After the market closed, CMES Shipping disclosed the performance for the first half of 2021 on Shanghai Stock Exchange's website.

According to the Company's semi-annual report, affected by both the severe depression of the tanker market and the gradual recovery in the dry bulk market, the net profit attributable to the parent company for the reporting period was RMB950 million. With a sharp year-on-year decline in performance though, there were some highlights:

1. There was a sharp year-on-year increase of 54.5% in the business income of the dry bulk fleet, and an increase of multiple times in the earning contribution in the second quarter compared to the previous quarter, showing that the dry bulk earnings began to benefit from the pickup of BDI.

2. The VLCC oil tanker fleet was particularly competitive, risk-resistant, and tenacious. Though hit by the extreme depression of the market for several consecutive quarters, the fleet remained profitable in the first quarter of this year and had only a slight loss of around USD16 million in the second quarter (The earning contribution of the VLCC fleet in the second quarter of last year was nearly USD300 million).

3. The development of low-carbon business remained stable. The earning contribution of the wind power installation ships reached RMB30 million, representing a significant year-on-year increase.

4. The development of LNG carriers remained stable, and that of Ro-Ro ships gained significant recovery after the pandemic.

5. The low-carbon development of the fleets continued to be promoted. As of the end of the reporting period, there were 55 active oil tankers in the Company's oil tanker fleet, with a total of 15.99 million DWT; there were 179 dry bulk carriers in the dry bulk fleet with 24.59 million DWT. Besides, the average vessel age and the proportion of energy-saving and environmentally friendly vessels are far better than the average of global fleets. Meanwhile, seizing the chance when the asset price of vessels rose sharply, the Company made timely adjustments to the fleets, and disposed of old non-energy-saving and environmentally friendly vessels, achieving a good income.

Looking ahead, the Company indicated in the semi-annual report that the freight rate pickup of oil tankers would be a high-probability event, and that as the supply and demand pattern changed, the recovery of the oil tanker market should be persistent. The major risks still lie in the resurgent pandemic and the lower-than-expected retirement of old vessels that would be continued for a long time. It is expected that demand for major dry bulk cargoes will increase, the delivery pressure of new shipping ability will decrease, and the efficiency loss of global fleets resulted from the pandemic may last longer.

As of the closing on August 25, the closing stock price of CMES Shipping was RMB4.21/share, increased by 4.21%, with 55.2 million shares traded.

Source: CMES

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

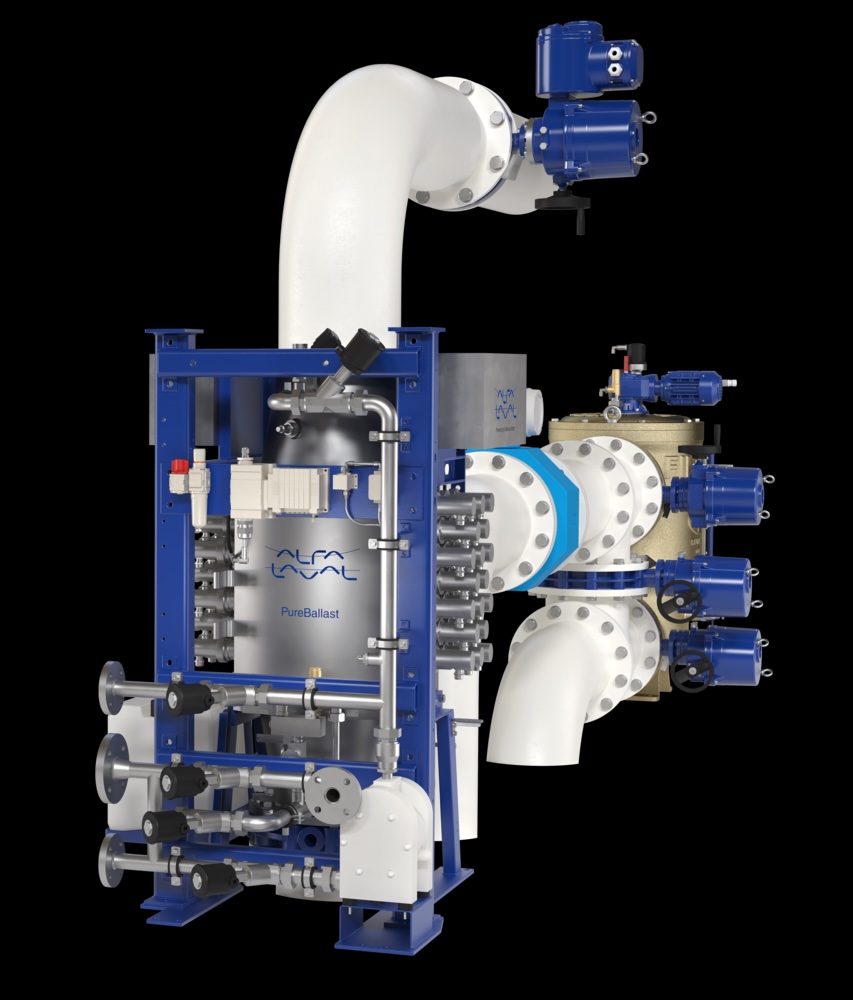

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive