DSV announces its biggest transaction to date after signing an agreement to acquire Schenker from Deutsche Bahn. The acquisition will strengthen DSV's global network, expertise and competitiveness, benefiting employees, customers and investors. The value of the acquisition is EUR 14.3 billion.

DSV is proud to announce that it has signed an agreement to acquire Schenker from Deutsche Bahn in a transaction worth EUR 14.3 billion at enterprise value (approximately DKK 107 billion).

The reach of the combined company will strengthen the organisation’s competitiveness and provide access to new markets in a very dynamic and competitive industry. Together, DSV and Schenker will have an expected pro forma revenue of approximately EUR 39.3 billion (based on 2023 numbers) and a combined workforce of approximately 147,000 employees in more than 90 countries.

The acquisition of Schenker will strengthen DSV's global network and capabilities. In addition to greater reach and better opportunities to serve its customers, the acquisition strengthens DSV's platform for growth and the development of a more sustainable and digital transport and logistics industry.

With this acquisition, Germany will be a key market for DSV with a substantial impact on the future organisation. Various central functions will stay in Germany, including at the Schenker location in Essen. DSV expects to grow in Germany and plans EUR 1 billion investments in Germany in the next 3-5 years. The investments will contribute to long-term growth and job creation, as well as promoting modern and attractive workplaces. It is anticipated that five years from now, the combined organisation will have more employees in Germany than Schenker and DSV have today.

Jens H. Lund, Group CEO, DSV:

“This is a transformative event in DSV’s history, and we are very excited to join forces with Schenker. With the acquisition we bring together two strong companies, creating a world-leading transport and logistics powerhouse that will benefit our employees, customers and shareholders.”

“By adding Schenker’s competencies and expertise to our existing network, we improve our competitiveness across all three divisions: Air & Sea, Road, and Solutions. As well as enhancing our commercial platform across DSV, the acquisition will provide our customers with even higher service levels, innovative and seamless solutions and flexibility to their supply chains.”

Jochen Thewes, CEO, Schenker:

“DB Schenker is one of the most powerful and innovative teams in transportation and logistics with more than 150 years of experience. The recent years have been the most successful in our company’s history and we have proven that DB Schenker is fit for the future. We are excited about the future prospects of the combined business. Together with DSV, our goal is to transform the industry and build a truly global market leader with joint European roots for the best of our employees and our customers.”

Richard Lutz, CEO, Deutsche Bahn:

“The sale of DB Schenker to DSV marks the largest transaction in DB's history and provides our logistics subsidiary with clear growth prospects. It has been important for us to find a strong partner for Schenker and a long-term home for the employees of the company.”

A bright future together

The companies are a strong match with many similarities in business models and services, shared values and high operational standards, creating a wide range of service offerings for customers across industry verticals, and exciting career paths for employees.

DSV is committed to a smooth transition that prioritises the continuity of service excellence for all Schenker customers and with careful consideration for employees and stakeholders. DSV recognises the importance of combining the operations seamlessly and is dedicated to upholding the high standards both companies are known for.

The integration planning will be a joint effort between DSV and Schenker and the specific plans will be developed between the signing and closing of the transaction.

As part of the agreement, DSV has issued social undertakings for employees in Schenker in Germany, which apply until two years after closing. Collective agreements and individual employment conditions for German employees on the closing date will generally be retained in the two years period. DSV will apply the German principles of co-determination.

Next steps

The deal is conditional on approvals by the Supervisory Board of Deutsche Bahn and by the German Federal Ministry for Digital and Transport, which are expected in the coming weeks. In addition, the acquisition is conditional on obtaining customary regulatory clearances, which are expected to be secured in Q2 2025. DSV expects to finance the transaction through a combination of equity financing of around EUR 4-5 billion and debt financing.

Until the closing of the transaction, DSV and Schenker remain two separate companies conducting business as usual.

source: DSV

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

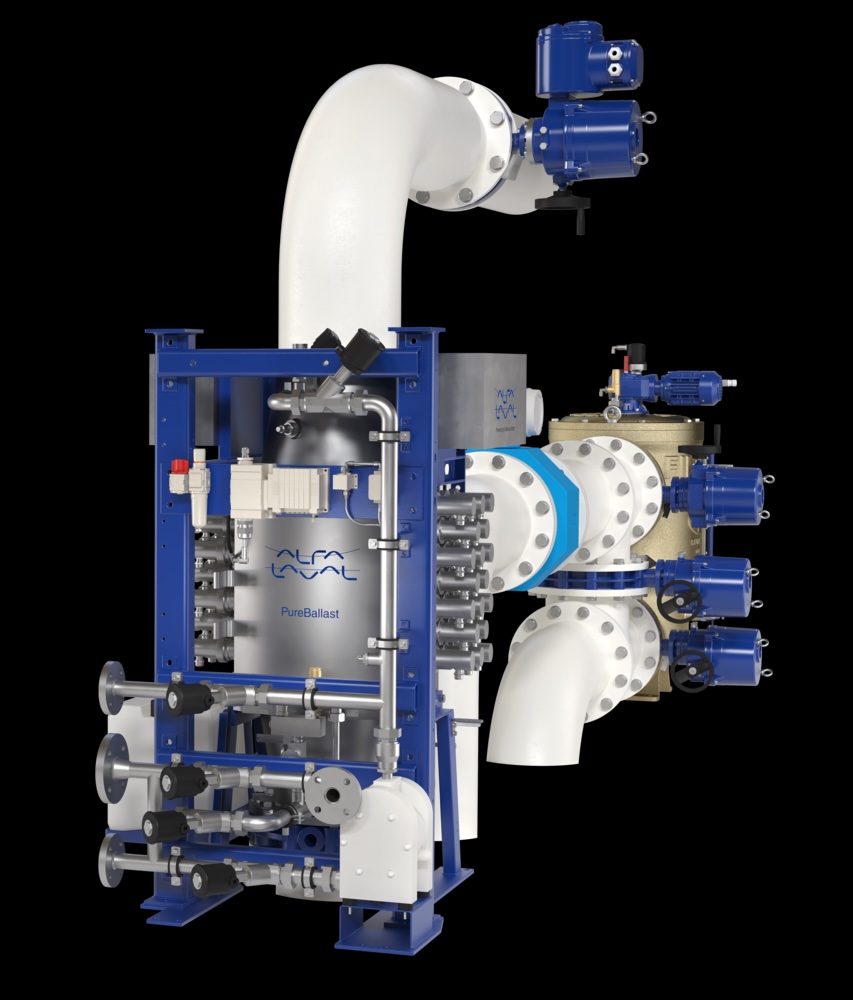

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive