Copenhagen, Denmark – A.P. Moller – Maersk’s (Maersk) financial results for third quarter of 2023 were in line with expectations in a difficult market environment with rates well off their 2022 peak and tested by the increase of capacity in Ocean. Revenue was USD 12.1bn compared to USD 22.8bn in Q3 2022 with an EBIT margin at 4.4% impacted by lower freight rates and lower volumes. Maersk maintains its guidance ranges but now expects to be towards the lower end of the ranges.

"Our industry is facing a new normal with subdued demand, prices back in line with historical levels and inflationary pressure on our cost base. Since the summer, we have seen overcapacity across most regions triggering price drops and no noticeable uptick in ship recycling or idling. Given the challenging times ahead, we accelerated several cost and cash containment measures to safeguard our financial performance. While continuously streamlining our organisation and operations, we remain dedicated to our strategy of fulfilling our customers’ diversified supply chain needs while pursuing growth opportunities across our Terminals business and Logistic & Services." says Vincent Clerc, CEO of Maersk.

Ocean reported a 9% increase in volumes since the previous quarter and a strong cost focus supported an 11% decrease in unit cost at fixed bunker compared to Q3 2022. However, EBIT was negative at USD 27m, down from USD 8.7bn in Q3 2022, driven by significant pressure on rates, in particular on Asia to Europe, North America and Latin America trades.

Revenue in Logistics & Services was USD 3.5bn compared to USD 4.2bn in Q3 2022. The segment was impacted negatively by lower prices, especially in the air and haulage market, while volumes were broadly back in line with last year’s level. Increased cost management helped stabilise margins sequentially.

Terminals reported revenue at USD 1.0bn compared with USD 1.1.bn in Q3 2022 driven by less demand for storage amid eased global congestion and a 4.1% decline in volume. Results were strong as a combination of price adjustments and cost measures. Return on invested capital (ROIC) increased to 10.3%, exceeding the expectation of above 9% towards 2025.

Enhancing competitiveness and resilience through a leaner operation

Maersk has imposed rigorous cost containment measures during the year to effectively cushion the impact of the challenging market conditions, including headcount reduction from 110,000 early 2023 to around 103,500 today. Given the worsening price outlook in Ocean, Maersk is intensifying those measures and today introduce plans to further decrease the workforce by 3,500 positions, with up to 2,500 to be carried out in the coming months and the remaining to extend into 2024. This will reduce the global workforce to below 100,000 positions. Accordingly, total expected restructuring charge is now expected at USD 350m, up from USD 150m announced in February.

The adjustment of the workforce complements the decisive actions taken on cost containment throughout the year. The accumulated effect will bring down Maersk’s selling, general and administrative expenses (SG&A) cost by USD 600m for 2024. In addition, CAPEX spend has been adjusted downward for 2023 and 2024 and further measures are under review, including the continuation of the share buyback program into 2024. Guidance for 2024 will be given on 8 February 2024, as part of the release of the Annual Results.

Financial guidance for 2023

Maersk now sees global container volume growth in the range of -2% to -0.5% compared to -4% to -1% previously. Ocean expects to grow in line with the market.

Maersk maintains its ranges for the full year 2023 guidance but now expects results towards the lower end of the previously communicated ranges of underlying EBITDA of USD 9.5-11.0bn and underlying EBIT of USD 3.5-5.0bn. Guidance for free cash flow (FCF) of at least USD 3.0bn remains unchanged.

CAPEX is now expected at around USD 8.0bn (previously USD 9.0-10.0bn) for 2022-2023 and USD 8.0-9.0bn (previously USD 10.0-11.0bn) for 2023-2024.

For the announced restructuring cost of USD 350m (previously USD 150m), the majority will be recognised in 2023. The total cost savings are expected to be around USD 600m in 2024 compared to 2023.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

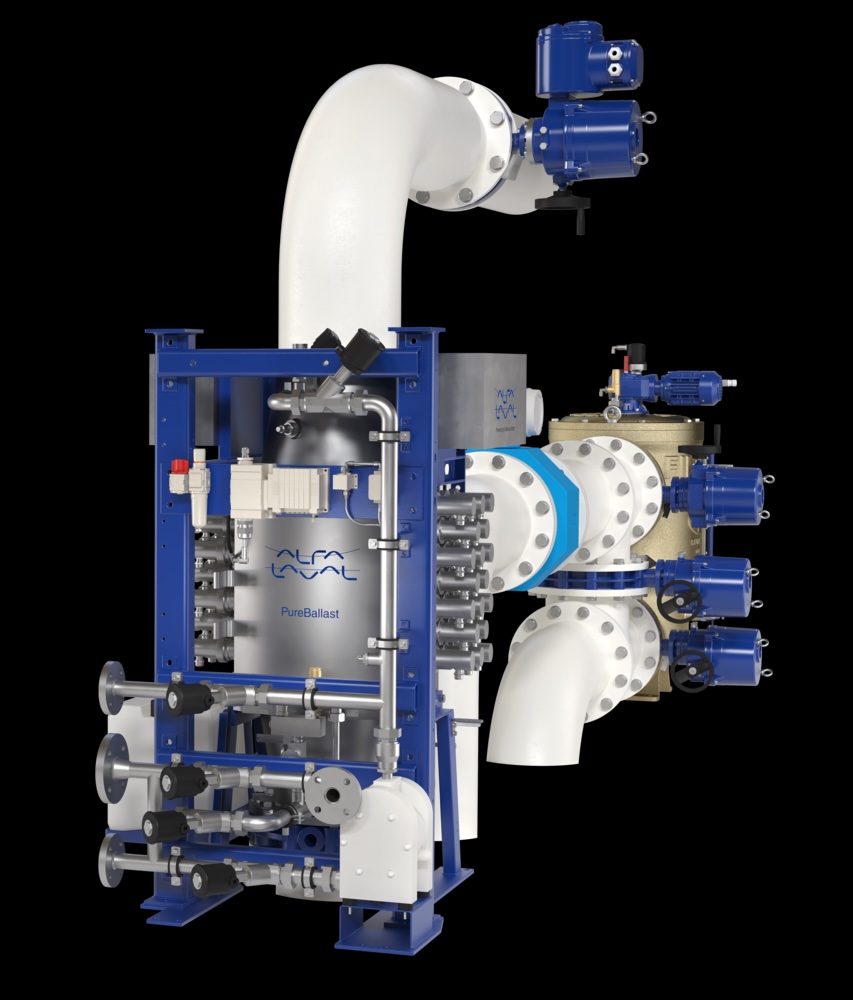

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive