Contships Management Inc, the largest independent tonnage provider in the 900-1,500 TEU feeder segment, is making history as the first Greek private shipowner to issue a $100 million bond in the Nordic high-yield market.

COO of Contships,

Angelos Tyrogalas told

XINDE MARINE NEWS in an email,We has made history by being the first Greek private shipowner to issue a bond in the Nordic market.

Led by renowned Greece shipowner Nikolas Pateras, this sustainability-linked bond marks a significant milestone in maritime finance, highlighting Contships' commitment to fleet renewal and sustainability. The proceeds from this bond will focus on acquiring younger, more efficient vessels, addressing the growing demand for greener and more modern tonnage.

Key Highlights:

Purpose: Fleet renewal, debt refinancing, and general corporate needs.

Fleet Strength: 41 vessels, with a robust client base including MSC, CMA CGM, Maersk, COSCO, and ZIM.

Sustainability Goals: Aiming for a 2% improvement in the fleet's well-to-wake efficiency ratio over five years. -> 10% over 5 years (or 2% annually on average)

Financial Outlook: 2025 EBITDA estimated at $98M with $186M in net revenue.

This groundbreaking move underscores the importance of sustainable growth and financial innovation in the shipping industry. As the world transitions to greener shipping practices, initiatives like this set a strong example for others to follow.

With a conservative financial strategy and a proven track record of delivering value to investors, Contships is well-positioned to lead the industry in its journey toward a sustainable future.

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

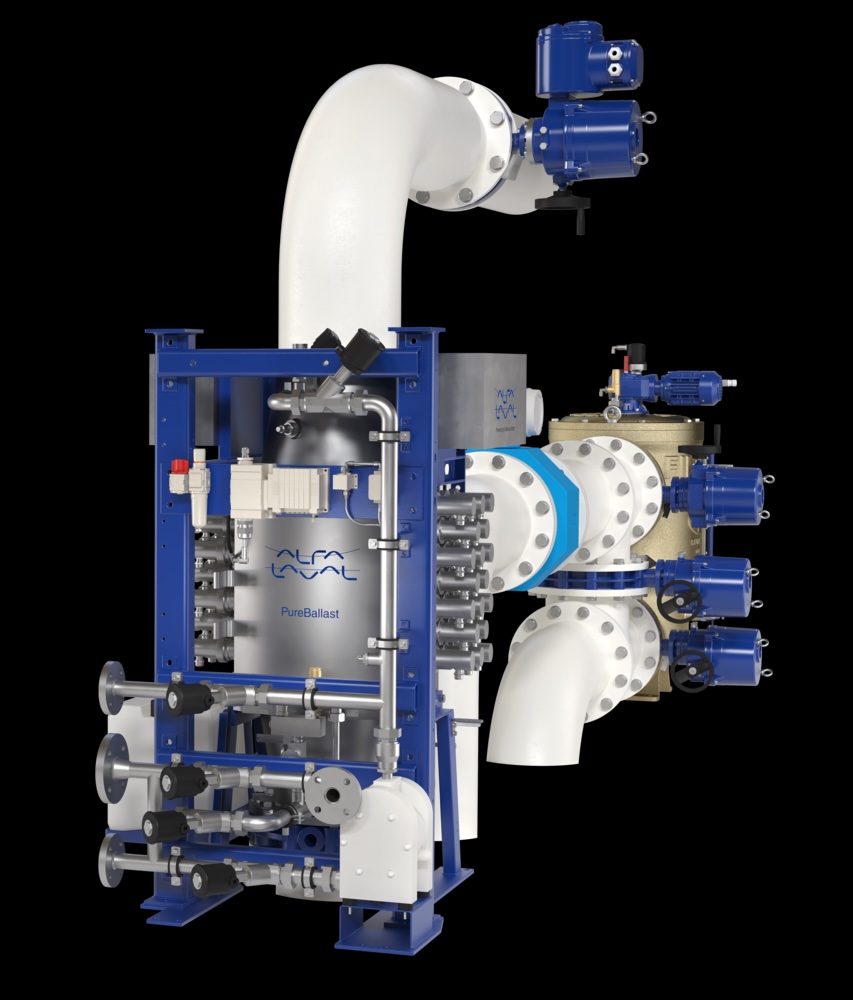

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive