LNG exporter Cheniere Energy is in talks with state-run Sinopec for a new long-term LNG supply agreement and the parties are waiting for further instructions from the government authorities, a Beijing-based Cheniere executive, who declined to be named, said.

The new LNG agreement will be in addition to Cheniere’s three existing contracts with Chinese buyers — two long-term contracts with China National Petroleum Corp., or CNPC, and a third short-term contract with CNPC, the executive said.

The executive said that Cheniere has been in talks with Sinopec “for some time” but declined to provide further details on the size of the new deal and which government was holding back on approvals.

Houston-based Cheniere is expected to sign an $18-billion supply agreement with Sinopec that could be announced as part of a broader US-China trade deal at a summit between the US President Donald Trump and Chinese President Xi Jinping at the end of March, The Wall Street Journal reported Sunday.

The deal could also include financing from Chinese state banks for Cheniere’s export capacity expansion, the newspaper said, citing people familiar with the matter.

The Sinopec deal, if it goes through, will mark a cessation in trade hostilities between Beijing and Washington that has blocked trade flows for a range of commodities like crude oil, LNG, LPG, soybeans and coal.

Before the US-China trade war began, Cheniere announced two LNG sale and purchase agreements with CNPC in February 2018 under which CNPC’s subsidiary PetroChina International would purchase around 1.2 million mt/year of LNG, with a portion of the supply beginning in 2018 and the balance starting in 2023.

The agreement would last through 2043 and the purchase price would be indexed to the Henry Hub price plus a fixed component, according to Cheniere’s statement.

The global LNG fleet grew at its fastest rate ever in 2018, with newer and better technologies. But was this enough to absorb the vast amount of new LNG supply coming 2019, mainly from the US, and still keep freight rates at affordable levels?

The Chinese ministry of commerce had announced retaliatory tariffs on US imports that included a 10% tariff on LNG, effective September 24, 2018. Before the tariff, China was taking nearly 15% of US LNG cargoes but after the tariffs only three or four cargoes have reached China.

While the tariffs impacted ongoing trade flows, wider differences between Beijing and Washington meant that Chinese investment in US LNG projects and long-term offtake agreements also suffered.

Chinese buyers have been unofficially barred from signing long-term agreements with US LNG projects since the trade war began last year, an executive, who was part of the Trump administration’s trade delegation to Beijing in 2018, said last week.

Unipec, Sinopec’s trading arm, has been planning to grow its LNG trading profile and been speaking with potential suppliers since 2018 for long-term contracts starting from 2023. It has an LNG trading desk in Singapore that trades around 2-3 million mt/year of LNG, and plans to grow the volume to 10 million mt/year in the coming years, in line with its expanding crude oil trading activities.

Source:Platts

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

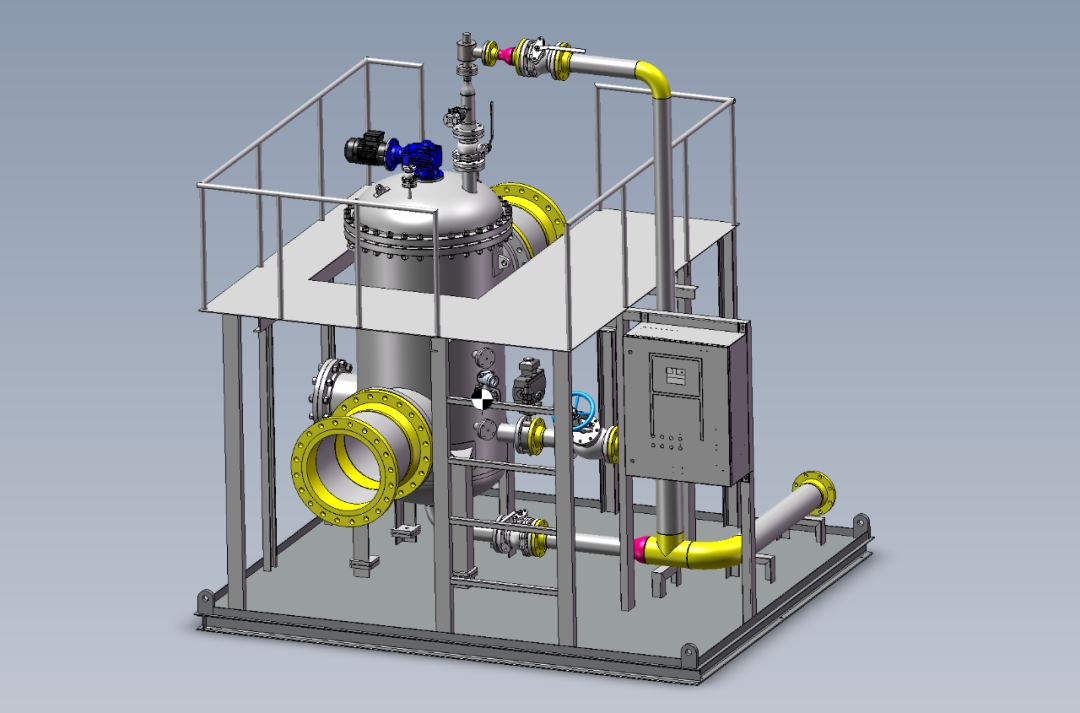

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship