Financial advisory and asset managing capabilities help smaller ship owners, and financial and industrial groups alike overcome complex market challenges, writes Capt. Anurag Mathur, Managing Director, Wallem Commercial Services

Smaller shipowners seeking expansion, as well as multinational corporations entering the maritime industry for the first time, often encounter a shared challenge: the complexities of the market frequently exceed their own expertise and that of the advisors they typically consult.

However, what may be a perceived obstacle to maritime business development has become a catalyst for growth within Wallem Group, manifested in the success of Wallem Commercial Services.

Expanding its range of capabilities has helped Wallem Commercial Services achieve double digit growth over the last couple of years, based on its ability to boost the performance of its partners.

Launched in 2008, Wallem Commercial Services initially focused on areas such as commercial ship and cargo management, broking, chartering and S&P, but has evolved to take in insurance, advisory financial services, loan facility and distressed asset management as core activities.

The unique portfolio of capabilities means that Wallem Commercial Services can effectively perform in the role of shipowner for companies without their own expertise, or act as the point of worldwide contact for smaller owners wishing to serve different vessel types or enter new markets.

In doing so, the Wallem’s Commercial Services team leverages Wallem Group’s experience in areas that are usually closed to third party managers – such as market research, commercial knowhow, back-office support and asset financing.

Closer to market

Originally set up to help Wallem get closer to shipping markets as a ship broker based in Hong Kong, Wallem Commercial Services moved into sale and purchase activities. After it started acting on behalf for a distress asset management company, it expanded into operating vessels commercially as well as technically.

Over time, evolution has enabled Wallem to provide a one-stop service for ship owners seeking new opportunities, diversification or to deal with increasingly complex regulatory requirements and financial modelling. Wallem Commercial Services works with a number of international shipowners in support of bulk carriers, tankers, chemical tankers and PCTC vessels.

In Asia, its activities have been driven by large commercial groups seeking to enter shipping markets where they see strong opportunities to assist their growth. An example has been an unfolding relationship with a giant Chinese automaker, where Wallem has provided day-to-day support of vessel operations including cargo stowage, route and bunker planning for the manufacturer’s first fully chartered PCTC vessel.

That work led on to providing support for other maritime functions such as cargo bookings and vessel performance management, with Wallem emerging as a key value-add partner, providing support to the Automaker’s vision for fleet expansion.

Confidential partners

Wallem’s 122-year legacy of quality operations also puts the group in a strong position to work with new interests as counterparty. It takes boldness for industrial groups to become ship owners, no matter how large they are, but Wallem Commercial Services has the attributes to manage the transition safely and efficiently, and to help build the teams and strategy that will lay the best foundations for their businesses.

Smaller ship owners that lack the management resources or inhouse expertise to expand into new sectors or wish to go from a local base to global operations have also benefited from partnering with Wallem Commercial Services.

In these cases, private owners can prefer to keep relationships confidential but, for example, a Chinese and South east Asian ship owners may want to work worldwide, and Wallem can help by facilitating negotiations with established charterers and operators. In addition, Wallem draws on longstanding relationships with oil majors and big commodity players, for example, and enjoys a growing niche position with Asian financiers due to its close ties with Chinese and Japanese leasing houses.

We have seen the need for alternative financing for shipping markets grow because of the size of investments, and a reduced appetite from traditional bankers. Chinese and Japanese finance leases are often now a more attractive way to fulfil new investors’ requirements as ship owners.

Technical challenges

A major challenge for all owners, new or established, is the changing technological sphere and environmental regulatory requirements as the industry gets to grips with digitalisation and decarbonisation.

We also see a growing number of queries regarding what owners need to do to improve vessel efficiency, as it can be extremely difficult for ship owners to plan which new technologies will make their fleets more sustainable and which alternative fuels will be available worldwide.

Wallem has developed its own advisory software inhouse to help make vessels more efficient and find what routeing and utilisation will achieve the best environmental ratings under the CII system. We can work with owners’ own IT to ensure that the best stowage, routing or hardware options are selected to ensure regulatory compliance for the EU ETS and FuelEU Maritime regimes, for example.

Increasingly, Wallem Commercial Services is involved with owners at the strategic level over how these issues will develop, utilising our experience and connections to develop project management pathways with our customers.

Across multiple ship types, Wallem Commercial Services will continue to serve the best interests of its partners, whether by giving smaller owners the network they need to achieve sustainable growth, or by putting our strong operational capabilities at the disposal of international conglomerates.

In fact, I believe there are opportunities in every situation; the ‘right’ answer may not be the same for all because much depends on the position of the asset and the owner in the investment cycle. For instance, a vessel may at one and the same time be a candidate for investment based on sustainability criteria which one owner wants to sell and another to buy.

source: Wallem Commercial Services

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

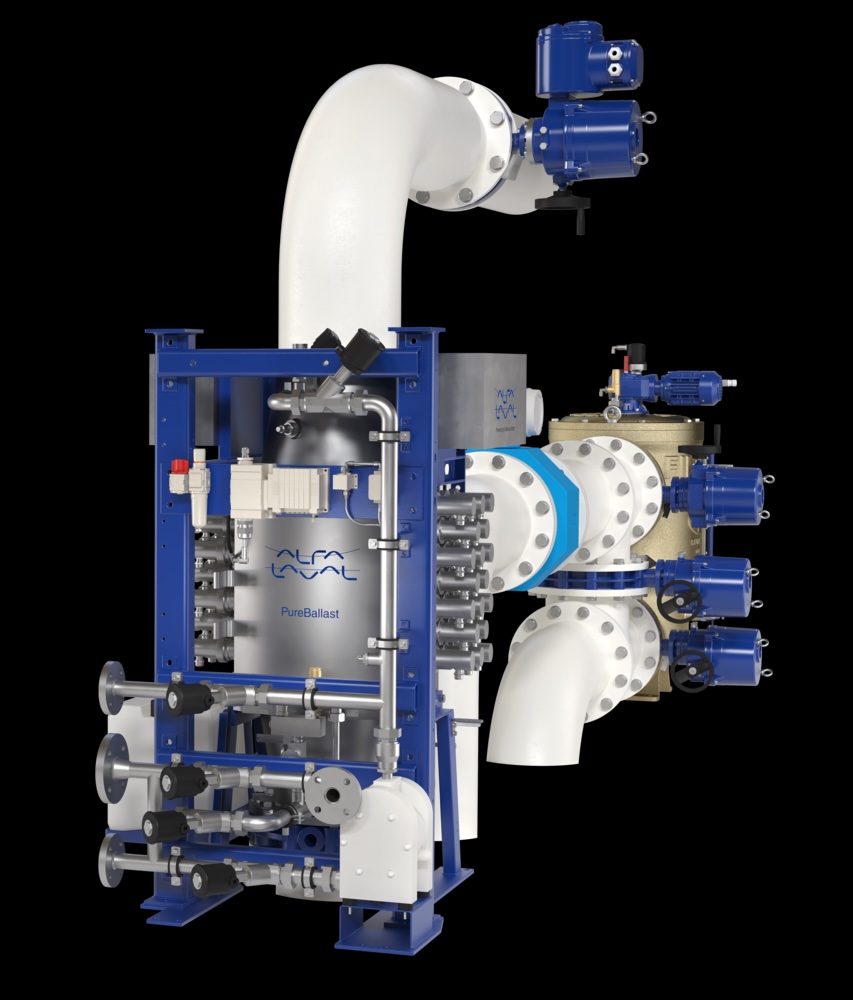

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive