A.P. Moller - Maersk delivered record results in Q2 2022. Revenue increased by 52pct. and earnings more than doubled compared to same quarter last year. Results were driven by continued exceptional market conditions and sustained momentum from the strategic transformation focused on integrated logistics. Based on the strong performance in first half of 2022, Maersk has upgraded its guidance for the full year 2022 and increased the current share buyback programme.

"We delivered an exceptionally strong result for the second quarter and consequently recorded the 15th quarter in a row with year-on-year earnings improvements. We are pleased with our performance across the business in first half of 2022, which clearly demonstrates the progress and great work by the entire Maersk team, transforming the company towards becoming a global, integrated logistics company." says Søren Skou, CEO of A.P. Moller - Maersk.

In Q2, revenue grew to USD 21.7bn, EBITDA and EBIT increased to USD 10.3bn and USD 9.0bn respectively, and free cash flow rose to USD 6.8bn. The Q2 net result came in at USD 8.6bn and USD 15.4bn for the first half of the year. Return on invested capital (ROIC) was at 62.5 pct. for the past 12 months.

"The result was driven by strong contract rates in Ocean, rapid profitable growth in Logistics and continued solid performance in Terminals. Volumes in Ocean were softer as congestion continued and the war in Ukraine weighed on consumer confidence, particularly in Europe. However, in Logistics we grew volumes above the market as our Ocean customers continue to buy into our value proposition, resulting in organic revenue growth of 36pct., notching up the 6th quarter in a row of more than 30pct. organic growth." says Søren Skou, CEO of A.P. Moller - Maersk.

In Ocean, revenue grew to USD 17.4bn and EBIT increased to USD 8.5bn over the second quarter. The higher freight rates were partly offset by 7.4pct. lower volumes and by higher fuel, handling, and network costs. Although spot rates have softened from their peak earlier in the year, the company continued to sign contracts at rates above previous year levels given strong demand and continuing global supply chain congestion.

During Q2, Maersk maintained its strong momentum in bringing integrated logistics solutions to customers. For the quarter, revenue in Logistics grew 61pct. to USD 3.5bn and EBIT increased to USD 234m mainly due to higher volumes from new customer wins and increased spending from existing customers. Maersk continued to invest in its logistics portfolio and capabilities; in Q2 the acquisitions of logistics specialist, Pilot Freight Services and the global air freight expert, Senator International were completed, and Maersk further strengthened its air freight offering by launching Maersk Air Cargo.

In Terminals, revenue grew to USD 1.1bn and EBIT increased to USD 316m, mainly driven by strong import demand in the United States and above market growth in Asia as well as higher storage income, which was however partly offset by higher costs.

Market situation

Global demand for logistics services continued to moderate across global supply chains in Q2 2022. Freight rates softened marginally over the quarter but remained at a high level historically as supply chain congestion increased across the globe. Global container volume declined by 2.3pct compared to Q2 2021 while global air cargo volumes (CTK) were 9.4pct lower in April/May. Geopolitical uncertainty and higher inflation via higher energy prices continued to weigh on consumer sentiment and growth expectations. Given this background, in 2022 global container demand is now expected to be at the lower end of the -1% to +1% forecasted range.

Guidance for 2022

As announced in a trading update August 2, for the full year 2022 Maersk anticipates an underlying EBITDA of around 37bn, an underlying EBIT of around 31bn and a free cash flow above USD 24bn. This is based on the strong performance in first half of 2022, and a gradual normalisation of Ocean freight rates taking place in the fourth quarter of 2022.

Based on the improved guidance, the Board of Directors has decided to increase the current share buyback programme by USD 500m annually from USD 2.5bn to USD 3.0bn for the years 2022-2025.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

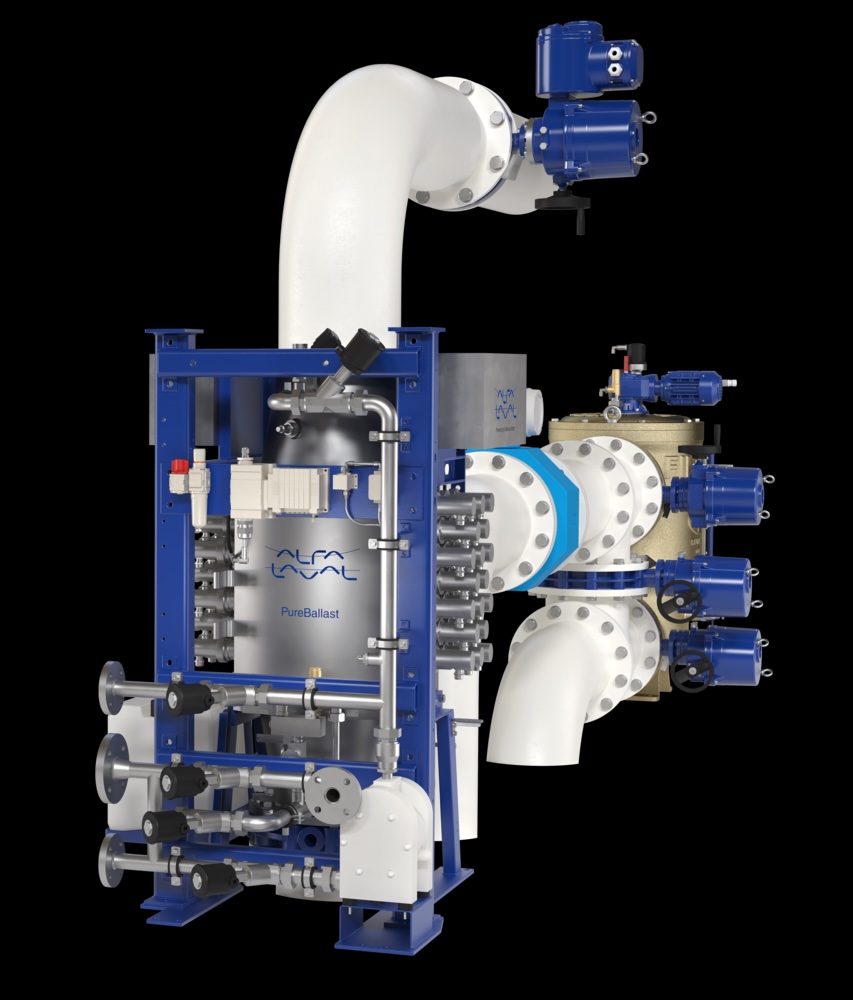

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive