Strong FY2022 Financial Performance from Continuing Operations

The Group delivered a strong set of results for FY2022. Total revenue increased by 37% yoy to RMB20.7 billion, driven by the active shipbuilding and shipping business activities. In line with the revenue growth, cost of sales of RMB17.5 billion increased by 34% yoy from RMB13.1 billion for FY2021. Gross profit for FY2022 was RMB3.2 billion, up 53% yoy from RMB2.1 billion for FY2021. Gross profit margin for FY2022 stood at 15%, slightly higher than 14% for FY2021. Accordingly, the Group reported net profit from continuing operations of RMB2.6 billion, up 31% yoy.

With the robust financial and operational performance, the Group is declaring a final dividend of 5 Singapore cents per ordinary share to reward its shareholders’ long-term trust and support, which is subject to shareholders’ approval in the forthcoming Annual General Meeting. The proposed dividend represents a 36% pay-out1 based on fully diluted earnings per share of RMB71.25 cents for FY2022.

Segmental Performance Review for 2H2022

Core shipbuilding segment registered a higher revenue of RMB9.9 billion in 2H2022, as compared to RMB8.4 billion achieved in 2H2021. Gross profit margin for this segment was 13% in 2H2022, an improvement from 11% for 2H2021. This was due to the depreciation of RMB against USD and the normalisation of steel prices during the reporting period.

Revenue generated from shipping business increased by 49% yoy to RMB822 million, mainly attributable to an expanded charter fleet size and improved charter rates for the reporting period. However, operating costs increased significantly in 2H2022 driven by the rising oil prices, leading to a slightly lower gross profit margin of 41% for 2H2022, as compared to 42% for 2H2021.

Revenue contributed by other business, such as trading, terminal services, ship design services, and investments, declined to RMB291 million in 2H2022, mainly due to lower volume of trading activities. As the reduced trading activities had lower margins, other business segments registered a higher gross profit margin of 38% in 2H2022, as compared to 18% in 2H2021.

Interest income decreased to RMB200 million in 2H2022 from RMB213 million in 2H2021, mainly due to lower bank interest income. Other income - others increased to RMB92 million in 2H2022 from RMB34 million in 2H2021, mainly due to higher material sales income.

Other losses of RMB73 million were recorded in 2H2022 due to foreign exchange related losses of RMB258 million, which was partially offset by RMB141 million of fair value gain on derivative financial instruments and RMB44 million of subsidy income.

Finance costs increased to RMB55 million in 2H2022, higher than RMB34 million in 2H2021 due to higher bank borrowing costs.

Consequently, the Group achieved 2H2022 net profit attributable to equity holders from continuing operations of RMB1.4 billion, up 33% yoy. As of 31 December 2022, the Group’s balance sheet position remained strong, with cash and cash equivalents registered at RMB10.8 billion.

REVIEW / OUTLOOK / FUTURE PLANS

Yangzijiang’s order-win momentum continues. Since its last announcement dated 14 November 2022, the Group has clinched additional 4 units of vessels in 2022 and 14 units of vessels in 2023, totalling 18 vessels for USD0.91 billion. Adding to the existing orderbook, the Group’s total outstanding orderbook stood at USD11.03 billion for 149 vessels, further extending its revenue visibility to the end of 2025. In the global race to enable a greener maritime future, the Group’s order-win strategies have steadily shifted to alternative fuelled vessels and dual fuel vessels. As of 31 December 2022, 27% of the Group’s outstanding orderbook are classified as eco-friendly vessels compared to 15% as at 31 December 2021, which is a great testament to the Group’s commitment and efforts. In FY2022, the Group built a total of 71 vessels which exceeded its full year target of 70 vessels, of which 67 units were delivered to customers and 4 units were added into the Group’s own fleet.

The shipbuilding industry continues to reap the benefits from stricter environmental regulations. International Maritime Organisation (“IMO”) has tightened its greenhouse gas emission reduction measurements since 1 January 2023, which required all existing ships to calculate their attained Energy Efficiency eXisting Ship Index (“EEXI”) and to collect data for the reporting of operational carbon intensity indicator (“CII”) and CII rating2. In this evolving and dynamic environment, the Group will continue to be selective on new orders and target prioritize higher value-added vessels to strengthen its long-term profitability. In addition, the Group is working towards converting the existing chemical terminal located on the shore of Yangtze River to an LNG terminal with LNG storage and distribution infrastructure. The new initiative is expected to diversify its revenue streams across the maritime value chain through the provision of LNG terminal services, LNG storage and distribution services, whilst strengthening the collaborations with LNG shipping liners as well as LNG traders.

Having been through a dynamic year in 2022 with geopolitical tensions and inflationary pressures progressively dampening the market sentiments, the shipping industry is expected to see a potential turnaround on the back of China’s reopening. Shipping demand is expected to improve in 2023, boosted by the seasonal cycles post Chinese New Year and lower spot rates as compared to forward shipping rates, thereafter steadily driving up the shipping rates3. Given that the shipping business is an important addition to the Group’s business model in terms of revenue diversification, the Group will well leverage on its current fleet portfolio and seize any possible opportunity for long- term stable revenue generation.

“2022 was a remarkable year for Yangzijiang Shipbuilding as we delivered record numbers post the spin off of our investment segment. Our shipyard has hit new levels of operational efficiency with the yard delivering 71 vessels during the year. In addition, our R&D team has expanded our capability to build more sophisticated and greener vessels such as the LNG Carrier, dual fuel vessels with ammonia-ready tanks and methanol dual fuel engines. All of these bode well for our future growth as we keep a firm focus on long-term objectives such as sustainable profitability and growth.

Yangzijiang Shipbuilding is well positioned to progressively convert a sizeable amount of its record- high order book of US$11 billion. As such, we expect to generate healthy cash flow in the coming years, allowing us to generate sustainable returns to our shareholders.” ---- Mr. Ren Letian (任乐天) Executive Chairman and CEO, Yangzijiang Shipbuilding (Holdings) Ltd.

Source: Yangzijiang Shipbuilding

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

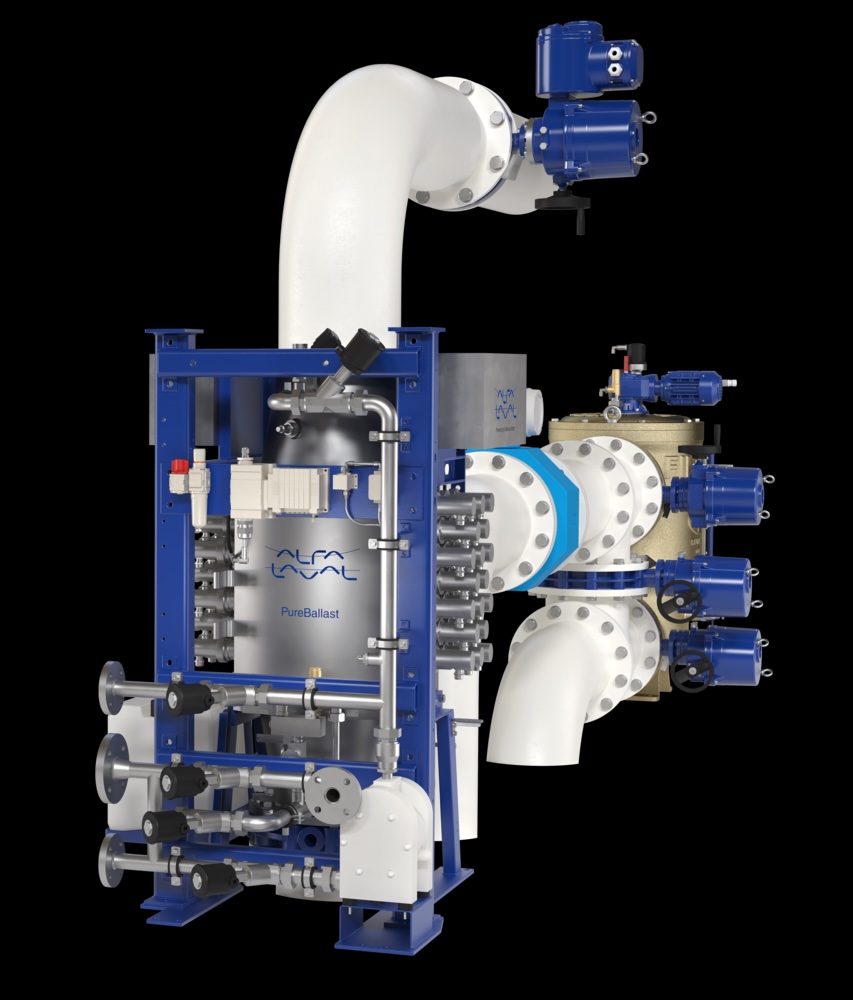

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive