Zhejiang Seaport Financial Leasing Co. (ZSFL), a subsidiary of Zhejiang Seaport Group /Ningbo Zhoushan Port Group Co., Ltd., has acquired its first-ever 话题标签Capesize bulk carrier—the 180,000 DWT MV.SEALEADER II—through a pioneering cross-border direct leasing project.

Deal Structure: Partnering with Singapore’s Xiehai Bulk Shipping Pte Ltd and Greece’s original owner (THENAMARIS), ZSFL purchased the 2011-built vessel via an SPV in Tianjin Dongjiang, leveraging cross-border RMB settlements to mitigate currency risks.

Strategic Impact: This transaction sets a replicable template for international shipping finance, reinforcing China’s role in global maritime asset management.

Green Momentum: Aligning with China’s “dual-carbon” goals, ZSFL now manages 530,000+ dwt of green fleet capacity, including methanol-fueled vessels and offshore engineering ships.

ZSFL continues to lead in innovative financing, having executed 34 vessel deals (total: ~¥1.797B RMB) across bulkers, containerships, and specialized offshore vessels.

The deal highlights the rise of China’s leasing hubs like Tianjin Dongjiang, offering tax/policy advantages for global lessors.

Shipbid Net, as the third-party transaction platform, ensured seamless execution with end-to-end services—from valuation and technical surveys to compliance oversight—guaranteeing secure fund flows and smooth delivery.

As China’s maritime finance sector expands, cross-border collaborations like this will drive fleet renewal and sustainable shipping. ZSFL’s focus on “finance + industry” synergy positions it as a key player in decarbonizing global trade routes.

by Xinde Marine News Chen Yang

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

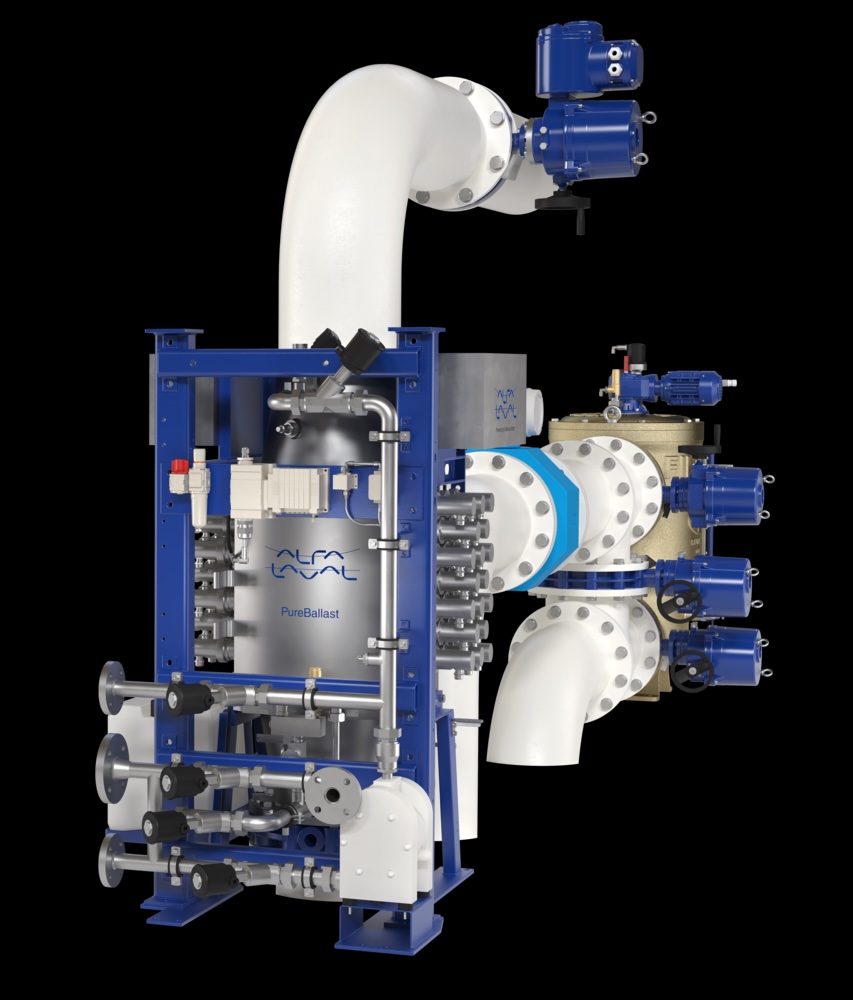

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive