Australian LNG production — already at record highs — is set to grow even further over the next couple of years, helping to boost Australian export volumes.

It's clear from the chart below where that demand is coming from: China.

The chart comes courtesy of the Commonwealth Bank, showing the market share of Australian LNG exports.

Whereas Japan used to be the major source of demand, China is quickly catching up, actually taking more market share than Japan for the first time ever in November and December last year.

Given current trends, and the outlook for demand from both countries, Vivek Dhar, Mining and Energy Commodities Analyst at the Commonwealth Bank, says China may replace Japan as the top destination for Australian LNG exports as early as next year.

"Current LNG contracts suggest that Japan will retain its position as the number one destination for Australian LNG," he says.

"China is not far off in second place, but will likely take top spot during cold winter months when China purchases significant LNG cargoes.

"China could still overtake Japan consistently as Australia's largest buyer of LNG by 2020 given how active Chinese buyers are in the spot market."

Dhar says the lift in Chinese demand for LNG reflects a desire from the government to lift gas as a share of electricity production from 5.3% in 2015 to between 8.3-10% in 2020.

While there are risks to Chinese demand for Australian LNG from gas imports from Russia, increased domestic production and the potential for increased LNG exports from the US as part of any trade deal, recent trends suggest those factors have yet to take force.

Another factor that could see China take spot for Australian LNG cargoes is the potential for softer demand from Japan.

"Japan's power sector, which accounts for around two-thirds of Japan's total gas consumption, is also expected to consume less gas as nuclear restarts begin," Dhar says.

"That could potentially reduce Japan's LNG imports in coming years. Nine nuclear reactors have restarted since the accident and another 17 operable reactors have applied to the regulators for a restart. Japan has 42 operable reactors."

Alongside the potential for nuclear restarts, Dhar adds that a "strong emphasis on renewables is also likely to weigh on Japan's LNG imports."

According to data from Refinitiv Eikon, Australia overtook Qatar as the world's largest exporter of LNG for the first time on record in November last year.

Australia loaded 6.5 million tonnes of LNG for export, more than the 6.2 million tonnes shipped by Qatar.

Source:sxcoal

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

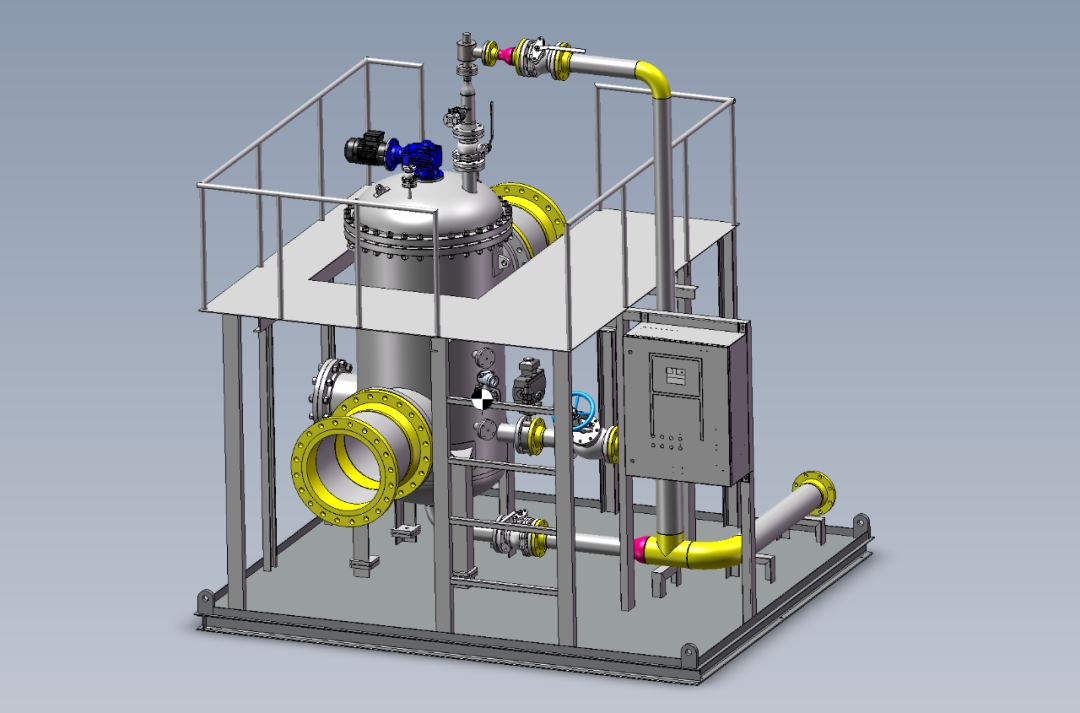

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship