Major Developments! China Merchants Energy Shipping (CMES) Plans to Control Antong Holdings, Introducing the New "China Merchants Container Shipping"

In a significant move, China Merchants Energy Shipping (CMES) has announced its plan to control Antong Holdings, paving the way for the emergence of the new "China Merchants Container Shipping."

On the evening of June 12th, CMES released an announcement titled "The Pre-Plan for the Restructuring and Listing of Sinotrans Shipping and Guangzhou China Merchants Ro-Ro Transport." This restructuring plan signifies a major step forward in CMES's strategy to split off its container shipping and Ro-Ro business for a potential listing.

Key Highlights of the Announcement:

Restructuring Plan: Antong Holdings will issue shares to CMES to acquire 100% equity in Sinotrans Shipping Co., Ltd. (referred to as "Sinotrans Shipping") and 70% equity in Guangzhou China Merchants Ro-Ro Transport Co., Ltd. ("Guangzhou Ro-Ro"). This transaction will effectively lead to the restructuring and listing of Sinotrans Shipping and Guangzhou Ro-Ro under Antong Holdings.

Ownership and Control: Post-restructuring, CMES's equity structure will remain unchanged, and Antong Holdings will become the controlling shareholder of Sinotrans Shipping and Guangzhou Ro-Ro. Furthermore, CMES is expected to become the controlling shareholder of Antong Holdings, with China Merchants Group becoming the actual controller.

Synergistic Benefits:

CMES anticipates significant synergistic benefits from this transaction. The restructuring aims to enhance the sustainable profitability and shareholder returns for both CMES and Antong Holdings by focusing on their core businesses. The complementary nature of the main businesses—foreign trade and domestic trade, container shipping, and Ro-Ro—will drive substantial synergies, benefiting all three companies involved, as well as CMES and China Merchants Group.

Market Impact and Operational Scale:

Sinotrans Shipping: Currently operates 31 vessels with a total capacity of 48,280 TEU, ranking 34th in the global liner company capacity rankings.

Antong Holdings: Operates 83 vessels with a total capacity of 83,008 TEU, ranking 23rd globally and among the top three domestic trade container logistics companies in China.

The merger will result in a combined fleet of 114 vessels, enhancing the total capacity to 130,000 TEU and elevating the global ranking to 19th, achieving 75% of SITC's capacity.

Strategic Advantages:

The combined entity will leverage high levels of business complementarity. While Sinotrans Shipping primarily focuses on international trade routes in Northeast Asia and Southeast Asia, Antong Holdings concentrates on domestic trade routes, thus ensuring a broader and more comprehensive service network. This integrated approach will further enhance competitive strength and market influence.

Guangzhou Ro-Ro:

Strategic Positioning: A leading player in automotive transport with a well-established logistics network covering major domestic and international routes.

Future Prospects: The integration of container and Ro-Ro services promises substantial synergies and increased market competitiveness.

Focus on Core Businesses:

Following the restructuring, CMES will concentrate on its core businesses of oil, dry bulk, and LNG transportation. This strategic realignment will enhance the company's ability to respond to market changes effectively and drive high-quality development in the energy and bulk cargo sectors.

Protection of Minority Shareholder Interests:

CMES assures that the transaction will enhance the development quality of its container shipping business, creating a dual capital operation platform for both irregular shipping (oil and gas transportation + dry bulk transportation) and liner shipping (container transportation + automotive Ro-Ro). This restructuring aims to improve business clarity, resource allocation, and strategic management, benefiting all shareholders, particularly minority shareholders.

Conclusion:

This strategic restructuring marks a significant milestone in CMES's maritime market strategy, laying a solid foundation for future sustainable development. We look forward to CMES achieving greater heights in its new shipping journey, delivering more returns to shareholders and the market.

by Xinde Marine News Chen Yang

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

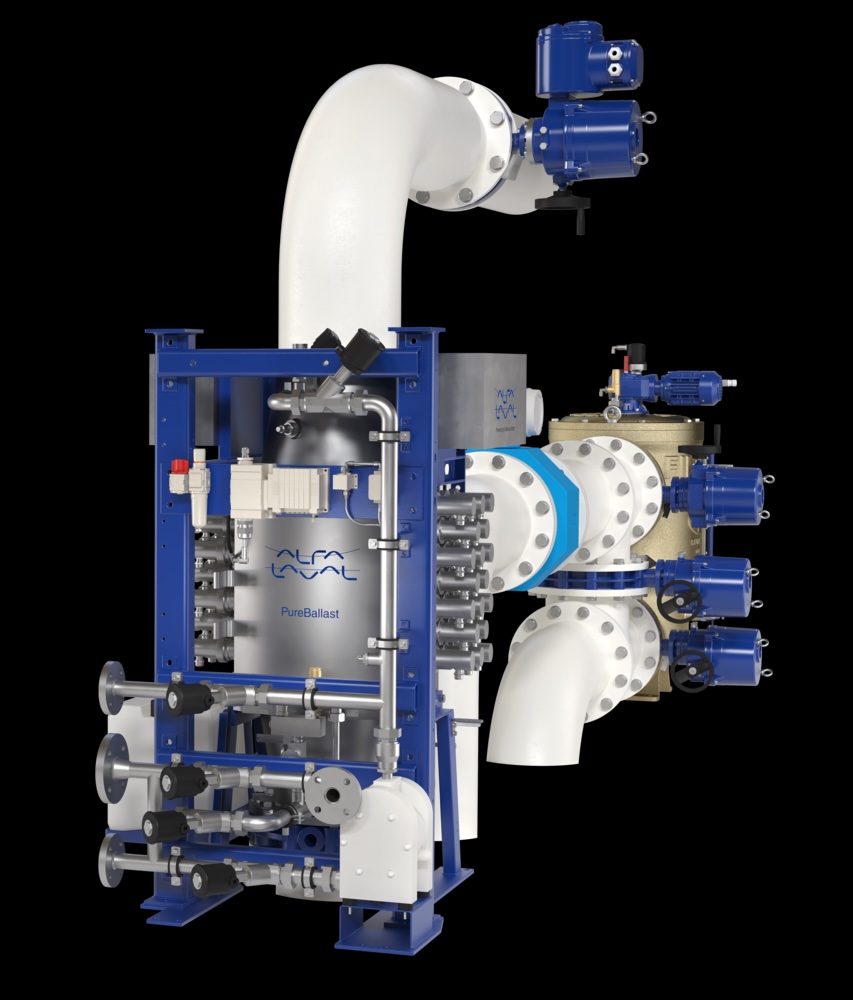

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive