On the evening of August 2, Antong Holdings Co., Ltd. (referred to as "Antong Holdings" or "the Company") announced a significant transaction involving the leasing of vessels to Sinotrans Container Lines Co., Ltd. (referred to as "Sinotrans Container Lines"), a wholly-owned subsidiary of China Merchants Energy Shipping Co., Ltd. (referred to as "CMES"). This strategic move is designed to enhance Antong Holdings' profitability amid intense competition in the domestic container logistics market.

Key Details of the Transaction:

· Leasing 4 container vessels for international trade:2 vessels with 2,444 TEU capacity (Renjian Fuzhou, built in 2018, and Renjian Dalian, built in 2019) at a daily rate of $23,500 (excluding tax) for a period of 16-20 months.2 vessels with 698 TEU capacity (Haisu 6, built in 2006, and Haisu 7, built in 2004) at a daily rate of $7,500 (excluding tax) for a period of 11-13 months.

· Total transaction value is estimated between RMB 1.90 billion and RMB 2.50 billion (excluding tax).

Strategic Rationale:

Faced with declining domestic container shipping rates and intensified market competition, Antong Holdings has decided to allocate part of its fleet to the international trade market. With rising freight rates in the international container shipping market driven by the Red Sea crisis and increased demand, this transaction aims to seize market opportunities and boost the company's overall profitability.

Market Impact and Future Prospects:

This transaction aligns with current market trends and is expected to significantly enhance Antong Holdings' profitability in the international shipping market. The pricing of the transaction is deemed fair, ensuring no conflict of interest and safeguarding the interests of the company and its minority shareholders.

In a previous announcement on May 28, Antong Holdings and CMES revealed plans for a major restructuring involving the spin-off and merger of subsidiaries Sinotrans Container Lines and Guangzhou China Merchants RoRo Transportation Co., Ltd. (referred to as "Guangzhou RoRo"). The proposed restructuring aims to list these subsidiaries through a reverse merger with Antong Holdings.

Read More: This restructuring plan, confirmed on June 12, will see Antong Holdings issuing shares to acquire 100% of Sinotrans Container Lines and 70% of Guangzhou RoRo, resulting in CMES becoming the controlling shareholder of Antong Holdings, with China Merchants Group as the actual controller.

This strategic merger, anticipated to bring significant synergies, underscores the companies' commitment to win-win cooperation and industry upgrading. While the final merger awaits shareholder approvals and regulatory reviews, the recently announced transaction highlights the immense potential and advantages of the combined entities.

Looking Ahead: As the restructuring progresses, the collaboration between Antong Holdings, Sinotrans Container Lines, and Guangzhou RoRo promises new growth opportunities and a brighter market outlook. Stay tuned for more updates on this transformative journey!

by Xinde Marine News Chen Yang

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

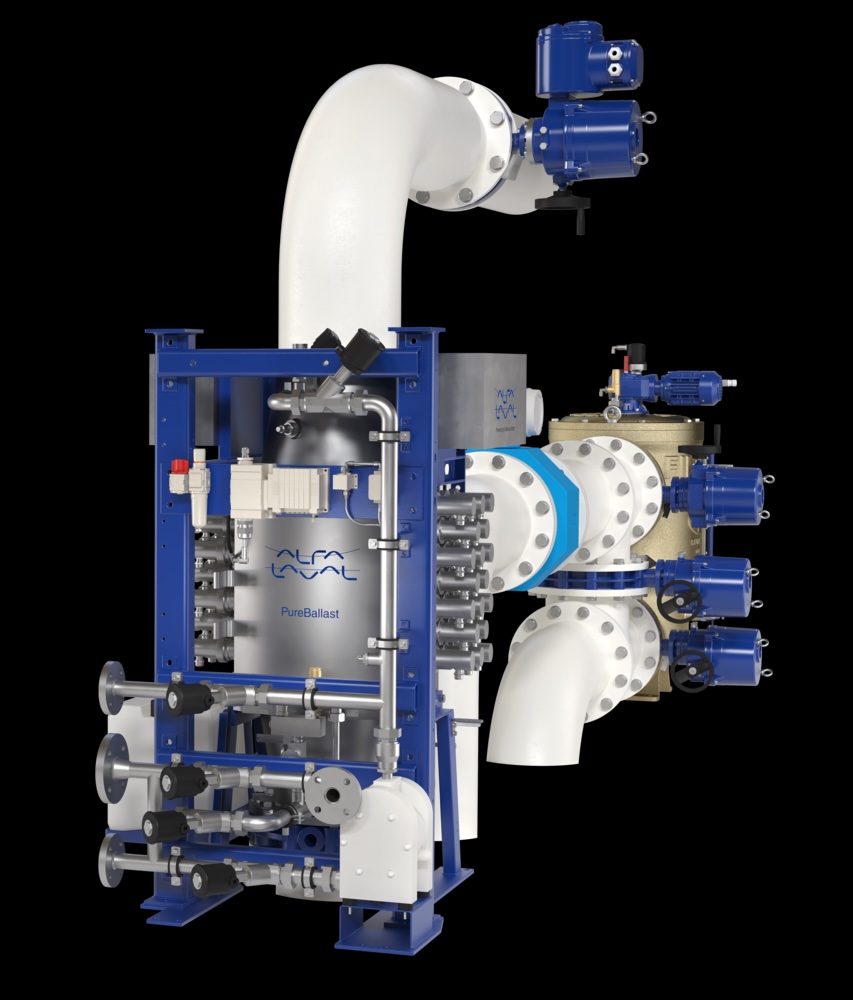

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive