This blog post compares the uses of liquefied natural gas (LNG) as a marine fuel with other options for complying with the more stringent sulfur emission requirements of the International Maritime Organization (IMO) beginning in 2020 and then discusses the development of LNG as a marine fuel.

The IMO 2020 sulfur limit

The IMO is the United Nations agency tasked with setting global standards for safety, security and environmental performance in global shipping. In 1973 the IMO signed the International Convention for the Prevention of Pollution from Ships (MARPOL), and on May 19, 2005 the provisions for preventing air pollution from ships (Annex VI of MARPOL) came into force. Over the past decade the IMO’s Marine Environment Protection Committee (MEPC) has been lowering the emission limits set forth in Annex VI for sulfur as well as other pollutants such as nitrogen oxide. Ships had originally been permitted sulfur emissions of 4.5 percent, but after several incremental reductions the MEPC confirmed in October 2016 that the new sulfur emissions limits effective January 1, 2020 are 0.5 percent globally and 0.1 percent in IMO-designated emission control areas (ECAs).

Sulfur reduction options

Low sulfur fuel oil

There are currently three options for meeting the IMO’s 2020 sulfur limits. The most straightforward option, and the one with the least capital investment required, is simply to switch from powering ships with high sulfur oil fuels to oil fuels that have low enough sulfur emissions to be deemed compliant by the IMO, such as gas oils and low, very-low or ultra-low sulfur fuel oils. Since the marine sector has been responsible for around half of the global fuel oil consumption in recent years, many analysts doubt that oil refineries have the capacity to produce the quantity of low sulfur oil fuels required for such a shift in fuel oil consumption patterns.

There is also a significant price differential between low and high sulfur fuel oils (HSFO). As of May 8, 2019, the current spread between IFO 380 (the HSFO most commonly used by ships) and marine gas oil (the low sulfur fuel most commonly used by ships) was $261.5 per metric ton. Energy and shipping consultancy Wood Mackenzie estimated that the spread would increase to closer to $350 per metric ton once demand for compliant fuels grows in 2020. For owners of large ships such as Newcastlemax bulkers or very large crude carriers (VLCC), which consume 60 to 70 metric tons of fuel per day, such a price jump could drastically increase operating costs. Most shipowners will pass these higher fuel costs onto charterers since fuel costs are usually for charterers’ account, but this will in turn will reduce such ships’ attractiveness to chartering clients.

Scrubbers

A second option is to use abatement technology known as “scrubbers” that capture sulfur and other pollutants as the ship burns fuel. This path toward compliance presents significant upfront capital investment of $2 million to $6 million (depending on the size, type and age of the ship) in material and installation costs per ship. Scrubbers allow the ship to continue to use HSFO, the lower cost of which offsets the hefty upfront investment. According to Gibson Shipbrokers, the installation costs on a retrofitted VLCC would be repaid in less than one year if the spread is $350 per metric ton (as predicted by Wood Mackenzie), less than 18 months if the spread is $200 per metric ton, and still a relatively short two and a half to three years should the spread fall to $87 per metric ton as shipping consultancy Drewry predicts will occur by 2023.

Hesitation about pursuing this approach to sulfur reduction compliance exists because (i) scrubber technology is new and unproven, (ii) further environmental regulations may render this approach unviable – for example, some countries have banned the use of open-loop scrubbers (e.g., China, Singapore and Fujairah), and (iii) the availability of HSFO in small or distant ports is uncertain as refineries reduce their production of such fuels and global supply shrinks.

LNG

Introduction

Liquefied natural gas (LNG) is created by cooling natural gas to minus 260 degrees Fahrenheit (minus 162 degrees Celsius). Liquefying the gas reduces its volume by a scale of about 600. The midstream energy industry has used LNG for decades because this denser form of gas can be carried on ships like oil rather than needing to be pumped through pipelines, as is required for the energy form in its natural, gaseous state. The first ship fueled by LNG, the Glutra, was a ferry built in 2000. By 2015 and 2017 there were 102 and 117 LNG-powered ships, respectively. Growth has occurred more rapidly since then due to the IMO 2020 sulfur cap. As of February 2019, there were 143 LNG-powered ships in operation and a further 135 on order.

Emissions

LNG is the cleanest burning fossil fuel form. It emits almost zero sulfur and particulate matter and achieves approximately 90 percent nitrogen oxide emission reductions. LNG-fueled ships could therefore operate in ECAs without switching fuel sources, while oil-fueled ships would need to switch to a fuel that emits even less sulfur than the standard low sulfur fuel oil when passing through ECAs. It also results in a 27 percent carbon emission reduction when compared to the fuels currently used, which is a 10 or 20 percent improvement on the low sulfur fuels that will be increasingly used beginning in 2020. Using LNG as fuel will increase the emission of methane, another greenhouse gas, but only by a small degree. Furthermore, the IMO may continue to impose new limitations. It has stated that it will attempt to reduce total annual greenhouse gas emissions by at least 50 percent by 2050 compared to annual greenhouse gas emissions in 2008. Given that ships have relatively long lifespans of 20 to 30 years, long-range planning is wise.

Installation and maintenance

Building an LNG-fueled, as opposed to oil-fueled, ship adds about $5 million to building costs. This cost is comparable to installing a scrubber. Analysts previously concluded that the economics of retrofitting a ship to run off LNG were prohibitive. Since engineers have been giving increasing attention to the LNG-fueling option in the shipping space, certain efficiencies have been achieved. Trial retrofitting projects are now being undertaken and further projects are being considered.

Many analysts also believe that LNG-fueled ship engines and associated equipment have greater longevity and require less maintenance than ships fueled by oil. This feature is especially notable given that there have been reports that the corrosive nature of the gases exhausted by the scrubbers means that these ships require more maintenance than ships without scrubbers.

Cost and efficiency of fuel

The cost of the fuel is almost certain to put LNG at an advantage to the low sulfur fuel option. There is currently not a standard global price for natural gas. Natural gas sold in the U.S. market is traded on its own exchange, called Henry Hub, while gas sold on most other markets is linked to the price of oil. In either case, a premium is added because a gas processing company must liquefy the gas. The price of LNG produced from Henry Hub gas, the world’s cheapest, is consistently less expensive on a million British thermal unit (mmBTU) basis than HSFO, let alone the more expensive low sulfur fuel oil. Henry Hub prices have also remained remarkably stable, another significant benefit to business operations. The price of Japan LNG, the world’s most expensive, has over the past five years been consistently more expensive than HSFO, and at almost all points in that period of time has been less expensive than low sulfur fuel oil on a mmBTU basis. That LNG is a more efficient form of energy, providing 50 GJ of energy per metric ton compared with HSFO providing 40.5 GJ of energy per metric ton, makes LNG the more economical fuel choice at this point in time.

Supply of fuel

A disruption in the supply of natural gas could alter the price dynamic between the fuels. The two oil-based paths to IMO 2020 compliance – burning low sulfur fuel oils and installing scrubbers – have supply shortage concerns because they depend on a certain type of oil refinery output in a market that is experiencing a profound change in demand. Most LNG industry observers predict that the supply of LNG will be abundant over the next few years, but some also predict that there could be a period of supply shortage beginning around 2022.

LNG is a form of energy that is much easier to consume than to produce. LNG production in the U.S., now strong, required years of investment both in infrastructure development and in political advocacy to convince regulators to greenlight the massive coastal projects. LNG export capacity in the U.S. may fall short of European and Asian demand for U.S. LNG though, in part because state governments on the west coast have prevented LNG export capacity there despite its valued geography for export to Asia. Australia, whose significance as a new (post-shale revolution) entrant to the LNG export space is rivaled only by the U.S., faces its own challenges. LNG export projects on the island continent have slowed or stalled due to technical difficulties and cost overruns, while domestic gas shortages led Canberra to institute LNG export controls.

One way for ship operators to mitigate their supply risk is to enter into long-term supply contracts with the major suppliers of LNG as a marine fuel. Linking the price of the LNG in the contract to benchmark oil would also mitigate price risk should a global shortage in LNG indeed occur.

Developing the LNG alternative

Current state of the industry

The use of LNG as a marine fuel is the 2020 compliance option least pursued at this point in time despite its environmental advantages and probable economic advantages. There are about 280 LNG-fueled ships in operation or on order, but there are over 600 scrubber-outfitted ships in operation and over 600 ships under construction that have plans to include scrubbers. Analysts predict 300 (lowered from 400 to 600) LNG-fueled ships, compared with 2,000 ships with scrubbers, by 2020. The slow start for building orders of LNG-fueled ships belies the positive long-term view for LNG held by much of the shipping industry. DNV GL, the maritime classification society most familiar with the LNG sector, estimates that the proportion of LNG in the global marine fuel mix will rise from the current less than 0.3 percent to over 10 percent by 2030 and 23 percent by 2050. Other consulting and non-governmental organizations have made similar estimates. The Oxford Institute for Energy Studies (OIES), one of the most respected think-tanks in its field, has fairly consistently assessed LNG to be a viable marine fuel despite uncertainty as to when implementation might occur.

The slower rate of adoption of LNG as a path to 2020 IMO compliance compared to scrubbers can be partially explained by the fact that scrubbers can be retrofitted on an existing ship, whereas engineering a ship from oil- to LNG-fueled is more complicated due to the larger size of the average LNG fuel tank. Therefore, unlike with scrubbers, there will be no sudden burst of LNG-fueled ship orders. Shipowners will instead decide their desired newbuild when they need to order new ships, resulting in LNG-fueled ships being phased into the world fleet at a steady pace rather than being converted en masse.

To the extent that shipowners are hesitant about ordering LNG-fueled ships, some observers believe it reflects a “wait-and-see” approach, whereby shipowners might be holding off on new orders until (i) more LNG bunkering infrastructure (the infrastructure used to load LNG on to the ships) is built, (ii) LNG fuel and bunkering technology develops further, (iii) more data points on the price of LNG fuel exist and (iv) more ships in the global fleet are scrapped given that the market is currently oversupplied. We are likely reaching the end of this waiting period, which has been commented on by industry insiders since at least early 2015, in part due to the approaching implementation of the IMO 2020 sulfur regulations and in part due to advances in LNG bunkering infrastructure.

LNG bunkering infrastructure

A couple of years ago LNG as a marine fuel was described by industry insiders as facing a “chicken and egg” problem: without sufficient development of LNG bunkering infrastructure, shipping companies faced serious risk and little incentive to order LNG-powered ships; but without sufficient growth of the LNG-powered fleet, LNG bunkering companies faced serious risks and little incentive to develop LNG bunkering infrastructure. Today, nine of the ten most frequented bunkering ports in the world offer, or have firm plans to offer by 2020, LNG fueling options.

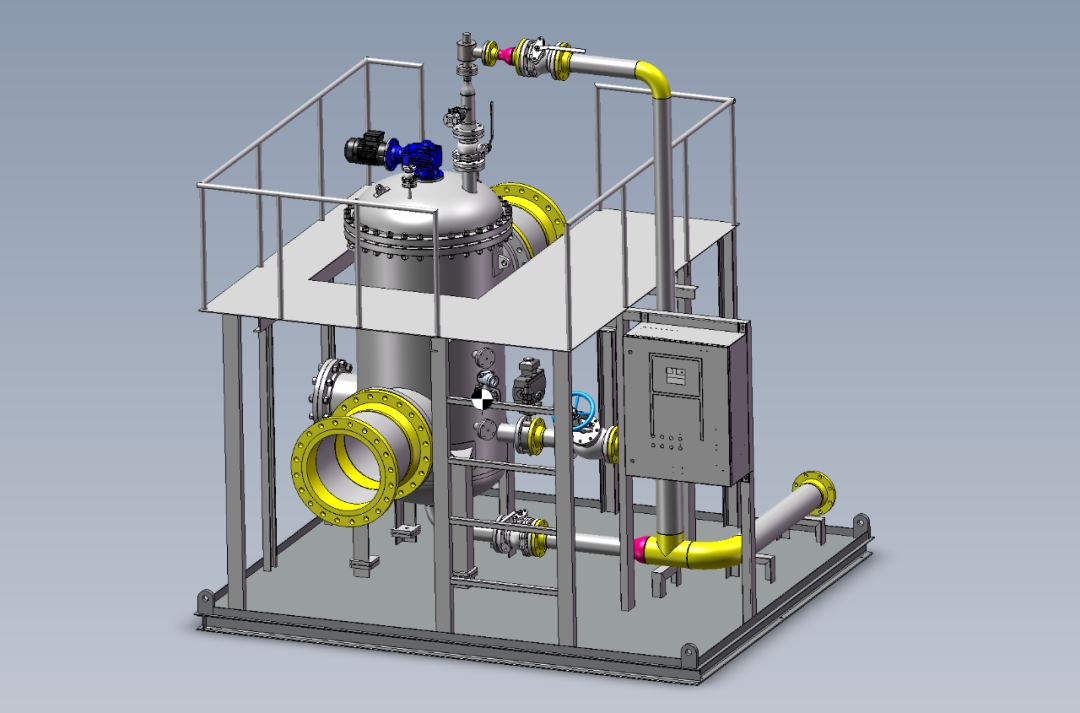

There are three main types of LNG bunkering methods. LNG can be transferred from a truck to the ship (“truck-to-ship”) using a flexible hose, from a ship to another ship (“ship-to-ship”) and from a land-based tank or terminal to the ship (“shore-to-ship”).

The truck-to-ship method involves limited costs and is relatively flexible, as the trucks could also be used to supply LNG to vehicles other than ships. For this reason, and while LNG bunkering infrastructure is in its early stages of development, the truck-to-ship method is currently the most prominent. A truck holds enough LNG to fill the tanks of smaller LNG-fueled vessels such as tugboats or small passenger boats, but not for blue water cargo carriers or cruise ships.

The ship-to-ship method is the most flexible in terms of location and has a high “flow rate,” or rate at which the LNG can be transferred. However, it is expensive infrastructure to build (between €30 million and €60 million depending on size, compared with about €600,000 for the truck-to-ship method) and operate, and the ships would not have alternative uses when demand is low. This method might also lead to congestion at the ports.

The shore-to-ship infrastructure could be utilized by modifying existing LNG terminals or by installing tanks using fixed LNG pipelines. This method is best for ports with stable and substantial bunkering demand. This method is also best for inland ships since they more frequently pass by ports.

Financing LNG-fueled ships and infrastructure

Financing LNG-fueled ships and LNG bunkering infrastructure is similar to financing other shipping and infrastructure assets. Bank debt, private equity, and leasing structures such as sale-leaseback arrangements are the sources of financing most likely to be utilized. One aspect of financing LNG ship and bunkering assets different from financing other shipping assets (although similar to financing the installation of scrubbers) is that public and private sector programs exist to subsidize assets that contribute to lower emissions and other environmental objectives.

Private programs include “Green Bonds” and “Green Loans.” Both programs enable companies to raise capital for new and existing projects deemed compliant with “Green Bond Principles” and “Green Loan Principles” respectively, which principles are outlined by financial services trade groups such as the International Capital Market Association (in the case of Green Bonds) and the Loan Syndications and Trading Association and the Loan Market Association (in the case of Green Loans). If a project is deemed green, a financial institution will extend to the project company a Green Loan, often offered at a lower rate than standard loans. Financial institutions acting as bookrunners or structuring agents also make determinations as to whether a project is green, but companies issuing Green Bonds should, in addition, engage a third party to evaluate the project’s alignment with Green Bond Principles and issue a “second opinion.”

Japanese shipping and logistics company NYK issued the first Green Bonds in the shipping sector on May 24, 2018. The $92 million bonds have a maturity of five years, are unsecured, were managed and structured by Mitsubishi UFJ Morgan Stanley Securities Co. Ltd. and received a second opinion from Vigeo Eiris, an ESG (environmental, social and governance) evaluator based in France. The proceeds of the bonds will support several initiatives that will aid NYK’s efforts to comply with IMO 2020 and other environmental regulations: (i) LNG-fueled ships, (ii) LNG bunkering vessels, (iii) ballast water treatment equipment and (iv) scrubber systems. The author is unaware of any uses of Green Loans for LNG as of April 2019.

Public sector programs to finance LNG assets have come out of Europe and Asia. The European Investment Bank (EIB), a nonprofit lending institution of the European Union, launched the €750 million Green Shipping Financing Programme in the fall of 2017 to provide financing with favorable terms for projects advancing environmental objectives, including LNG-fueled ships. EIB signed framework agreements with Société Générale, ABN AMRO and ING, and plans to provide up to 50 percent financing for new ships and 100 percent financing for the green elements of retrofitting operations.

South Korea has launched a range of programs to make it competitive for LNG-fueled ships. In November 2018 the South Korean government announced it would order 140 LNG-fueled ships from domestic shipyards by 2025. In addition to placing this $886 million order, the government will also provide the shipyards with $886 million of guarantees and $620 million of financial aid. Further, the South Korean government announced in February 2019 plans to spend $2.48 billion on developing the country’s LNG bunkering industry. Singapore, focused on becoming an LNG bunkering hub rather than building an LNG fleet, has offered a more modest $2.25 million grant to each of FueLNG and Pavilion Gas in order to promote ship-to-ship refueling in Singapore in addition to these companies’ current truck-to-ship refueling businesses.

The northern European model

The most developed LNG bunkering infrastructure exists, and over half of the world’s LNG-fueled ships operate, in the North Sea and Baltic Sea. The successes of the northern European countries (particularly Norway) with LNG as an alternative marine fuel have been enabled by (i) government (and particularly supranational) support, (ii) abundant gas supplies, (iii) the prevalence of local shipping routes with predictable journey patterns and (iv) the fact that these countries have been using LNG as a marine fuel years for 20 years and thus have had time to incrementally develop supporting infrastructure.

The first sulfur ECAs were created by the European Union for the Baltic Sea and North Sea in 2005 and 2006, respectively, due to the susceptibility of the regions to acidification. In October 2014 the EU passed Directive 2014/94/EU requiring member states to take part in the construction of a core network (the “Trans-European Transport Network”) of both marine and inland ports with LNG bunkering. Individual states had some flexibility in their path to developing their allotted portions of the network, but national policy plans were required to be submitted to the European Commission for review in November 2016. LNG-fueled ships had been in use in the region long before then. The aforementioned Glutra, built in 2000, was Norwegian, as were the two dozen LNG-fueled ships built in the following decade. The European Union standards, however, were responsible for spurring the expansion of LNG bunkering infrastructure, which allowed the industry to overcome the “chicken and egg” problem.

As of January 2019 there were 22 ports with LNG bunkering capacity in the Baltic Sea ECA, 18 such ports in the North Sea ECA, and a further 49 such ports in the rest of the EU. 40 of these ports are coastal. Another 50 LNG bunkering ports are in development as of April 2019. To promote this network the EU spent over $250 million on LNG bunkering (as of June 2018) through mechanisms such as the Connecting Europe Facility, which provides equity, debt, guarantees and project bond credit enhancements, with funds usually at a level that matches the private sector contribution.

The Norwegian government has independently provided incentives to develop the industry for LNG as a marine fuel. In 2007 the government introduced a tax on nitrogen oxide emissions; in 2008 it launched the Business Sector NOx Fund, which diverted some of the NOx taxes toward subsidizing LNG-fueled ships. According to OIES, 39 of Norway’s 61 LNG-fueled ships listed by DNV GL have received financial support from this NOx fund. Other national governments have launched their own initiatives as well. In September 2017 Germany’s Federal Ministry for Transport and Digital Infrastructure announced that as part of its Mobility and Fuels Strategy it would grant a total of €278 million to German shipping companies willing to switch to LNG by 2020.

Norway’s energy abundance also contributed substantially to the development of LNG in northern Europe. Norway was the world’s fifth, sixth and seventh largest natural gas producer in 2006, 2011 and 2016, respectively. With a population of only five million, Norway is a leading exporter within Europe and globally, and thus had gas export infrastructure (including liquefaction facilities) already in place along its coasts as it began to develop LNG as a marine fuel. A portion of gas supplies already liquefied for export were thus able to be diverted toward separate facilities for the discharge of LNG into the fuel tanks of ships rather than on to LNG carriers used to transport the gas as a commodity.

Another key factor in the adoption of LNG as a marine fuel in the North Sea and the Baltic Sea was the fact that the ports in these regions feature a high degree of calls from roll-on/roll-off ships, cruise ships, ferries and similar ships making local, predictable journeys. A regular, short-distance route drastically reduces the chances of being stranded without an opportunity to refuel. By contrast, an oil tanker on a spot trade traveling great distances between Africa or the Middle East and northeast Asia or North America might face such a difficulty.

Conclusions

The use of LNG as a marine fuel represents a significant shift from the current operating environment due to the fact that an alternative bunkering infrastructure is required and over 99 percent of ships cannot burn LNG. Yet, LNG appears to be progressing toward becoming a viable alternative. The “chicken-and-egg” issue is no longer discussed in industry circles as being unresolved, although given the time needed to develop sufficient LNG bunkering infrastructure, shipping companies may continue to adopt a “wait-and-see” approach while the industry continues to develop, technology improves and costs are reduced.

Government financial support can facilitate a final investment decision by improving the cost of capital, such as in the Norwegian and South Korean cases, and government logistical support can help create an environment of enhanced cooperation between stakeholders, such as in the case of the European Union. However, LNG bunkering can be developed without government support, such as in the case of the states of Florida and Louisiana in the United States.

Regardless of private-public sector cooperation, developers of LNG bunkering infrastructure will have to consider as primary concerns (A) the gas source they plan to use to supply the LNG-fueled ships and (B) the trading and fueling patterns of the ships to which they plan to market. Many developers of LNG bunkering infrastructure will thus decide not only to locate their facilities near LNG suppliers, but also to negotiate long-term supply contracts with them prior to making significant investment in the facilities. Some developers might also seek joint venture or other contractual relationships with companies that use LNG-fueled ships and have regular trading routes that pass the LNG bunkering facilities.

The success of LNG as a marine fuel will depend on, in addition to the cooperation of stakeholders, levels of government support, global supply of natural gas and degree of technological innovation, the international community’s perception of global – and, as the ECAs have shown, particularly coastal – environmental needs, and the comparative environmental advantages provided by burning LNG as opposed to other fuel sources. While using LNG as a marine fuel may create certain economic and other tangible business advantages, the impetus for more widespread interest in LNG was environmental concerns, particularly the IMO 2020 sulfur regulations. Similarly, environmental concerns may substantially reduce the desire to develop LNG as a true global marine fuel alternative to oil. Should climate science and/or political sentiment evolve toward stances that are significantly less concerned about greenhouse gas emissions, LNG may be considered not worth the investment and market disruption. More likely, however, given the political and cultural context today and over the past 20 to 30 years, is that if deep concern about the climate persists, and technological breakthroughs for alternative marine fuels with even lesser environmental impacts (such as renewables) occur, LNG may be considered an insufficient improvement to the marine fuel mix. Close attention to international maritime regulations, industry sentiment and the technological outlook remains essential.

Source:Drewry

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship