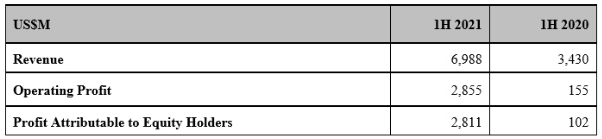

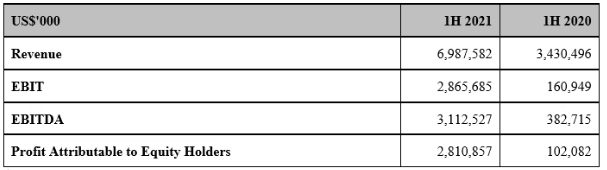

·Group Revenue of US$6,988 million

·Group EBIT of US$2,866 million

·Group EBITDA of US$3,113 million

·Operating Cash Flow of US$2,955 million

·Profit Attributable to Equity Holders of US$2,811 million

·Interim Dividend of US$1.76 per ordinary share and Special Dividend of US$2.65 per ordinary share

Financial and Operational Highlights – First Half of 2021

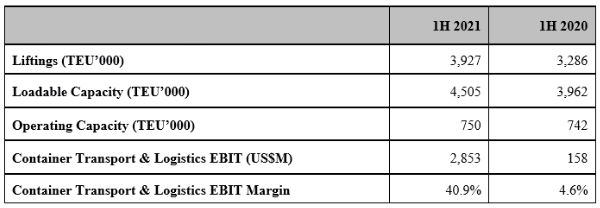

·Container Transport and Logistics business reported EBIT of US$2,853 million, representing an EBIT margin of approximately 40.9%.

·Liner liftings grew to 3.9 million TEU.

Liquid assets represent cash and bank balances, restricted bank balances, portfolio investments at fair value through profit or loss and investments at amortised cost. Net cash represents liquid assets deducted by total debt.

Details

OOIL Financial Results – First Half of 2021

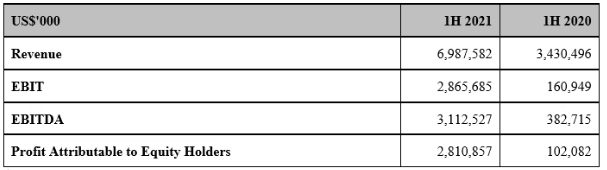

Orient Overseas (International) Limited (“OOIL") announced a profit attributable to equity holders of US$2,810.9 million for the six-month period ended 30th June 2021, compared to a profit of US$102.1 million for the same period in 2020.

Earnings per ordinary share for the first half of 2021 was US442.4 cents, whereas earnings per ordinary share for the first half of 2020 was US16.3 cents.

The Board of Directors is pleased to announce an interim dividend of US$1.76 per ordinary share and a special dividend of US$2.65 per ordinary share.

After the lockdowns that immediately followed the onset of the COVID-19 pandemic in early 2020, OOIL started to see signs of reopening and economic recovery as from the middle of last year, led at first by China and other Asian economies and then joined by other nations. This trend has continued very strongly throughout this reporting period. Demand in key importing economies has been considerably stronger than forecast, especially on Trans-Pacific routes.

However, even with this increase in nominal supply, the level of total effective supply has been under severe pressure as a result of a long list of operational challenges, occurring all over the world, for different reasons and at different times. During the period OOCL have seen port congestion, bad weather delays, labour disputes, shortages of truckers, the Suez Canal incident, insufficient rail capacity, empty box shortages in key locations, quarantine/social distancing in terminals, depots, yards, and for vessel crew, and a range of other difficulties. All these have combined to slow down the velocity of circulation of container boxes across the network, as well to slow down the progress of container ships travelling from port to port. The global container shipping system is one large, interconnected network: any material disruption rarely has only a localised effect, but rather has a ripple effect around the world.

Despite the efforts to increase capacity, supply and demand have been in severe imbalance as a result of both stronger-than-expected demand and also the numerous operational challenges.

The first half of 2021 produced the best six-monthly result in the Group's history. Compared to the same period in 2020, OOCL's total liner liftings for the first half of 2021 increased by 19%, total revenue increased by 108%, and revenue per TEU increased by 74%.

The average price of bunker recorded by OOCL in the first half of 2021 was US$449 per ton compared with US$424 per ton for the corresponding period in 2020. The price increase, in combination with increased consumption in fuel oil and diesel oil led to an increase in total bunker costs of 26% for the first half of 2021 when compared to the corresponding period in 2020.

OOIL continues to benefit from its co-operation with the wider COSCO SHIPPING Group. OOIL were able to obtain additional space to offer to our customers by means of taking extra slots on COSCO SHIPPING Lines' services, including extra loaders, and the company has suffered fewer problems of box availability than most liner companies.

In the first half of 2021, no new-build container vessel was delivered, and no new order was placed by the Group. The twelve 23,000 TEU container vessels ordered by the Group in 2020 are expected to be delivered starting 2023.

For the first half of 2021, OOCL Logistics revenue and contribution increased significantly as compared with the same period last year. The contribution from all business units recorded healthy increases, with International Business Units more than doubling their performance, as business volume handled improved significantly year on year. While Domestic Logistics continues to face fierce competition, the business unit achieved a revenue increase of over 15%.

Looking forward, the signs remain positive. Demand appears to be at healthy levels, with global GDP forecasts remaining strong, at 6.0% for 2021. US data shows US GDP already back to above pandemic levels, and very importantly it still shows retail-sector inventory-to-sales ratios at historic lows, which means that there is an ongoing need for a high level of imports to satisfy local demand. The network continues to see multiple operational disruptions, reducing the ability of container shipping companies to satisfy the strong levels of customer demand. Longer-term, supply side growth, in terms of newbuildings, is relatively low for the remainder of 2021 and in 2022. The market continually for early signs of any change in circumstances, but for the time being, it would appear that the outlook for the remainder of 2021 and the early part of 2022 seems promising. Beyond that, in this time of COVID-19 and of the early stages of economy recovery, it is simply impossible to predict.

OOIL, as part of the COSCO SHIPPING Group, continues to be at the forefront of container shipping. OOIL is broadening our network, aiming to provide the best customer service, and developing more and more end-to-end capabilities. OOIL is playing a leading role in the digitalisation of the industry and building on very solid foundations in providing integrated container logistics services, which will help the company to respond better to the evolution of our customers' requirements in the post-epidemic era. As a key part of one of the world's leading container shipping groups, with the scale and capability to provide the best network for our customers, OOIL will continue to be a Vital Link to World Trade.

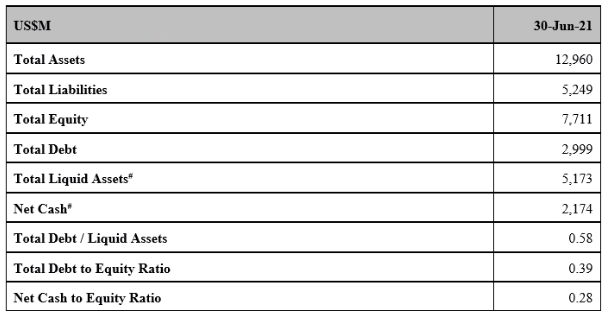

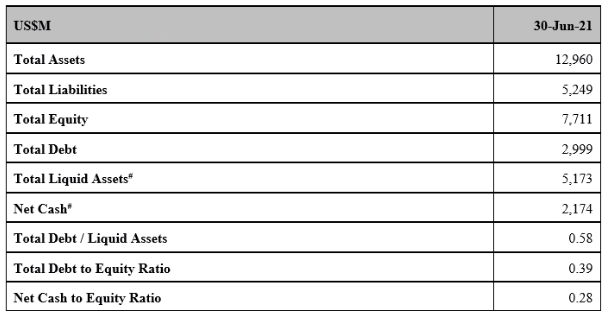

As at 30th June 2021, the Group had total liquid assets of US$5,173.5 million compared with debt obligations of US$681.6 million repayable within one year. The Group remained at net cash position with a net cash to equity ratio of 0.28 : 1 as at 30th June 2021. The Group from time to time prepares and updates cashflow forecasts for project development requirements, as well as working capital needs, from time to time with the objective of maintaining a proper balance between a conservative liquidity level and an effective investment of surplus funds.

OOIL owns one of the world's largest international integrated container transport businesses which trades under the name “OOCL". With more than 420 offices in over 90 countries/regions, the Group is one of Hong Kong's most international businesses. OOIL is listed on The Stock Exchange of Hong Kong Limited.

Source: OOCL

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive