Hong Kong, 28 July 2022 – Pacific Basin Shipping Limited, one of the world's leading dry bulk shipping companies, announced the results of the Company and its subsidiaries for the six months ended 30 June 2022.

"In the first half of 2022, we generated our best interim results ever, producing an underlying profit of US$457.5 million, a net profit of US$465.1 million and an EBITDA of US$566.9 million. This yielded an exceptionally strong return on equity of 48%, with basic EPS of HK74.5 cents."

Martin Fruergaard, chief executive of Pacific Basin

The company's results benefited from significantly higher average TCE earnings compared to the same period last year, strong operating activity results, and a competitive cost structure. PB continued to significantly outperform the market index rates, especially in the Supramax business, which delivered an exceptional performance over the period.

Global minor bulk loading volume grew approximately 9% in the first half compared to the same period last year. Construction materials were the main driver, in particular cement, clinker and aggregates where loadings were up 8% year on year. On the other hand, the global dry bulk fleet grew only 1.5% net during the half-year compared to 1.9% in the same period last year mainly due to slowing newbuilding deliveries. The global fleet of Handysize and Supramax vessels grew by 1.6%, which despite slowing global economic growth has helped to support higher rates over the period.

The core business generated average Handysize and Supramax daily time-charter equivalent earnings of US$26,370 and US$33,840 net per day in the first half, representing an increase of 83% and 85% compared to the same period in 2021, respectively. The company's performance continues to benefit from diverse cargo and customer base and the close customer interaction facilitated by the extensive global office network. The operating activity contributed US$30.7 million, generating a margin of US$3,330 net per day over 9,200 operating days in the first half. While margins varied over the period, they still remain historically high.

PB's financial position continues to strengthen with available committed liquidity of US$698.6 million and a net cash position of US$68.9 million as at 30 June 2022.

In light of the strong earnings, cash position and the company's confidence in the longer-term outlook for minor bulk shipping, the Board has declared an interim basic dividend of HK35 cents per share, representing 50% of the net profit for the period, and an additional special dividend of HK17 cents per share, representing 25% of the net profit for the period. The basic dividend and the special dividend together amount to a total dividend of HK52 cents per share.

Benefitting from the Fleet Renewal Strategy

PB remains committed to the long-term strategy to grow the company's owned fleet of Supramax ships by acquiring high-quality, modern, second-hand vessels, and to sell older and less-efficient Handysize ships and replace them with younger and larger Handysize vessels. During the period of solding five of older Handysize ships, while taking delivery of one Ultramax vessel purchased in 2021. This strategy is resulting in an even more efficient fleet with greater longevity, while crystallising value from historically high second- hand prices.

Pacific Basin currently own 117 Handysize and Supramax ships and, including chartered ships, the company has approximately 240 ships on the water overall.

Market Outlook

In light of a softening global economy, PB expects dry bulk demand in the second half to moderate somewhat from recent highs but remain relatively firm mainly due to seasonal factors in the grain market, elevated coal demand for electricity production and continued investment in global infrastructure.

Any revival of the Chinese economy is expected to be supported by domestic property construction, manufacturing and infrastructure spending as government policies are needed to drive growth in light of continuing Covid restrictions.

Changes in trade flows caused by the conflict in Ukraine have positively impacted tonne-mile demand for some commodities to date, but the company continues to monitor the impact that the conflict might have as PB comes close to the typical Black Sea grain export season.

Supply is still tied up in congestion around the world, and although vessel speeds remain elevated leaving limited scope to increase vessel capacity through higher speed, historically very high bunker costs have begun to lower speeds taking some supply out of the market.

PB believes uncertainty over new environmental regulations and the high cost of newbuildings, will continue to discourage any significant new ship ordering. According to Clarksons Research, current orderbook is at a 30-year low of just 7.2% of total fleet and new ordering is down 60% in the first half of 2022 compared to the same period last year. The low orderbook coupled with IMO regulations to reduce carbon intensity likely resulting in slower speeds and increased scrapping from 2024 onwards, bodes well for the long-term health of the dry bulk market.

Well Positioned for the Future

Given the supportive fundamentals of the industry PB is excited by the long-term prospects of dry bulk shipping despite any short-term headwinds. The company's large and modern owned fleet of highly versatile Handysize and Supramax ships, combined with close customer partnerships, enhanced access to cargo opportunities, and high vessel utilisation, enables the company to outperform in this strong earnings environment.

Having significantly further strengthened the balance sheet in the first half of 2022, PB anticipates that the still healthy dry bulk market, the company's strong cash generation and limited expected capital expenditure will enable the company to continue to reward shareholders by returning capital and take advantage of opportunities to grow the fleet going forward.”

Source: Pacific Basin

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

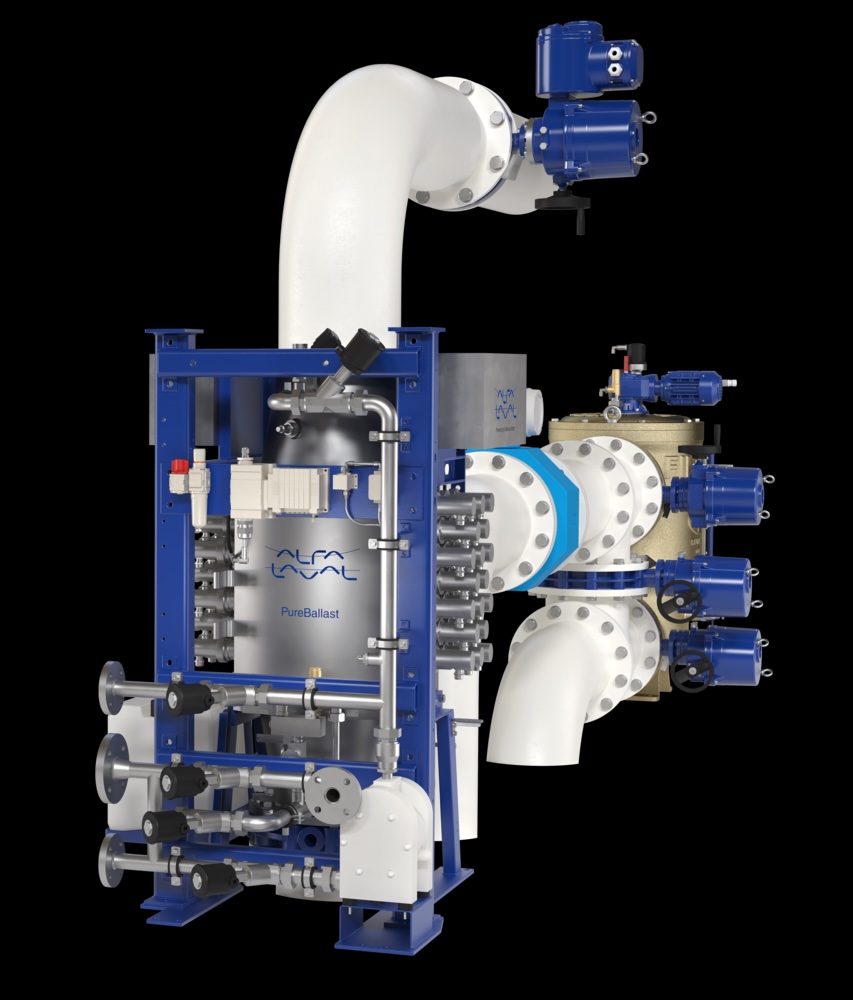

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive