China's growing appetite for liquefied natural gas, or LNG, is set to change the market pattern as the country's energy majors rush to meet the demand.

Under a policy to encourage the use of gas for heating instead of burning coal to combat air pollution, the country's LNG demand is expected to nearly double to 68 million tonnes per year by 2023 from the 2017 figure and exceeds that of Japan, the world's biggest consumer, before 2030, market insiders said.

While the industry was surprised by China's rapidly growing thirst for natural gas, energy companies are already taking action to leverage the bullish long-term picture painted by the government.

CNOOC Gas and Power Group, a unit of China National Offshore Oil Corp, imported more than 20.46 million tonnes of LNG in 2017, accounting for 54.7% of the country's total import.

With nine LNG terminals scattered across the country, especially on the east coast, the company-the third largest LNG importer worldwide-said it plans to set up more LNG terminals in Fujian, Jiangsu and Zhejiang provinces and enlarge the current LNG terminal in Tianjin to increase its receiving capacity.

The company will also diversify its overseas LNG sources in addition to the current one in Australia to further ensure supply.

CNOOC is not alone. Two other top energy companies in China are also speeding up their LNG business layout in the country.

China Petroleum and Chemical Corp, or Sinopec, the world's largest refiner, announced earlier that its newly-built Tianjin LNG facility, which comprises an LNG receiving terminal, pipelines, docks and associated facilities, had started commercial operations on April 18.

The terminal supplies natural gas to the Beijing-Tianjin-Hebei-Shandong region through its pipeline networks and is expected to ease the supply shortage of natural gas in the northern regions.

Sinopec has vowed to more than double its receiving capacity for LNG imports over the next six years. The company will add new LNG receiving facilities along China's east coast to a total capacity of 26 million tons annually by 2023, up from the current 9 million tonnes. China so far has 17 LNG import receiving terminals.

China National Petroleum Corp, or CNPC, the country's largest oil and gas producer, is also eyeing the opportunity and gearing up to meet the growth in LNG trucking in the country.

At the end of last year, CNPC signed two long-term contracts with Houston-based Cheniere Energy for LNG imports from Sabine Pass and a new LNG facility under construction near Corpus Christi, a port city in Texas along the Gulf of Mexico.

Before that, it had already increased its presence in the Arctic region's natural gas sector by participating in the Yamal LNG project with Novatek, Russia's independent natural gas producer, which will ensure that China can get more than four million tons of LNG each year when the project is in full operation.

According to Marc Howson, a senior managing analyst of LNG at S&P Global Platts, thanks to the major LNG imports that will help to alleviate the gas shortages in northern China, the country won't see a gas shortage this winter despite its growing natural gas demand.

"LNG imports will help bridge the supply-demand gap even though domestic output and pipeline imports are unable to keep up with the gas consumption growth, especially in the densely populated coastal regions, which are more distant from gas fields and import pipelines," he said.

Analysts believe China's growing gas demand will put state-owned companies under mounting pressure to open their terminal and pipeline infrastructure to more end users as the government seeks to improve end-user cost efficiency and enhance supply security.

According to Abache Abreu, an LNG analyst for the Asia-Pacific and Middle East regions, as the share of LNG imports in the total Chinese gas supply increases, it's imperative to set up domestic pricing formulas that more closely reflect LNG market fundamentals.

"More and more Chinese companies are entering the LNG market, drawn by growing domestic consumption and the opportunity to trade the arbitrage between spot LNG prices and regulated gas hub prices or oil-linked LNG contracts," he said.

A slew of term contracts have also been signed by independent players. In 2017, long-term contracts by non-State-owned companies accounted for 500,000 tonnes, or 1.3% of contracted LNG import volumes. This will rise to 4.42 million tonnes, close to 10% of contracted LNG shipping imports, in 2020, Abreu said.

Given State-owned companies' resistance to grant third-party access to their existing terminals, some independent buyers are building their own LNG import facilities, despite high taxes and an onerous approval process, he said.

"As internal competition rises, pressure to turn domestic gas sector liberalization guidelines into policy and push for greater flexibility in international supply agreements will follow, with challenges and opportunities for all LNG stakeholders," Abreu added.

Sources:sxcoal

Please Contact Us at:

admin@xindemarine.com

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU

WOODSIDE AND CHINA RESOURCES AGREE LONG-TERM LNG SU  Shanghai Yangshan Port Bunkered Two LNG Powered Con

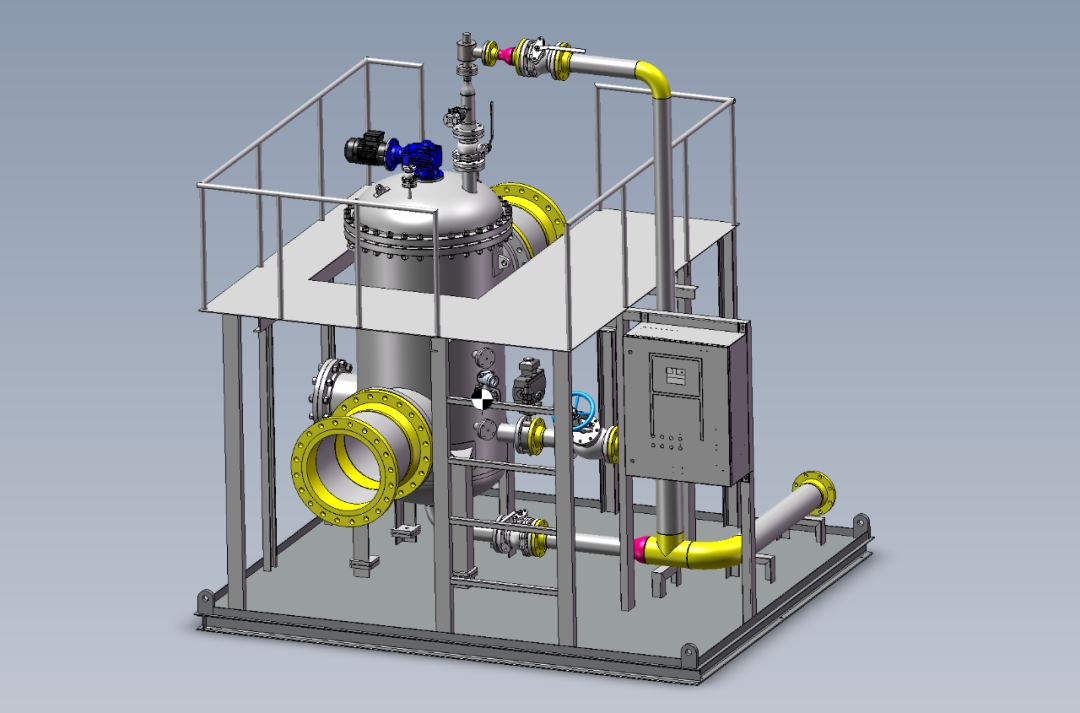

Shanghai Yangshan Port Bunkered Two LNG Powered Con  Headway successfully delivers filtration skid solut

Headway successfully delivers filtration skid solut  Celebrating the Launch of “Green Energy Pearl” –

Celebrating the Launch of “Green Energy Pearl” –  PIL and SSES complete the inaugural LNG bunkering o

PIL and SSES complete the inaugural LNG bunkering o  BW LNG secures e-procurement deal with Procureship

BW LNG secures e-procurement deal with Procureship