China may overtake Japan this year to become Australia’s biggest customer of LNG, analysts told Montel on Tuesday, as a trade dispute with Washington accelerated a trend driven by Beijing’s effort to tackle pollution.

China was Australia’s biggest LNG customer in May – the second consecutive month it displaced Japan from this perch, according to Commonwealth Bank figures.

While the country also beat out Japan over the last two months of 2018, most observers assumed this was only due to China buying spot volumes to cover a potential winter shortfall, said the bank’s commodities analyst Vivek Dhar.

“If you see the long-term contracts that are available, it always looked like Japan would absorb more,” Dhar told Montel.

“China’s buying of spot LNG may be enough to eclipse Japan regardless of seasonal demand. That opens the door for China to overtake Japan consistently as Australia’s largest buyer of LNG.”

Rising importance

Only five years ago, Japan was absorbing more than 80% of Australia’s LNG exports.

Since then, Australia’s LNG export industry has grown to become the world’s largest, with supply in excess of 80m tonnes per annum.

At the same time, China’s gas demand has taken off, lifted by Beijing’s efforts to clean air pollution and curb carbon emissions. Between 2015 and 2020 the country aims to almost double the share of gas in the electricity mix to 10%.

Now Australia’s LNG exports are split roughly 40-40 with China, while Korea – the world’s third-biggest LNG buyer – takes a large share of the remaining volumes, according to CBA figures.

Graeme Bethune, director of Australian consultancy Energy Quest, expected the world’s number two LNG buyer to become Australia’s most important customer “over the next year or two”.

Trade dispute

As long as China’s trade dispute with the US lingered, Beijing was likely to favour Australian spot cargoes for LNG, adding to pressure on US suppliers to seek other markets like in Europe, Dhar said.

Australia’s spot LNG exports to China – around 8% of the country’s total LNG exports last year – would be at risk if Beijing and Washington resolved their dispute, he added.

So far this year China has been tracking a 20% rise in last year’s 54m tonnes of LNG imports. By contrast, Japan has been tracking an 8% decline in its imports of 83m tonnes in 2018, thanks in part to greater nuclear power plant availability.

“Japan is a quite mature market and the future demand for LNG depends a lot on what happens with nuclear generation,” said Bethune.

Source: Montel

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

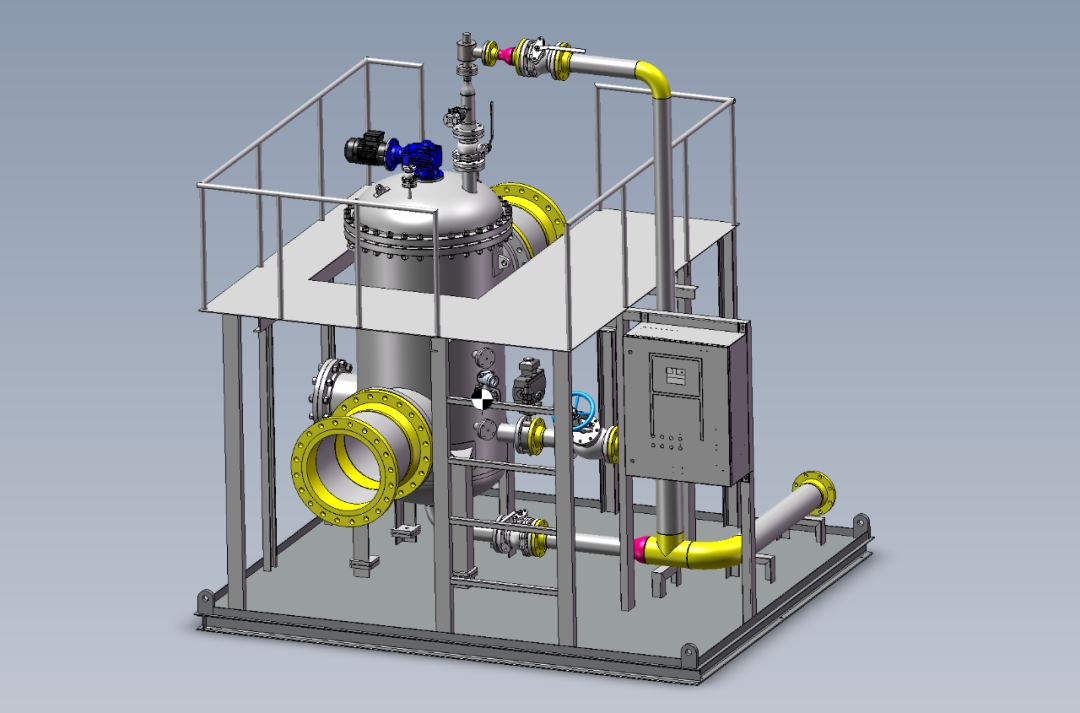

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship