On October 14th, several A-share listed companies under China Merchants Group announced significant stock buybacks and shareholder increase plans, totaling billions of RMB! This strategic move involves companies like China Merchants Port, China Merchants Shekou, China Merchants Expressway, China Merchants Energy Shipping, China Merchants Nanyou, Sinotrans, and more.

· China Merchants Energy Shipping (601872): Plans to buy back A-shares with a total amount between 2.22 billion and 4.43 billion RMB, aimed at reducing capital and increasing earnings per share.

·China Merchants Port (001872/201872): Proposed a buyback of A-shares valued between 1.95 billion and 3.89 billion RMB, with all repurchased shares to be canceled.

·China Merchants Nanyou (601975): The parent company, China Changjiang Shipping Group, plans to increase its stake by 1-1.72%, with a total amount between 2.24 billion and 3.86 billion RMB.

·China Merchants Shekou (001979): Buyback plan with an estimated amount between 3.51 billion and 7.02 billion RMB, with shares to be canceled to boost EPS.

·China Merchants Expressway (001965): A-share buyback worth between 3.1 billion and 6.18 billion RMB, aiming to stabilize market expectations and enhance shareholder value.

·China Merchants Property Operation & Service (001914): Announced a buyback of 78 million to 1.56 billion RMB, to reduce share capital and improve EPS.

·Sinotrans (601598): Announced a buyback of 2.71 billion to 5.42 billion RMB worth of shares, with a planned cancellation. Its parent company also plans to increase its stake with an additional 2.5 to 5 billion RMB.

·Liaoning Port (601880): Proposed a buyback plan valued between 4.2 billion and 8.4 billion RMB, with shares to be canceled and the buyback window extending to September 2025.

This series of actions underscores the group's strong confidence in their future and sends a clear message to the market: We are committed to long-term growth and stability!

By reducing capital through share buybacks, the companies aim to boost EPS (Earnings per Share), ensuring value for shareholders and stabilizing stock prices. Investors have already reacted positively, with notable stock price increases across the board.

As a central state-owned enterprise (SOE), China Merchants Group is not only playing its role in market stabilization but also contributing to China’s high-quality economic development. These efforts serve as a powerful example for other SOEs in uncertain market conditions.

This initiative reflects their commitment to investor confidence, shareholder protection, and national economic resilience.

by Xinde Marine News Chen Yang

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

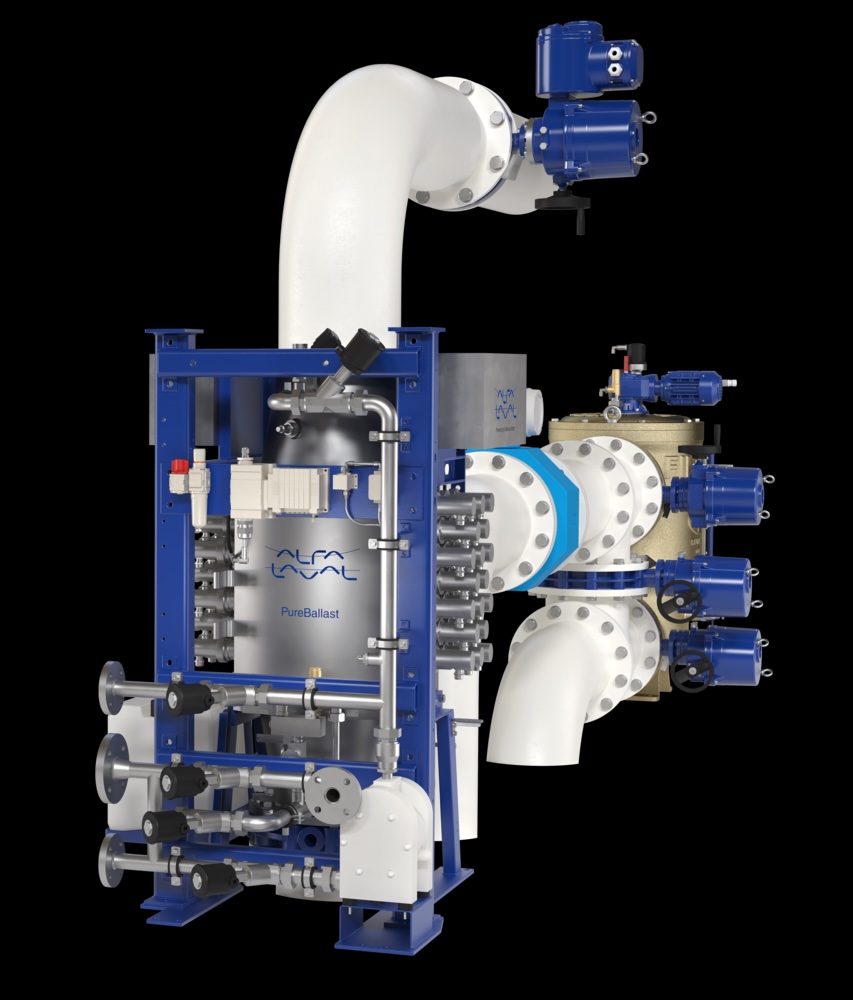

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive