COSCO SHIPPING Development Co., Ltd. (“COSCO SHIPPING Development” or “the Company”) (SSE: 601866, HKEx: 2866) yesterday announced its annual results for the twelve months ended 31 December 2019 (“the Period”).

In 2019, with the strategic objective to build an integrated supply chain financial service platform featuring shipping logistics, the Company focused on its principal business-shipping business, explored market opportunities, and expanded the growth potential of various segments in an effort to grow stronger and better. During the Period, the Company’s revenue was RMB14.156 billion; net profit attributable to owners of the parent of the Company amounted to RMB1.745 billion, up 26% from 2018; and basic earnings per share amounted to RMB0.1285. The Board of Directors proposed a final dividend of RMB0.045 per share.

The Leasing Segments Achieved Steady Growth Through Inward and Outward Efforts

During the Period, the Company recorded a revenue from its leasing business of RMB11.040 billion, accounting for 70.5% of the total revenue of the Company. In terms of the vessel leasing business, the Company focused on the strategic requirements of industry-finance integration, further strengthened internal coordination, and provided high-quality leasing services for upstream and downstream players in the shipping industry chain. The Company opportunistically made a breakthrough in the cruise leasing business, helping China’s cruise industry to sail to the world. In addition, the Company vigorously developed external leasing business (covering various vessels such as chemical vessels, finished oil tankers and bulk carriers), in a drive to continuously enhance its competitiveness and brand influence in the industry. As at 31 December 2019, the Company had a fleet of 87 container vessels with a total capacity of 609,400 TEU, 4 bulk carriers of 64,000 DWT each, a total of over 80 LNG vessels, heavy lift vessels, oil tankers and other vessels, and over 30 projects regarding terminals, terminal equipment and major transportation.

The container leasing business reinforced industry chain synergy and made multiple breakthroughs. In an overall challenging industry environment, the Company made strategic adjustments in a timely manner to seek breakthroughs in the container leasing business and related innovative business lines. Specifically, the Company advanced the big customer strategy and captured the market demand for reefer containers and special containers to promote the development of non-dry container business. Meanwhile, the Company developed innovative container lease business, scaled up mobile warehousing and leasing projects, and explored finance lease business, thus improving the overall return on investment. As at 31 December 2019, the container fleet of Florens International Limited (“FIL”), an affiliate of the Company, boasted a total capacity of about 3.66 million TEU, ranking second in the world.

As for other leasing business, the Company actively sought new profit growth drivers while consolidating its existing development advantages and strived to expand financing channels to effectively reduce financing costs.

Container Manufacturing Segment Achieved Economies of Scale and Enhanced Research and Innovation Capabilities

In 2019, given the weak demand for containers, the Company actively sought business breakthroughs, optimized service quality, and innovated in service models to further enhance the synergy of shipping business. During the Period, the Company recorded a revenue from its container manufacturing business of RMB4.583 billion, accounting for 29.2% of the total revenue of the Company.

The boutique assets of Singamas Container acquired by China COSCO SHIPPING Corporation Limited (“COSCO SHIPPING”) had been entrusted to Shanghai Universal Logistics Equipment Co., Ltd., a subsidiary of the Company, for management, pushing up the market share of the Group’s container manufacturing segment to rank second in the world. The acquisition also made up for certain weaknesses of the Group, such as insufficient production capacity, lack of presence in key regions, and lack of reefer containers. In addition, the Group continuously improved its research and innovation capabilities and concentrated on upgrading technical management, with a view to enhancing the core competitiveness of its container manufacturing segment.

Investment Segment Deepened Industry-finance Integration to Improve Overall Financial Returns

With a focus on the shipping industry chain, the Company constantly optimized its investment portfolio and successfully implemented sizeable financial and other equity investment projects, buffering the fluctuations in the shipping market. The Company further promoted the launch of COSCO industry funds to build up a characteristic industry brand and achieved breakthroughs in multiple projects. In addition, the Company expanded the scope of supply chain financial services, enhanced service capacity and leveraged the strengths of its service portfolio to increase customer stickiness in different industries.

Improving the Return on Investment and Safeguarding the Interests of Investors

The Company has always attached importance to the interests of investors. In May 2019, the Company repurchased a total of approximately 155 million A and H shares. By doing so, the Company became the first listed company in the capital market to successfully implement share buybacks in two stock exchanges, winning wide recognition in the capital market, enhancing investors’ investment confidence and promoting the Company’s long-term sustainable development. In the second half of the year, the Company completed the dividend distribution to A-share and H-share investors, distributing a total cash dividend of approximately RMB380 million to all shareholders. The generous dividend distribution was a move to share the development achievements with investors.

Adhere to Original Objective of Developing Shipping Finance and Strive to Seize Market Opportunities

The Company will strengthen macro analysis and market research, promote reform and transformation, develop new competitive strengths focusing on industry-finance integration, continuously improve high-quality development, and seek breakthroughs in distinctive shipping financial services.

In terms of shipping and industry-related leasing segments, the Company will continue to strengthen the combination of industry and finance, reinforce the collaboration among internal industry chains, and steadily expand external business. In terms of container manufacturing segment, the Company will steadily advance the multi-dimensional integration of its entrusted container manufacturing assets into the Company’s existing business, and enhance its overall competitiveness through technological upgrading, management improvement, process promotion and cultural integration. In terms of investment and services segment, the Company will focus on upstream and downstream customers in the industrial chain, constantly optimize its investment portfolio, and seek a balance between strategic value and financial returns

The year 2020 is a new beginning. In this era where challenges and opportunities coexist, COSCO SHIPPING Development will adhere to its original objective of developing shipping finance, and ride on the deepening reform of state-owned enterprises to set sail towards high-quality development, so as to achieve its corporate vision of “building an excellent industry financial services provider.

Source:COSCO SHIPIING Development Co., Ltd.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

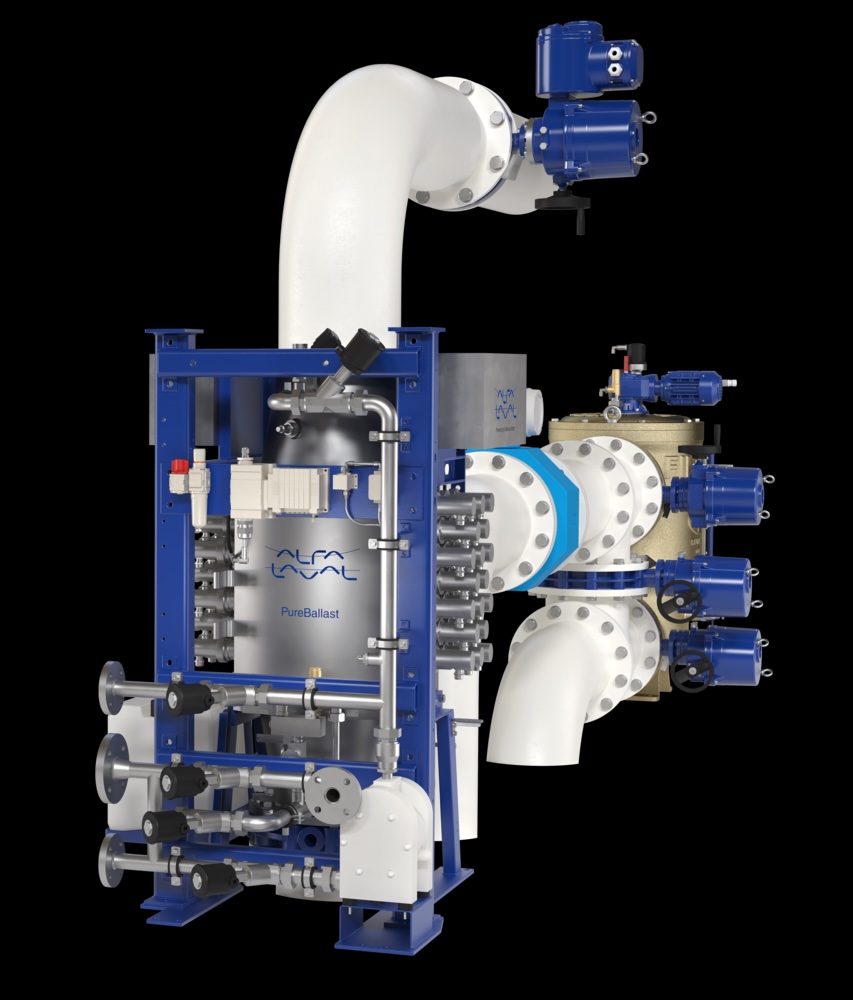

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive