On March 22, Orient Overseas (International) Limited (“OOIL”) announced a profit attributable to equity holders of US$9,965.2 million for 2022, compared to a profit of US$7,128.1 million in 2021.

Earnings per ordinary share in 2022 was US$15.09, whereas earnings per ordinary share in 2021 was US$11.08.

The Board of Directors has recommended that the dividend for full year 2022 is approximately 70% of the profit attributable to equity holders at approximately US$6,974 million, with proposed payment of a final dividend of US$2.61 per ordinary share and a second special dividend of US$1.95 per ordinary share for 2022.

For much of the first half of the year, the container shipping market endured the same conditions through which it had been persevering for the previous 18 months, with effective levels of supply being under immense pressure at the same time as demand continued to grow, albeit moderately. The pressure on levels of effective supply had been caused by severe congestion at multiple locations around the network, and was most obviously visible in long queues of ships lining up to enter the ports of Long Beach and Los Angeles and, at times, in delays of two to three weeks for ships to enter some of the main ports on the East Coast of the USA. The impact of the downwards pressure on effective supply caused by these disruptions far outweighed the effect of the increased nominal supply coming from massive deployment of additional capacity injected into the busiest tradelanes, and from the entry of new smaller competitors into key markets such as the Transpacific tradelanes. However, as the year progressed, it became increasingly evident that market conditions had started to change.

On the supply side, the shift of cargo away from the US West Coast eventually helped to reduce the pressure on the ports and local supply chain, and began to have a significant effect in terms of reducing congestion. Some of this change was driven not by fluctuations in underlying demand, but by deliberate steps on the part of some importers to avoid in 2022 some of the chokepoints that been at the centre of disruption in 2021, especially if there was potential for any additional disruption from possible labour disputes. Initially, this helped to increase congestion on the US East Coast, but after some months, congestion there too, as also in Northern Europe and the major ports of Asia, started to abate. This significant reduction in congestion has already led to an increase in the effective level of supply in the market.

In terms of demand, excess inventory levels started to build up in some key importing economies, most notably the US, partly because of unfulfilled expectations in respect of year-on-year demand growth, and partly because supply chain congestion meant that large quantities of goods were arriving late, including seasonally-sensitive goods. The result of this was that, while consumer spending was not slowing down to any material extent (despite perfectly rational concerns about the impact of inflation and interest rate rises), the demand from importers for containerised transportation was clearly starting to reduce. Freight rates on most major tradelanes started to fall from their tremendous heights, starting a long-predicted trend towards less extreme levels. In the final quarter of the year, rates were starting to approach their pre-pandemic levels on many trade lanes, and load factors were often below optimal levels. That said, we must all be careful not to be so swayed by the scale of the precipitous falls in freight rates that we fail properly to contextualise the current rate levels, which in general are similar to rate levels seen in 2019 and early 2020, and not similar to rate levels seen during the much tougher times of say 2016 or even 2009.

Co-operation with fellow members of the COSCO SHIPPING Group continues to drive significant benefits in terms of efficiency, cost savings and the ability to serve our customers with a more sizeable and global reach. We continue to evaluate ways to enhance and deepen our co-operation, with a win-win approach that will bring benefit to customers, employees, business partners and shareholders alike.

In March 2023, OOIL took delivery of the first vessel built for the Group since 2018. This 24,188 TEU mega vessel, the OOCL Spain, and the 28 vessels that are scheduled to follow her over the next 5 years, represent the next stage in our longstanding plan of measured and intelligent growth. Seven of the vessels still under construction will be Dual Fuel Methanol vessels, which puts OOIL at the very cutting edge of environmental advances in shipping, and is clear proof of OOIL's commitment to decarbonisation.

The logistics business, OOCL Logistics, performed very well during 2022. Furthermore, co-operation between our logistics business and our liner side will be a key driver in our plans to develop more and more end-to-end business with our customers.

The OOIL Group has long been seen as a leader in the field of the development of information technology applicable to container shipping, and in the digitalisation of the industry. The Freightsmart platform, which provides instant quotation and booking, provides a valuable new channel for customers and a new means of targeted outreach for OOIL. Freightsmart has made significant progress during 2022, and has been a valuable tool in managing the disruption and the changing trends of the market. OOIL continues to develop IQAX, a wholly-owned subsidiary, which will play a leading role in driving the digital transformation of the container shipping industry.

At the time of writing, it appears that this unmistakable downwards trend of freight rates may have started to stabilise. Even if we may reasonably expect occasional further falls during the seasonally quieter two to three months following the Chinese New Year holidays, weekly movements in spot rates are no longer as dramatic as they were during much of the second half of 2022, and load factors on some routes show clear signs of improvement. However, it seems unlikely that the general environment for the industry will change materially during the first half of 2023. Thereafter, once importers in countries such as the US have made further progress in reducing their inventories, then if the economic outlook has improved, for example if inflation has started to peak and if employment data remains strong, then we may see some improvement during the second half of 2023. There can, however, be no certainty about that outcome, given the extent of perfectly valid concerns about the future impact of inflation, interest rate rises and broader economic and geopolitical instability.

In 2023 and 2024, further supply increase will be created through the delivery of new ships – this could delay any improvement in the container shipping markets, even if the economic situation is more benign than anticipated. While mitigation of this risk from increasing supply most certainly does exist, through increased likelihood of vessel scrapping for example, and much more significantly from new environmental regulations, these will take time to be felt, and as such will not provide much counterbalance until the second half of 2023 at the earliest. In the meantime, during the first half, it may be that shipping companies will look at expected levels of demand, and re-calibrate their services in line with the potentially reduced requirements of their own customer portfolio.

As at 31st December 2022, the Group had cash and bank balances of US$11,213.9 million compared with debt obligations of US$712.2 million repayable in 2023. The Group had a net cash to equity ratio of 0.68 : 1 as at end of 2022, compared with 0.47 : 1 at the end of 2021. The Group from time to time prepares and updates cashflow forecasts for asset acquisitions, to serve project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds.

OOIL owns one of the world’s largest international integrated container transport businesses which trades under the name “OOCL”. With around 440 offices in approximately 90 countries/regions, the Group is one of Hong Kong’s most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

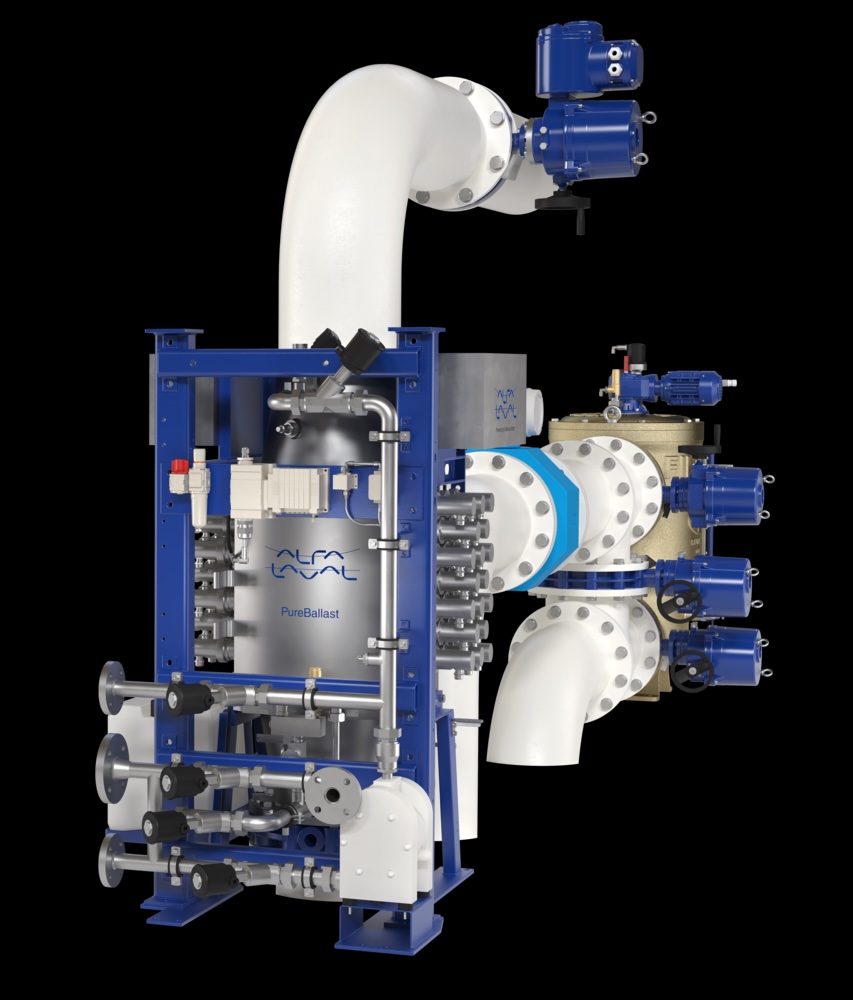

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive