NAR coal at 558 yuan/t FOB northern ports and VAT included, falling straightly from 583 yuan/t on October 9; the assessment for 5,000 Kcal/kg NAR coal declined to 488 yuan/t, the 15th drop in a row.

Source:sxcoal

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

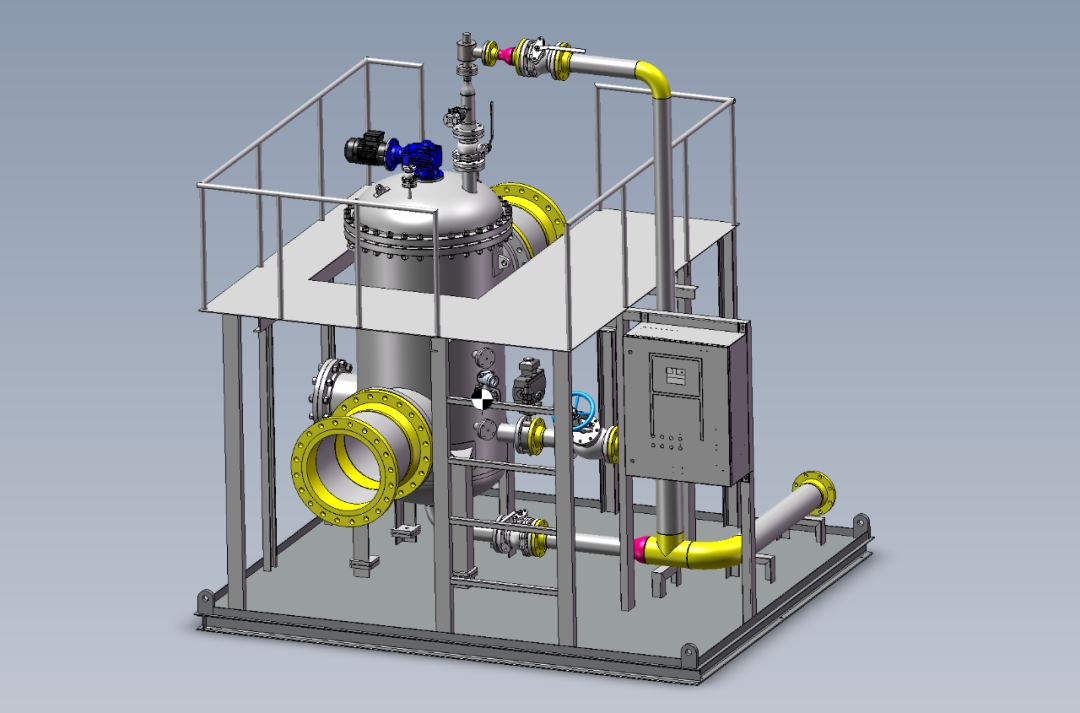

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship