The expansion of underground gas storage in northeast China could alleviate distribution network bottlenecks in the country's key winter demand centers, and help stabilize seasonal demand and price fluctuations in the wider Asian LNG markets.

China's growing LNG consumption, driven by coal-to-gas conversion policies, GDP expansion and industrial recovery, have tightened Asian LNG fundamentals, with the Platts JKM averaging $9/MMBtu in first-half 2018, up from $6.30/MMBtu in H1 2017, after peaking at $11.70/MMBtu on January 15 -- its highest level since late 2014, S&P Global Platts data showed.

The country's biggest underground gas storage is currently being built by Liaohe Oil Field Company, a subsidiary of state-owned CNPC, on the bank of the Bohai Bay, a strategic location and home to a natural gas pipeline network that connects China's heavily industrialized neighboring regions of Beijing, Tianjin and Hebei province, local media reported Wednesday.

The underground gas storage being built at the Liaohe oil field will have total storage capacity of 20 Bcm, the equivalent of 14.5 million mt of LNG, in a space of just under 10,000 sq km. That is nearly half of China's existing gas storage capacity of 41.5 Bcm across around 25 locations.

Liaohe Oil Field Company built China's first large-scale underground gas storage depository, Shuang 6, by using its abandoned gas field at Panjin in the northeastern Liaoning province. From 2017 to 2018, nearly 1 Bcm of natural gas was pumped out from the underground storage to ensure winter supply during the peak demand season.

Liaohe oil field has 28 abandoned gas reservoirs with proven gas storage capacity of more than 500 million cu m, and many of them are suitable for the construction of underground gas storage, said Shi Zhongren, a company executive in charge of storage.

Natural gas is normally injected into underground storage during offseason, and is then pumped out to meet demand during the peak season. China typically utilizes depleted or abandoned gas fields and reservoirs to build underground storages as they are more effective and economical compared with spherical tanks above ground.

As gas consumption increases, China has accelerated the construction of underground gas storage facilities, that will be located near the major cities and beside major gas pipelines.

China's natural gas consumption in 2017 rose 15.3% year on year to 237.3 Bcm, faster than the growth rate of 6.6% in 2016, data from the National Development and Reform Commission showed.

And the government targets to reach a domestic natural gas supply capacity of above 360 Bcm by 2020, according to China's 13th Five-Year Plan for natural gas.

Sources:Platts

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

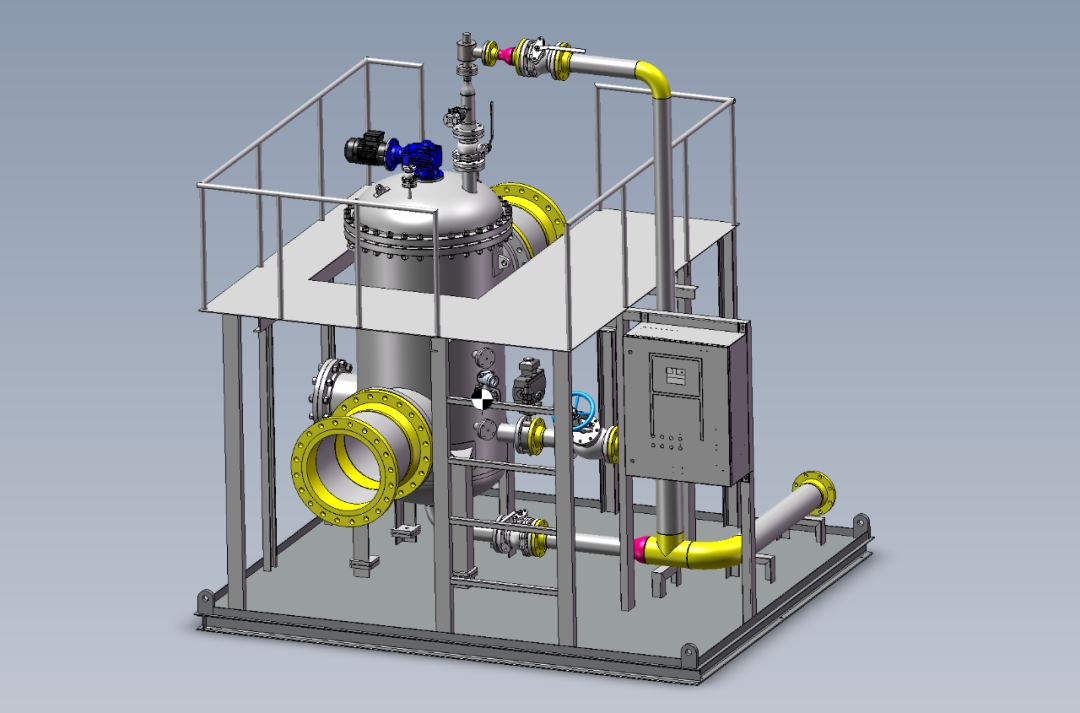

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship