SERVICE ORDER INTAKE INCREASED BY 36%

SERVICE ORDER INTAKE INCREASED BY 36%

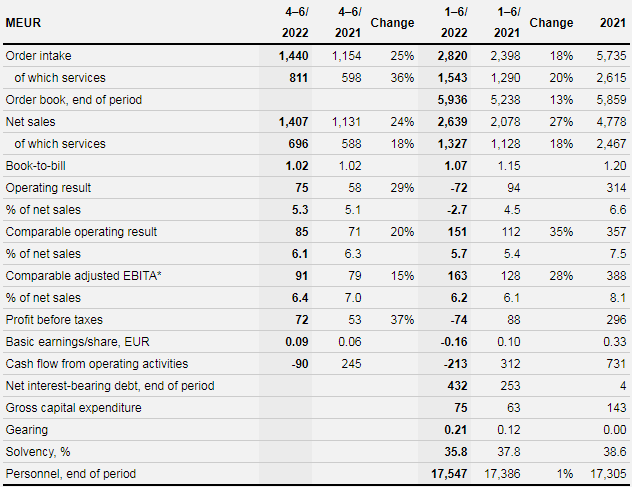

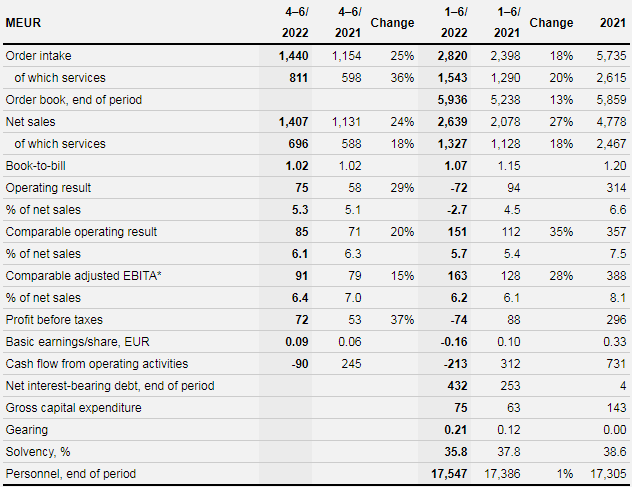

HIGHLIGHTS FROM APRIL–JUNE 2022

·Order intake increased by 25% to EUR 1,440 million (1,154)

·Service order intake increased by 36% to EUR 811 million (598)

·Net sales increased by 24% to EUR 1,407 million (1,131)

·Book-to-bill amounted to 1.02 (1.02)

·Comparable operating result increased by 20% to EUR 85 million (71), which represents 6.1% of net sales (6.3)

·Operating result increased by 29% to EUR 75 million (58), which represents 5.3% of net sales (5.1)

·Basic earnings per share increased to 0.09 euro (0.06)

·Cash flow from operating activities decreased to EUR -90 million (245)

HIGHLIGHTS FROM JANUARY–JUNE 2022

·Order intake increased by 18% to EUR 2,820 million (2,398)

·Service order intake increased by 20% to EUR 1,543 million (1,290)

·Order book at the end of the period increased by 13% to EUR 5,936 million (5,238)

·Net sales increased by 27% to EUR 2,639 million (2,078)

·Book-to-bill amounted to 1.07 (1.15)

·Comparable operating result increased by 35% to EUR 151 million (112), which represents 5.7% of net sales (5.4)

·Operating result decreased by EUR 166 million to EUR -72 million (94), which represents -2.7% of net sales (4.5)

·Basic earnings per share decreased to -0.16 euro (0.10)

·Cash flow from operating activities decreased to EUR -213 million (312)

WÄRTSILÄ'S PROSPECTS

Wärtsilä expects the demand environment in the third quarter to be better than that of the corresponding period in the previous year. However, the prevailing market conditions make the outlook uncertain.

HÅKAN AGNEVALL, PRESIDENT & CEO: STRONG PERFORMANCE IN SERVICES

“The second quarter of 2022 was characterised by uncertainty in the global business environment over economic development. The sanctions on Russia, supply chain bottlenecks, cost inflation, and Covid-19 related lockdowns in China have put the global economy under pressure and caused challenges in our business as well. However, while the market was challenging, we were able to grow our order intake.

The energy market continued to be volatile. However, the demand for balancing power is growing, and we received important orders for both thermal power and energy storage solutions. The service business in Energy performed very well, and is further supported by the recent launch of our Decarbonisation Services. In this, we utilise our sophisticated power system modelling and optimisation tools, alongside Wärtsilä’s in-house expertise, to reduce power system emissions and to ensure power availability with the lowest levelised cost of electricity.

The service business also developed well in the marine markets, thanks largely to fleet reactivation, especially in the cruise segment. Around 90% of the cruise fleet capacity was active at the end of June, and cruise port calls have reached pre-covid levels. One notable example of our success in the service business was the renewal of the optimised maintenance agreement with Maran Gas Maritime, covering their fleet of 21 LNG carriers. The newbuild market was more challenging due to rising costs and limited yard capacity, and investments eased from the previous year’s level. However, the ambition in Europe to break away from Russian pipeline gas continues to drive the contracting of LNG carriers. Our market leading position in hybrid solutions was confirmed by an order to supply hybrid propulsion systems for three new RoPax vessels, two of which will be the largest hybrid vessels to date. High fuel price drives the demand for fuel efficiency and energy saving solutions.

Total order intake increased by 25% and service order intake by as much as 36%. The service business is growing, driven by higher utilisation of vessels and power plants. We saw very good development in services in both Marine Power and Energy, as cruise activity increased and customers showed interest in long-term service agreements. The demand for energy storage solutions supported equipment orders. Net sales increased by 24%, driven by growth in energy equipment deliveries as well as services in both our end markets.

Our comparable operating result increased by 20%, supported by higher sales volumes. Profitability continued to be burdened by cost inflation and a less favourable sales mix between equipment and services. However, the growth in service order intake indicates that we are on the right path of moving up on the service value ladder.

On 14 July, we announced a plan to further optimise our European engine manufacturing footprint by ramping down our factory in Trieste, Italy and centralising our 4-stroke engine manufacturing to Vaasa, Finland. With this future set-up, we are taking the next step in strengthening our competitiveness and creating a structure enabled for future growth. Italy and Trieste will continue to be very important for Wärtsilä in many other areas. We are committed to working closely with unions and institutions to identify different support solutions for the impacted employees.

Today, we announced that we have completed our orderly exit from the Russian market. All adjustments and closures of Wärtsilä's operations in Russia were completed in accordance with local regulations. Throughout the various processes, our priority has been to ensure the safety and wellbeing of our employees. The financial impact of these divestments is in line with the provisions taken in the first quarter, and therefore there was no material impact on our financials in the second quarter.

On the technology front, we continued to make good progress. We launched the Wärtsilä 46TS-DF engine designed with a focus on efficiency, environmental performance, and fuel flexibility. In gas fuel mode, the engine has the highest efficiency thus far achieved in the medium-speed engine market. To further accelerate technological development, we are coordinating a consortium of shipping stakeholders in a project aimed at developing demonstrators for 2-stroke and 4-stroke marine engines running on ammonia.

We expect the demand environment in the third quarter to be better than that of the corresponding period in the previous year. However, the prevailing market conditions make the outlook uncertain. As communicated earlier, the share of equipment sales relative to service sales will be high during 2022, and cost inflation is anticipated to remain high also in the second half of 2022. We are committed to continuous improvement and price increases to mitigate the impact of cost inflation. In the longer term, we will focus on climbing further up the service value ladder towards more value-adding performance based agreements, which improve visibility and support the profitability of our business. We also continue to see opportunities in balancing power, as the use of renewable energy accelerates.”

KEY FIGURES

Wärtsilä's financial information for the year 2021 has been adjusted to reflect a change in categorisation between equipment and services in Wärtsilä Marine Power and Wärtsilä Marine Systems. This restatement has no impact on the group’s total financial figures.

Wärtsilä presents certain alternative performance measures in accordance with the guidance issued by the European Securities and Markets Authority (ESMA). The definitions of these alternative performance measures are presented in the Calculations of financial ratios section.

Source: Wärtsilä

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive