Sustainable shipping fuels could achieve cost parity with fossil fuels by 2035 through decisive emissions policies such as carbon pricing and emission limits, according to a recent report from Wärtsilä Marine. In this article Mikael Wideskog, Director of Sustainable Fuels & Decarbonisation explains how investing in fuel-flexible engine and power solutions can aid vessel operators in adapting to evolving regulatory frameworks.

Mikael Wideskog, Director of Sustainable Fuels & Decarbonisation at Wärtsilä

Wärtsilä's recent report, ‘Sustainable fuels for shipping by 2050 – the 3 key elements of success,’ reveals that the EU Emissions Trading Scheme (ETS) and FuelEU Maritime Initiative (FEUM) will more than double the cost of fossil fuels by 2030. By 2035, these measures are expected to close the price gap between fossil and sustainable fuels for the first time.

Despite forecasts showing that sustainable fuels will remain 3–5 times more expensive than today's fossil fuels in 2030, further regulations could close this gap. Achieving cost parity between sustainable and fossil fuels by 2035 through decisive emissions policies, such as carbon pricing and emission limits, indicates that reaching net zero is possible with the right mechanisms to drive change. Strong financial and commercial incentives are essential to engage all vessel owners and operators in this transition.

The Pathway to Decarbonisation

Current regulations are already exerting financial pressure to reduce emissions. The EU ETS rewards operators using low-carbon bunker fuels with lower payments and imposes penalties for excess emissions. From January 1, 2025, FEUM will require vessels to implement progressive reductions in the greenhouse gas (GHG) intensity of onboard fuels.

This scenario leaves vessel owners, operators, energy suppliers, and the broader marine ecosystem contemplating which sustainable fuels to adopt and when. Our latest analysis projects when each fuel type will likely become available: LNG as a transition fuel, followed by biofuels in the 2030s. 'Blue' fuels like blue ammonia will act as intermediaries before green synthetic fuels become the standard in the late 2030s and early 2040s.

Our report highlights that “individual operators can transform uncertainty and risk into competitive advantage and lower operational costs by investing in efficiency and fuel flexibility.” Investing in fuel-flexible engine systems positions operators to meet stricter emissions targets while maintaining flexibility to access various fuels amid ongoing sector disruptions and investment uncertainties.

Choosing Future-Proofed Solutions

Fortunately, fuel-flexible engines are already commercially available. Many owners and operators are unaware that current marine engines can use future clean fuels with minimal component exchanges. Although handling, storage, and fuel supply can be complex due to new fuel properties and vessel class restrictions, these challenges are manageable, particularly if vessels are designed for future conversions.

Dual-fuel engines can operate on diesel and low-carbon or zero-carbon future fuels. These engines allow vessels to switch from conventional diesel to ammonia, methanol, or LNG without power interruptions, with conversion technology further enhancing benefits. This capability reassures ship owners that they can adapt to evolving market dynamics and regulatory frameworks.

If new or more stringent emissions trading schemes or carbon pricing policies are introduced in the coming years, or if a particular fuel option becomes the most commercially viable bunkering solution, these operators are already primed to move.

After accounting for fuel storage considerations, such as ammonia requiring 2.4 times more volume than petroleum due to its lower energy density than petroleum-based fuels, owners and operators can build or adapt vessels to use future fuels.

Methanol and Ammonia-Ready Solutions

Wärtsilä has introduced a range of ammonia and methanol-ready engines, anticipated to be leading clean bunker fuel alternatives. Methanol is emerging as a key candidate for decarbonising shipping due to its simple handling, reliable combustion, and near carbon-neutral power when produced using renewable electricity and captured carbon. Wärtsilä’s methanol-fuelled engines have powered the Stena Line ferry Stena Germanica since 2015. Now, ship owners can leverage this expertise with the Wärtsilä 32 and MethanolPac fuel supply system.

The Wärtsilä 25 engine platform offers versatility, capable of running on diesel, LNG, gas or liquid carbon-neutral biofuels, and ammonia, being the first commercially available 4-stroke engine-based solution for ammonia fuel.

Using existing engine platforms for new fuel capabilities streamlines development and simplifies fuel conversion. The fuel gas system on the Wärtsilä 25DF engine shares components with the Wärtsilä 31DF, facilitating system validation and spare parts availability, and allowing continuous efficiency advances across different fuel types.

Methanol’s Promising Newbuild Orderbook

In a promising move for the newbuild orderbook, Wärtsilä recently secured China’s largest-ever methanol newbuild order. Wärtsilä will provide methanol-fuelled auxiliary engines for five new container vessels for COSCO Shipping Lines Co., Ltd, and seven new container vessels for Orient Overseas Container Line (OOCL). Each vessel will feature three 8-cylinder and two 6-cylinder Wärtsilä 32M engines, marking a milestone for the integration of greener solutions and the Chinese maritime sector’s commitment to greener shipping solutions.

The Wärtsilä 32M methanol-fuelled engine, which has received type approval certificates from several global classification societies, is central to this success, with the engines being complemented by Selective Catalytic Reduction (SCR) exhaust cleaning systems and alternators.

The 24,000 TEU ships for OOCL will be constructed at the Nantong COSCO KHI Ship Engineering yard, while those for COSCO Shipping Lines will be built at the Dalian COSCO KHI Ship Engineering yard. These vessels are scheduled to begin commercial operations in 2026, marking a significant advancement in the adoption of sustainable maritime fuels.

According to the IMO’s Future Fuels dashboard, based on DNV’s Alternative Fuels Insight, conventional fuels represent 99.27% of vessels currently in operation. Of the 0.73% running on alternative fuels, LNG takes the firm lead with 0.55% of that total volume. However, the picture changes when we look at the orderbook, with 15.56% of the vessels currently on order capable of running on alternative fuels, versus 84.44% running on conventional fuels.

Methanol as a fuel is becoming considerably more popular among the different alternative fuel options too, thanks to solutions becoming practically available globally, with the fuel taking up nearly half of new vessel contracts over the last 12 months.

Creating Catalysts for Change

While new engine and power technologies are crucial, the industry still awaits the widespread availability of zero and near-zero carbon fuels to replace fossil fuels. According to the 2023 UN Review of Maritime Transport, decarbonising by 2050 requires up to US $5 trillion in investments in near-zero fuels and propulsion technologies, plus an annual liquidity injection of $8 billion to $28 billion. This investment is essential to replace around 270 million tonnes of heavy fuel oil annually with alternative fuels.

Thus, while commercially viable and operationally safe engine technologies are available, fuel suppliers need certainty to invest in sustainable fuel production and supply. Wärtsilä’s report outlines key actions for policymakers, the shipping industry, and individual operators to scale sustainable fuel availability, maintain competitiveness, control costs, and mitigate risks.

Firstly, providing proof of demand for marine and energy industries requires clear, decisive policy. An internationally agreed pathway for phasing out fossil fuels, creating cost parity through carbon pricing, and encouraging global government collaboration on innovation and infrastructure is essential.

Secondly, collaboration within the shipping industry and with other sectors is crucial to overcoming barriers to making sustainable fuels commercially viable. Pooling purchasing power will help reduce costs, and sharing knowledge with smaller operators will support those lacking dedicated sustainability teams. Achieving net zero requires bringing everyone along on the transition.

Thirdly, individual operators, who may feel powerless in the transition to sustainable fuels, have a significant role. By advocating for access to cleaner fuels and engaging in policy shaping, they can influence the regulatory landscape positively. Operators also need to plan their compliance with the IMO’s GHG targets and set their path to net zero operations.

Proactive operators recognise that fuel supply and onboard storage infrastructure are already available, investing in solutions to see vessels through their lifecycle. Accepting that we are a single vessel lifespan away from the net zero target, the only way to afford the journey is to invest in solutions that lower emissions, reduce costs, and provide flexibility.

source: Wärtsilä

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

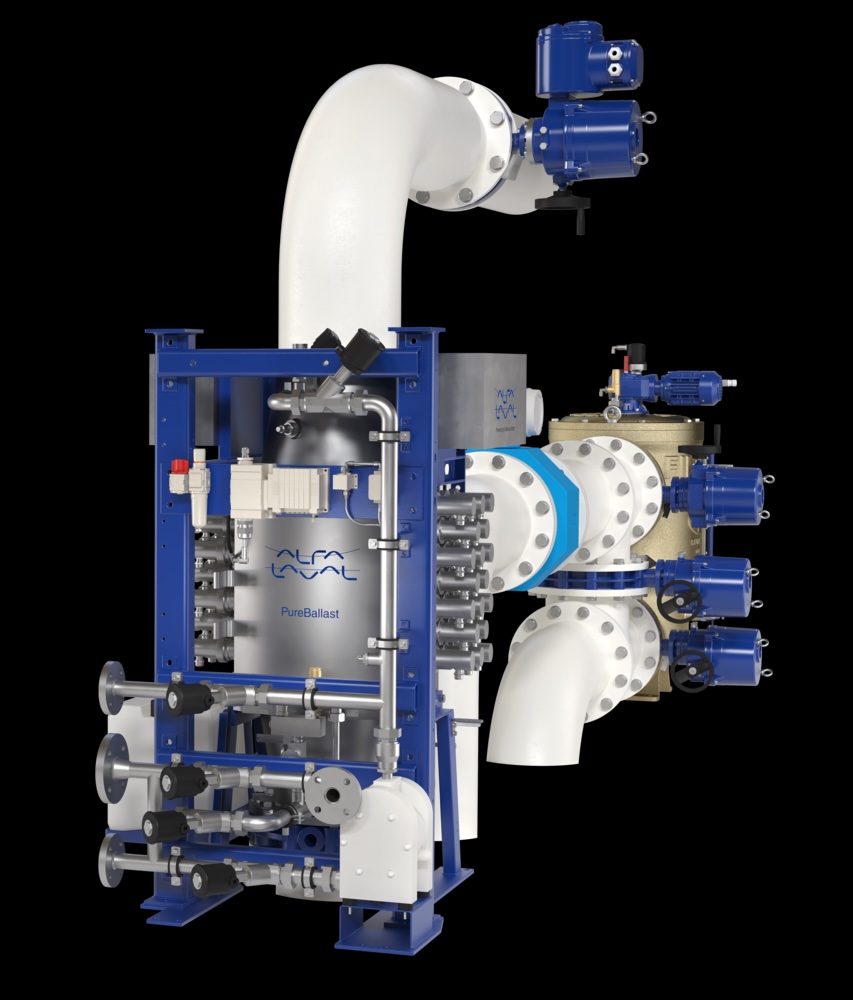

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive