Orient Overseas (International) Limited (“OOIL") announced a profit attributable to equity holders of US$7,128.1 million for 2021, compared to a profit of US$902.7 million in 2020.

Earnings per ordinary share in 2021 was US$11.08, whereas earnings per ordinary share in 2020 was US$1.44.

The Board of Directors has recommended that the dividend for full year 2021 is 70% of the Profit Attributable to Equity Holders at approximately US$4,990 million, with proposed payment of a final dividend of US$2.61 per ordinary share and a second special dividend of US$0.69 per ordinary share for 2021.

Our results for 2021, which include the highest ever revenue, liftings and profit figures for our core container shipping and logistics business, surpassed even the outstanding outcome for 2020. The financial results were achieved in a context that is entirely without precedent. The second year of a pandemic that affected every country and every industry, 2021 produced enormous challenges.

Since the middle of 2020, our industry, indeed the entire supply chain, has been battling the same confluence of factors. After global economies began to reopen after lockdowns driven by the pandemic, levels of demand consistently outperformed expectations, especially, but not only, on routes from Asia to North America. At the same time, despite full deployment of capacity, with more capacity than ever before being utilised on the routes with the highest demand, effective levels of supply have rarely managed to keep pace with that strong demand. The reason for this is well known: a long list of causes of disruption have brought severe congestion to many of the key hubs of container shipping, slowing down the round trips made by each vessel, and, in effect, reducing the capacity available to transport our customers' cargo.

If there were just one cause of all this disruption, or if all disruption originated in one region, we might already have been able to resolve the current problems. However, it is not that simple. Over the course of 2021, we have seen port congestion, bad weather delays, labour disputes, shortages of truckers, the Suez Canal incident, insufficient rail capacity, empty box shortages in key locations, COVID-19 rules affecting the availability of labour in terminals, depots, yards, quarantining requirements for vessel crew causing operational delays, and a range of other difficulties. The global container shipping system is one large, interconnected network: as we have been reminded multiple times over the past two years, even seemingly small or time-limited incidents and delays can create powerful ripple effects around the world, and large disruptions can cause even more severe and long-lasting challenges.

Our relationships with our customers are key to our success. We have consistently worked to assist our customers through these challenging times, honouring our contractual commitments, seeking new ways to co-operate with them on an end-to-end basis, helping them navigate the challenges of schedule changes and congestion, and adding extra capacity where possible. We look forward to continuing to deepen and extend our relationships with our customers in this way.

We have continued to explore new ways of creating additional synergy from our position within the COSCO SHIPPING Group. Our teams continue to have success in identifying new forms of co-operation, and we believe that this will be a critical part of our success in the coming years. Access to additional capacity from within the COSCO SHIPPING Group, whether through our ability to share container boxes or the option to take additional space onboard COSCO SHIPPING Lines's vessels has proved hugely valuable this year, and is a concrete example of where our co-operation brings tangible benefits to our Group and to our customers.

The Group's long-established and consistent pattern of measured and intelligent growth continues. In September 2021, we announced that the Group had placed orders for ten 16,000 TEU vessels, for a total cost of US$1.576 billion, for delivery between the fourth quarter of 2024 and the fourth quarter of 2025. These vessels are added to twelve 23,000 TEU vessels that we already have under construction, for delivery during 2023-2024. Not only will these modern, efficient vessels improve our cost structure and environmental efficiency, but they also serve as clear evidence of the entire Group's continuing commitment to our very successful dual brand strategy. Our newbuilding programme of 22 vessels is a clear indication of the intention of the COSCO SHIPPING Group, of which OOIL is an integral part, to be a leading player in the top echelon of the industry.

Seafarers, through their efforts and sacrifices, have kept world trade flowing during this pandemic, and we all owe them a special debt of thanks. We will exert every effort to ensure the safety and wellbeing of our seafarers, and this includes going the extra mile to help them return home at the end of each assignment, as well as facilitating arrangements, wherever possible, to allow all those of our seafarers who wish to be vaccinated, to be vaccinated. We believe that it is our duty to be among the very best performers in this regard.

Our logistics business, OOCL Logistics, performed very well during 2021. OOCL Logistics expertise in various modes of transportation has been extremely valuable, as we helped our customers find the best solutions for their supply chain needs. We believe that co-operation between our logistics business and our liner activities will help to drive our groupwide strategic growth plan for end-to-end services.

The OOIL Group continues to advance its longstanding track record as a leader in technology and digital innovation. Our Freightsmart platform, which provides instant quotation and booking, has provided a valuable additional channel for our customers, and we look forward to building on its very impressive start. We continue to develop IQAX, a wholly-owned subsidiary, which will play a leading role in driving the digital transformation of the container shipping industry. Our Business Continuity Infrastructure has been put to the test throughout the pandemic, as various countries introduced COVID-19 restrictions resulting in home working – at all times, we were able to maintain business operations and high-quality customer service.

In terms of outlook, at the time of writing, purely in terms of the container shipping market, the market situation remains very similar to what we saw during 2021. Demand still appears to be resilient, and continuing congestion and disruption around the world mean that there is considerable pressure on available space and consequently high demand for our services. It seems unlikely that this situation will change materially during the first half of 2022, but we will continue to pay close attention to key leading indicators and to the forecasts and expectations of our customers. Beyond the first half of 2022, forecasting becomes even more difficult, and it remains true that the full implications of the COVID-19 pandemic on world trade have yet to be seen, particularly in terms of supply chain evolution. We will remain attentive to market trends, and will seek to be at the forefront of positive developments, including enhancing relationships with our customers, offering more end-to-end solutions, and leading the process of digitalisation in our industry.

Even if the outlook from a purely container shipping perspective continues to encourage cautious optimism, at least in the near term, we are mindful of other events that could impact performance in the next few months. We refer not only to geo-political events, but also to potential further recurrences of COVID-19 outbreaks, high inflation and indeed to unexpected events that could arise during these uncertain times.

Be assured, no matter the challenges, OOIL will adapt and be ready to serve its customers. It is pleasing to see how successful the Dual Brand strategy has been since OOIL's entry into the COSCO SHIPPING Group in 2018, and in line with the clear vision of our 14th Five-Year Plan, the Dual Brand will continue to go from success to success. We will continue to work tirelessly and diligently to be at the forefront of our industry, as a Vital Link to World Trade.

As at 31st December 2021, the Group had total liquid assets of US$7,369.6 million compared with debt obligations of US$662.0 million repayable in 2022. The Group had a net cash to equity ratio of 0.48 : 1 as at end of 2021, compared with 0.04 : 1 at the end of 2020. The Group from time to time prepares and updates cashflow forecasts for asset acquisitions, to serve project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds.

OOIL owns one of the world's largest international integrated container transport businesses which trades under the name “OOCL". With around 420 offices in about 90 countries/regions, the Group is one of Hong Kong's most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

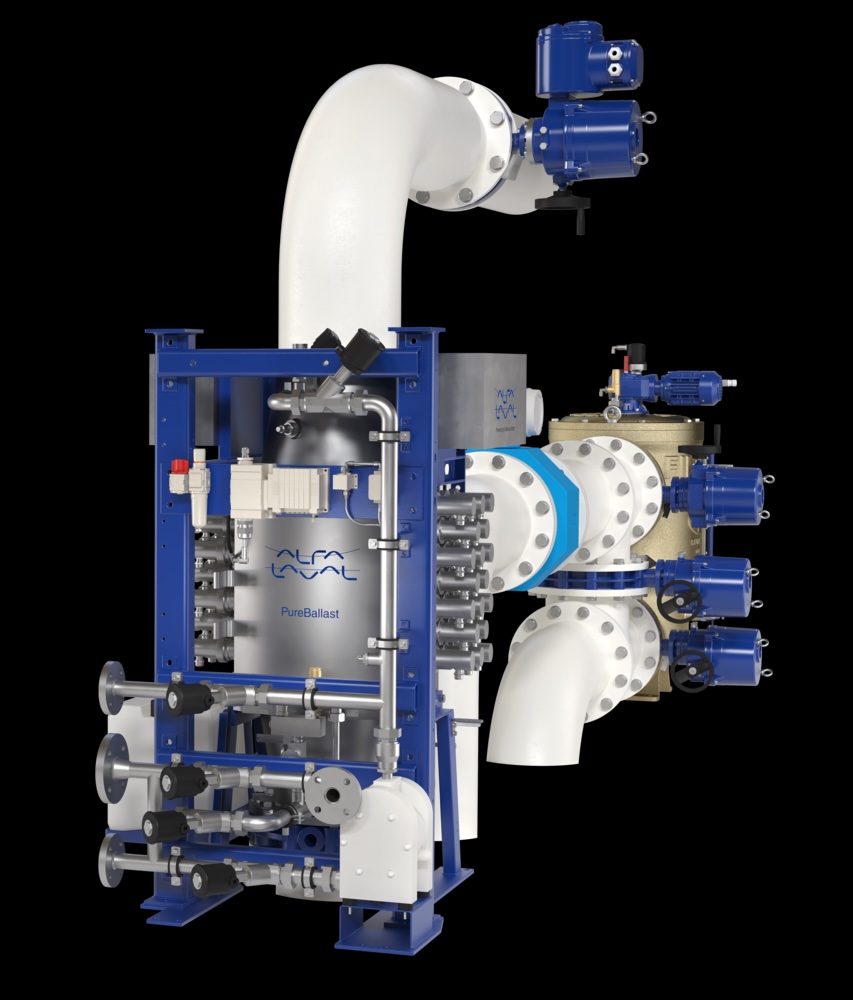

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive