Recently, the listed companies under COSCO SHIPPING announced their 2021 annual results. In 2021, they gave full play to the fundamental supporting role of shipping, ports and logistics to the supply chain and industry chain, fully implemented the requirements of "ensuring stability on the six fronts and security in the six areas", actively served domestic and foreign trade, and ensured the smooth flow of goods across the international supply chain. While providing an essential guarantee for the global economy and trade stability, it has also achieved encouraging business results.

COSCO SHIPPING Holdings Announces 2021 Annual Results

In 2021, COSCO SHIPPING Holdings (601919.SH/1919.HK) recorded EBIT of RMB131.5 billion. The profit attributable to the Company's equity holders was RMB89.296 billion, representing an increase of RMB79.369 billion or 799.52% compared to the year of 2020, and basic earnings per share were RMB5.59. The company's asset-liability ratio was reduced to 56.76%, representing a decrease of 14.3%s compared to the year-end of 2020. The Board of Directors recommends that the Company distribute a final dividend of RMB0.87 per common share (tax inclusive) for 2021, with a total cash dividend of RMB13.932 billion.

The Company's dual brands, together with the members of the OCEAN Alliance, officially launched DAY 5 products, covering 39 routes with an aggregate capacity of 4.1 million TEUs. The newly launched products provide more stable services with broader coverage, better quality and shorter lead time. The Company strengthened the overall arrangement of the dual-brand fleet and continuously improved its operational efficiency. In 2021, the available slots per week for Trans-Pacific trade and Asia-Europe trade increased 26% and 6% year-on-year respectively.

In 2021, the Company enhanced the advantages of industrial chain operation, actively created a land-sea integrated operating model to ensure the stability of the global industrial and supply chain, and provided more reliable end-to-end services to customers. During the Reporting Period, the Company's dual brand kept extending cargo sources in the European inland, achieving a rapid increase in cargo volume of China-Europe Sea-rail Express of 23% year-over-year. Meanwhile, there were 29 new sea-rail domestic and foreign trade corridors. China-Africa Rail-Sea Express and the Greater Bay Area – China Western Land-Sea Trade Corridor successfully commenced operation.

At the same time, the Company took advantage of technology upgrades to lead the integration of the digital ecosystem. During the Reporting Period, the Global Shipping Business Network (GSBN) announced the operation in 11 ports at home and abroad. GSBN has realized Cargo Release in Hong Kong, Singapore, Thailand and other countries and regions, which greatly simplified data exchange in the way of a paperless solution. Therefore, it improved customer experience and steadily strengthened its influence over the industry.

The Company actively fulfilled corporate social responsibility and promoted green and sustainable development. The Company has consistently implemented the concept of "energy saving, carbon reduction and green development" into the operation and management of the Company. The dual-brand fleet continued to reduce the impact of its business operations on the environment and lower carbon emissions through measures such as optimizing the fleet structure and route design and effectively reducing fuel consumption. In the future, the Company will contribute to carrying out social responsibility, environmental protection, and emission reduction in terms of developing green, low-carbon and intelligent shipping to create greater value for shareholders.

OOIL Announces 2021 Annual Results

In 2021, Orient Overseas (International) Limited ("OOIL"/0316.HK) recorded revenue of US$16.832 billion, EBIT of US$7.398 billion, EBITDA of US$7.967 billion, and operating cash flow of US$8.899 billion. The profit attributable to equity holders was US$7,128.1 million for 2021, with the proposed payment of a final dividend of US$2.61 per common share and a second special dividend of US$0.69 per common share for 2021.

Since the middle of 2020, the shipping industry, indeed the entire supply chain, has been battling the same confluence of factors. Despite the full deployment of capacity, a series of disturbing factors have caused severe congestion to many of the key hubs of container shipping, slowing down the round trips made by each vessel and, in effect, reducing the capacity available to transport the customers' cargo.

The relationships with customers are critical to the Company's success. OOIL has consistently worked to assist its customers through these challenging times. The company honored its contractual commitments, sought new ways to cooperate with customers on an end-to-end basis, helped customers navigate the challenges of schedule changes and congestion, and added extra capacity where possible.

OOIL continues to advance its longstanding track record as a technology and digital innovation leader. Its Freightsmart platform, which provides instant quotation and booking, has provided a valuable additional channel for the customers. OOIL continues to develop IQAX, a wholly-owned subsidiary, which will play a leading role in driving the digital transformation of the container shipping industry. Although its Business Continuity Infrastructure has been put to the test throughout the pandemic, OOIL has always been able to maintain business operations and high-quality customer service.

It remains true that the full implications of the COVID-19 pandemic on world trade have yet to be seen, particularly in terms of supply chain evolution. OOIL will remain attentive to market trends and seek to be at the forefront of positive developments, including enhancing relationships with its customers, offering more end-to-end solutions, and leading the digitalization process in its industry.

COSCO SHIPPING Energy Announces 2021 Annual Results

During the Reporting Period, COSCO SHIPPING Energy (SSE: 600026/HKEx: 1138) generated revenues from the core business of RMB12.645 billion with a year-on-year decrease of 22.0%; the cost of the core business of RMB11.769 billion with a year-on-year increase of 1.8%, and gross profit margin decreased by 22% year-on-year. The net profit attributable to the company's shareholders was RMB-4.975 billion with a year-on-year decrease of 309.7%, and earnings before interest, taxes, depreciation and amortization ("EBITDA") RMB-0.869 billion with a year-on-year decrease of 112.4%.

In 2021, the international oil transportation market remained in the doldrums. The Company worked on the following five aspects to counteract the impact of the downturn in the global oil transportation cycle on its overall performance: The first is to tap the potential of cost reduction and efficiency improvement and take multiple measures to reduce costs and expenditures; the second is to increase investment in LNG vessels and accelerate the implementation of LNG transportation projects; the third is to maintain and expand domestic oil shipping business to offset the losses of international oil shipping with stable revenue; the fourth is to optimize the route layout of the foreign trade fleet to improve the operating efficiency of the entire fleet; and the fifth is to adhere to green and innovative development, promote comprehensive benchmarking and enhance the efficiency of comprehensive corporate management.

Looking ahead, the company will maintain its leading position and strive to become a leader in the global oil tanker transportation industry. The Company will strive to become the world's top-tier player by prioritizing LNG development and new energy transport. It will also accurately grasp the cyclical trends in the shipping and capital markets to realize the side-by-side advance of production and capital operations. It will empower its shipping business through digitalization, use data assets to create value, accelerate the "low-carbon shipping" transformation, and strive to build a brand image as a "leader in sustainable development".

Net Profit of COSCO SHIPPING Development in 2021 Increases by 184.49% Year-over-Year

In 2021, COSCO SHIPPING Development (601866.SH/02866.HK) recorded operating revenue of RMB37.118 billion, representing a year-on-year increase of 83.95%; net profit attributable to shareholders and other equity holders recorded RMB6.091 billion, representing a year-on-year increase of 184.49%. The basic earnings per share amounted to RMB0.4979. The Board of Directors proposed a final dividend of RMB0.226 per share.

In 2021, the market experienced a structural shortage of containers. The Company closely followed market dynamics and gave a full play to industrial chain synergies on the premise of implementing pandemic prevention and control measures. The Company improved the production efficiency and provided strong support for the smooth operation of the supply chain. In the meantime, the Company actively implemented the dual-carbon strategy. Focusing on the positioning of "prioritizing ecological conservation and boosting green development" in the Yangtze River Economic Belt, the Company took the lead in coordinating industrial chain enterprises and relevant parties, researched the standardization of electric container ships on the Yangtze River trunk line, and strive to build a demonstration of green, zero-carbon and intelligent shipping. The Company established a sound whole-process quality management system, implemented "oil to water" technology, promoted the concept of environmental protection to the industry, and led the healthy and sustainable development of the industry.

In 2022, the Company will actively grasp the opportunities arising from the digitalization, low-carbon and intelligent development of the shipping industry chain, continuously expand the shipping leasing business and maximize the synergy between leasing and manufacturing. The Company will adhere to technology empowerment and digital innovation to explore the application of environmental protection and energy-saving technology in the electric ship industry chain. In the meantime, the Company will pay close attention to risk prevention and control and strive to promote high-quality and sustainable development.

COSCO SHIPPING Specialized Carriers' 2021 Net Profit Increases by 142.45% Year-on-Year

In 2021, COSCO SHIPPING Specialized Carriers (601428.SH) recorded a net profit of RMB0.307 billion, a year-on-year increase of 142.45% and a record high since 2011. The quality of the corporate development continues to improve, with a gearing ratio of 57.91% and a net operating cash flow of RMB1.686 billion. The Company has proposed to pay a cash dividend of RMB0.5 (tax included) per 10 shares to all shareholders.

In 2021, the Company seized opportunities in the shipping market, prioritized the development of its core fleet, actively expanded the two logistics chains for pulp and engineering logistics projects, accelerated digital transformation, and propelled forward the implementation of various strategic initiatives to build its core competitiveness. During the year, the Company's time-chartered vessels increased by 44.88% year-on-year. Its cargo structure also continued to be optimized, with the volume of pulp carried reaching 3.86 million tons, up 47.89% year on year and hitting a record high.

Looking forward to 2022, the Company will grasp market opportunities and address challenges, continue to strengthen and optimize its core business with stability as the primary concern, improve service quality, and strive to raise the level of profitability in order to deliver greater value to all shareholders.

COSCO SHIPPING Ports' Net Profit Increases by 23.6% Year on Year

In 2021, COSCO SHIPPING Ports' revenue increased by 20.7% year on year to US$1,208.3 million; gross profit increased by 39.8% year on year to US$325.2 million; the gross profit margin of the Company in 2021 expanded to 26.9%, an increase of 3.7% year onyear; and terminal profit from the subsidiaries surged by 156.4% to US$88.8 million.

Excluding one-off items, profit attributable to equity holders of the Company increased by 23.6% year on year to US$332.5 million. The Company declared a second interim dividend of US$2.16 cents per share (equivalent to HK 17 cents per share).

In 2021, COSCO SHIPPING Ports' total throughput increased by 4.4% to 129,286,375 TEUs; total equity throughput was 39,874,105 TEUs, an increase of 3.7% year on year; and total throughput from subsidiaries was 23,374,915 TEUs, an increase of 4.7% year on year.

Looking forward to 2022, the Company will firmly follow the trend of smart, green and low-carbon development, consolidate and intensify technological innovation, and promote a green shore power system for domestic terminals in which the Group has a controlling stake. Concentrating on the construction of smart port demonstration projects, the Company will seize the opportunity presented by the 5G smart port 2.0 to promote the intelligent transformation of traditional terminals and build smart, green and low-carbon ports. The Company will endeavor to promote its global terminal network, seek new breakthroughs in scale expansion, improve and optimize its global terminal network, strengthen the expansion of projects in emerging markets, capture fulcrums along the regions covered by the Belt and Road Initiative,, and grasp opportunities in premium projects within Southeast Asia, the Middle East and Africa under RCEP.

Hainan Strait Shipping's Total Profit Increases by 14.34% in 2021 Year on Year

In 2021, Hainan Strait Shipping (002320.SZ) recorded an operating revenue of RMB1.399 billion, an increase of 30.43% year on year; total profit of RMB337.394 million, an increase of 14.34% year on year; net profit attributable to owners of the parent company of RMB265.8836 million, up 6.61% year on year; basic earnings per share of RMB0.12; and weighted average return on equity of 6.75%. The Company has proposed to pay a cash dividend of RMB1.00 (tax included) per 10 shares to all shareholders.

During the reporting period, the Company leveraged its advantages in resources, management and a leading industry position to consolidate and develop its main business and carry out diversified operations in an appropriate manner. It actively promoted the integration of the Qiongzhou Strait and completed the integration of shipping resources on the south bank of the Qiongzhou Strait in June 2021 and on the north bank in late 2021, while also advancing the integration of resources in the port business segment.

Looking ahead, the Company will further promote the integration of ports and carriers across the Qiongzhou Strait in 2022 and boost the construction of Xinhai Integrated Passenger Transportation Hub to build a safe, efficient, economic, intelligent, and unclogged Qiongzhou Strait Great Channel. It aims to be the largest passenger roll-on/roll-off transportation (listed) company in China, and actively pushes forward the integration of Hainan into the new “dual circulation” development pattern in which the domestic economic cycle plays a leading role while the international economic cycle remains its extension and a supplement.

COSCO SHIPPING Technology Reports an Increase in Net Profit before Non-recurring Gains and Losses of 22.26% Year on Year in 2021

In 2021, COSCO SHIPPING Technology (002401.SZ) recorded an operating revenue of RMB1.707 billion, an increase of 12.25% year onyear; net profit attributable to the shareholders of RMB157 million, down 18.71% year on year; and net profit attributable to the shareholders before non-recurring gains and losses of RMB125 million, up by 22.26% year on year; The Company has proposed to pay a cash dividend of RMB1.2 (tax included) per 10 shares to all shareholders.

In 2021, the Company dynamically promoted digital industrialization and industrial digitization. On its platform “Vessel Value Visualization,” the Company launched a series of SaaS products for ship scheduling, vessel search, and port information. By virtue of the shipping data aggregation, analysis and sharing functions provided by the platform, COSCO SHIPPING Technology became one of the first contracted data vendors of the Shanghai Data Exchange.

The Company also established a joint venture with COSCO SHIPPING Bulk to build the platform “Chuan Huo Yi” for coastal bulk cargo transportation trading. It collaborated with the Shanghai Meteorological Service to set up a joint innovation lab for shipping meteorology and cooperated with China Fortune Futures to create a new mode of shipping data application. The company was also selected as a member of the GOI Project of Pudong Large Enterprises for the joint creation of a new and open shipping innovation ecosystem.

COSCO SHIPPING Technology continued to optimize its cloud computing products and services and promote new digital infrastructure. The “Cloud Computing Management

Platform for Shipping Enterprises” developed by the Company was awarded the Trusted Cloud Certification of “Multi-Cloud Management Platform Solution” by the China Academy of Information and Communications Technology (CAICT) and the First Prize of Science and Technology Award of China Institute of Navigation in 2021.

The Company was deeply engaged in the field of intelligent transportation and security, actively carrying out the research and development of a cloud platform for intelligent highway, promoting the research and development of a highway free flow toll collection system, and completing the overall research and development of “centralized monitoring + robot” unmanned highway networked toll collection system, and putting it into a pilot operation.

Looking ahead, the Company will firmly implement the innovation-driven development strategy and continue to improve its digital innovation capability by increasing investment in science and technology, building a shared resource platform and innovating the business integration mode. It will develop smart shipping, smart logistics, smart transportation and smart security industries, and make every effort to be the industry benchmark in terms of transportation and shipping technology innovation and digitalization.

PPA Makes History with Outstanding Business Performance in 2021

PPA S.A. made history with outstanding business performance and achieved high quality growth in 2021. It recorded an operating revenue of €154 million, up 16% year on year, and a total profit of €49.21 million, up 33% year on year, surpassing the prior highest performance in 2019 before the outbreak of the COVID-19 pandemic. The Board of Directors recommended a dividend of €0.63 per share, up 57.5% from €0.40 in the previous year, receiving positive response from the local community and investment institutions.

The throughput of No.1 container terminal and the PCTC terminal increased by 13.9% and 40.6% year over year, respectively. The business volume of the cruise terminal grew by 1724.9% year on year. The passenger throughput of the ferry terminal was up by 14.7% year onyear, and the business volume of the ship repair operations increased by 3.9% year onyear, which helped PPA maintain its position as the leading container port in the Mediterranean and a major integrated port in Europe.

Looking ahead, PPA will seize the opportunity of world economic recovery in the post-COVID era, adhere to value- and technology-led development, increase digital innovation, emphasize low-carbon green development, and promote the green and sustainable development of the Port of Piraeus.

COSCO SHIPPING International (Hong Kong)'s Operating Profit Surges 109% Year on Year

In 2021, COSCO SHIPPING International (Hong Kong) (0517.HK) focused on value creation and enhanced effectiveness, resulting in a 109% year-on-year increase of its operating profit, highlighting the excellent operational resilience of COSCO SHIPPING International (Hong Kong). During the year, profit attributable to equity holders of the Company was HK$288 million. Basic earnings per share were 18.81 HK cents. The Board proposed a final dividend of 9.0 HK cents per share. Together with the interim dividend of 10.0 HK cents per share, the total dividends are 19.0 HK cents per share (2020: 22.0 HK cents), representing a dividend payout ratio of approximately 101% (2020: 99.6%).

Looking ahead, in the face of the unprecedented changes in the recent century, COSCO SHIPPING International (Hong Kong) will further intensify its strategic focus to re-examine its strategic position and development direction with a broader vision, and proactively initiate upgrades and transformation to further sharpen its core competitiveness.

COSCO SHIPPING International (Singapore)'s Net Profit Increases by 261% Year on Year

Revenueof COSCO SHIPPING International (Singapore) for FY 2021 totaled $198.5 million, 7% higher than FY 2020. Net profit attributable to equity holders rose by 261% to $30.1 million. Earnings per share reached 1.34 cents per share.

Phase I of the Jurong Island Logistics Hub Project owned by Cogent Holdings, a subsidiary of COSCO SHIPPING International (Singapore), adopted a construct-as-you-go approach and achieved the completion and commissioning of warehouse facilities step-by-step on January 18, 2021. In this way, the Company firmly grasped the opportunity of increased demand in the logistics market and created satisfactory results. With the final completion of the project approved on April 19, 2021, the various parts of the Jurong Island Logistics Hub successfully commenced operations, including the commissioning of a laden container yard, which is an innovation of the project and helped add 50,000 square meters of warehouse space and nearly 20,000 square meters of yard space. With the completion and operation of the relevant projects, the Company's logistics service capacity will be further enhanced.

Source: COSCO SHIPPING

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

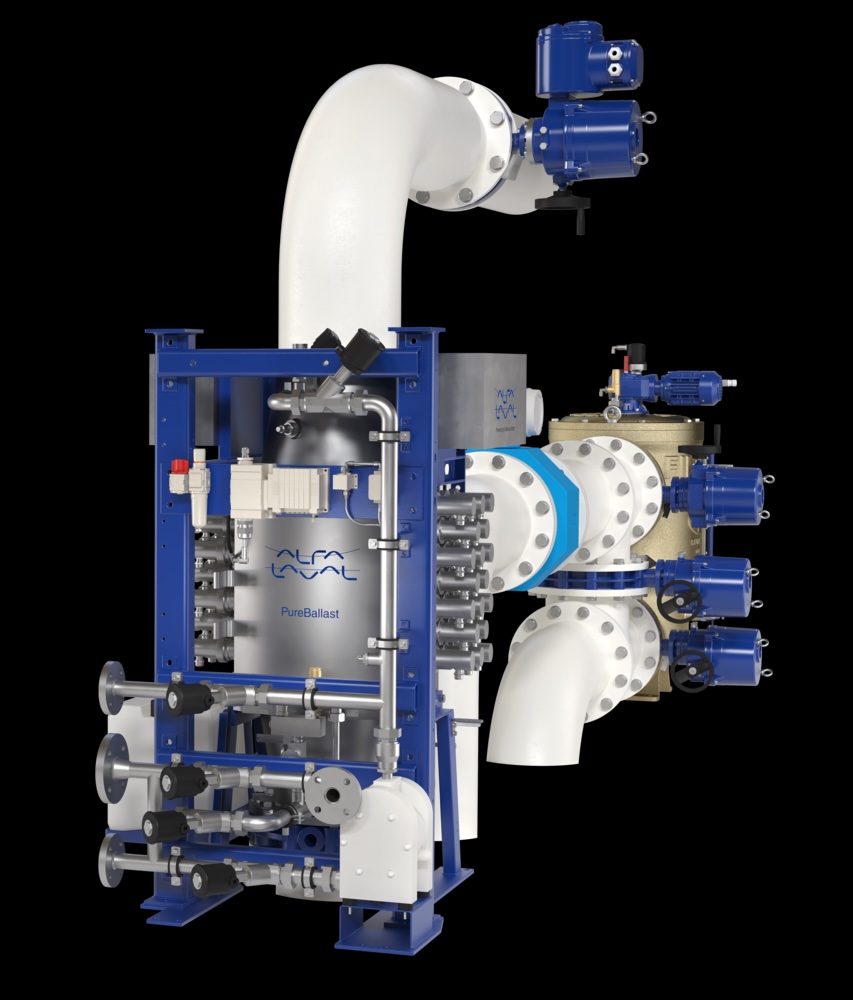

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive