Orient Overseas (International) Limited announced a profit attributable to equity holders of US$5,663.6 million for the six-month period ended 30th June 2022, compared to a profit of US$2,810.9 million for the same period in 2021.

Earnings per ordinary share for the first half of 2022 was US$8.58, whereas earnings per ordinary share for the first half of 2021 was US$4.42.

The Board of Directors announced that the dividend for the first half of 2022 is approximately 70% of the profit attributable to equity holders at approximately US$3,962 million, with an interim dividend of US$3.43 per ordinary share and a special dividend of US$2.57 per ordinary share.

The outstanding performance of the Group was driven by the continuing extraordinary conditions prevailing in the container shipping market. As has been the case for over two years, the market is neither enjoying an extraordinary demand boom, nor suffering from any lack of vessels in deployment. Rather, levels of demand, which are better than expected but not phenomenally strong, continue to outpace the effective level of supply, which is under significant downward pressure from a combination of congestion, delays and disruptions. Understanding this is key to any analysis of the current market situation and of the outlook.

These market forces pushed freight rates upwards on most tradelanes, and it is these market forces, in addition to the usual careful attention to cost control, that have driven the strong profitability that has been achieved during the period.

Throughout this period, it has been more important than ever to work closely with customers. In times of congestion and disrupted schedules, communication and co-operation help not only to mitigate the challenges of the current operational situation, but also serve to consolidate and deepen relationships.

The first six months of 2022 produced the highest half-year revenue in the Group's history. Compared to the same period in 2021, OOCL's total liner liftings for the first half of 2022 reduced by 7%, total revenue increased by 61%, and revenue per TEU increased by 74%.

The average price of bunker recorded by OOCL in the first half of 2022 was US$729 per ton compared to US$449 per ton for the corresponding period in 2021. The price increase of 62% in the first half of 2022 has led to a 46% increase in total bunker costs for the first half of 2022, as compared to the corresponding period in 2021, even though consumption of both fuel oil and diesel oil were lower in the first half of 2022 than in the corresponding period in 2021.

In the first half of 2022, no new-build container vessel was delivered, and no new order was placed by the Group. The twelve 23,000 TEU container vessels ordered by the Group in year 2020 are expected to be delivered starting from 2023, and the ten 16,000 TEU container vessels ordered last year will be delivered from 2024 fourth quarter to 2025 fourth quarter.

For the first half of 2022, OOCL Logistics revenue and contribution had good steady increment as compared with the same period last year. The revenue of the International Business Units exhibited healthy growth due to the growing demand of international logistics services. While Domestic Logistics continued to face fierce competition, the business unit still managed to maintain stable revenue. With the effort on streamlining processes and the use of IT systems, costs were further driven down and resulted in satisfying improvement in profitability.

Yet at the same time, consumers are still purchasing new goods, even if not necessarily the same goods they were buying last year, and thus far there has not been a complete return of pre-pandemic patterns of spending on services as opposed to goods. Furthermore, forecasts from various port and retail sources in the US suggest ongoing resilience in the demand for imported goods.

Anyone trying to forecast the future of container shipping must focus on what has created the current market, being the relationship between supply and demand as mentioned above, and not on any one individual factor. A proper understanding of the current market and its outlook must calmly consider each of the wide range of causes that have created current market conditions.

As at 30th June 2022, the Group had total liquid assets of US$11,076.9 million compared with debt obligations of US$805.7 million repayable within one year. The Group remained at net cash position with a net cash to equity ratio of 0.65 : 1 as at 30th June 2022. The Group from time to time prepares and updates cashflow forecasts for project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds.

OOIL owns one of the world's largest international integrated container transport businesses which trades under the name "OOCL". With around 420 offices in about 90 countries/regions, the Group is one of Hong Kong's most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

Source: OOCL

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

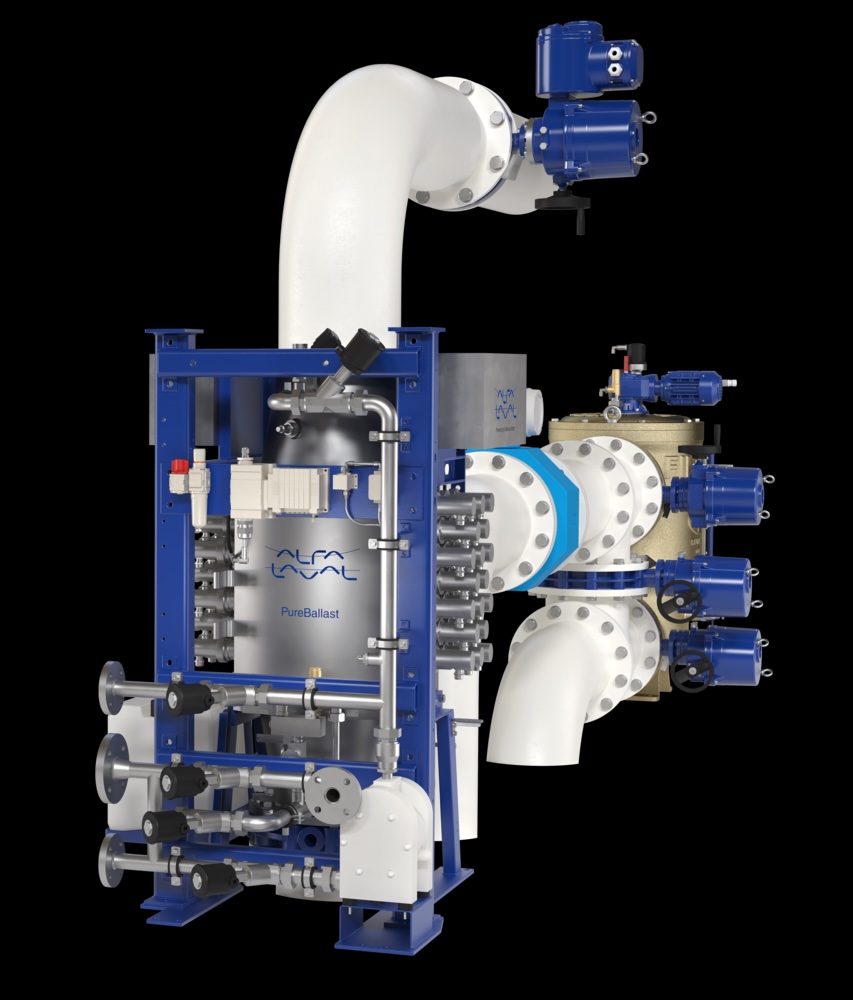

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive