Orient Overseas Container Line unveiled a full year net profit of US$137.7m, ably reversing the company’s US$219m loss in 2016. Net profit was achieved off the back of revenue of US$6.1bn, achieving an operating margin of about 1.7%.

During the year under review OOCL also joined the elite group of liner companies with the delivery of six 21,413, teu newbuildings.

Due to an agreement with the COSCO Shipping, which purchased OOCL for US$6.3bn in July last year, there will be no final dividend paid this year.

Chairman of OOCL parent, Orient Overseas International Ltd, C C Tung said: “the economic backdrop for 2017 was more robust than forecasters had expected. Following a decade of low growth, we saw healthier performance in both GDP and trade volumes across most of the world’s major economies…This synchronicity of growth, a rare phenomenon in recent memory, may bode well for the sustainability of the recovery.”

OOCL increased its liftings to 6.3m teu. 2017 was a year of tremendous growth for OOCL in both European and US bound trades. For the full year 2017, OOCL’s liftings were up 3.6% overall, but 16.3% on Trans-Pacific and 19.7% on Asia-Europe. This growth outpaced the already strong volume growth seen in the market as a whole.

However, Mr Tung imposed some restraint on any undue sense of celebration and self-satisfaction the industry might be feeling.

“However, growth on the supply side continues across the trade lanes. Even if the ordering of new vessels remains muted in relative terms, upsizing of capacity continues in certain key routes. Ultra-large vessels ordered in the past few years are now being delivered and brought into operation. Furthermore, as trade growth improves, the industry continues to introduce additional services using cascaded or previously idled capacity,” said Mr. Tung.

“This combination of better economic growth and continuing (if moderated) growth in supply, along with higher bunker prices, means that for OOIL and our peers, the environment remains merely one of gradual recovery, not the boom that some analysts expected when improved economic data first started to appear,” Mr. Tung added.

“The second phase of our Middle Harbor Redevelopment Project in California commenced operations towards the end of 2017. We are delighted with the progress made so far, and already feel the benefit of greater efficiency through welcome cost gains,” remarked Mr. Tung.

“OOCL Logistics continues to develop steadily and profitably. The profitability of OLL’s domestic logistics activities improved. OLL’s core business of managing the international supply chains of large retailers in North America and Europe retained its role as the key profit driver. The goal is to build and grow the business, in what is unquestionably a highly competitive market,” Mr. Tung said.

“2017 has been a year of considerable growth for the group. It is pleased to note that this growth has been achieved without a deleterious effect on the profit and loss account. We have now taken delivery of all six of our 21,413 teu ships, with these titans of the sea providing us not only with additional capacity, but also with a more efficient cost base,” noted Mr. Tung.

“Once the large new vessels scheduled to be delivered in 2018 have been brought into service, with a comparatively low order book for 2019 and 2020, and taking into account the improved economic data, we are hopeful that the industry may start to enjoy greater stability than it has done for many years. In the meantime, we maintain a positive, if somewhat cautious, stance,” he added.

Alan Tung, the Group’s Chief Financial Officer, commented, “As at 31st December 2017, the Group had total liquid assets of US$2,534.5m compared with debt obligations of US$624.2m repayable in 2018. The net debt to equity ratio remained low at 0.43 : 1 at the end of 2017.”

Sources:hongkongmaritimehub

Please Contact Us at:

admin@xindemarine.com

Sea-Cargo and Norsepower continue their collaborati

Sea-Cargo and Norsepower continue their collaborati  Alfa Laval expands its portfolio with ultrasonic an

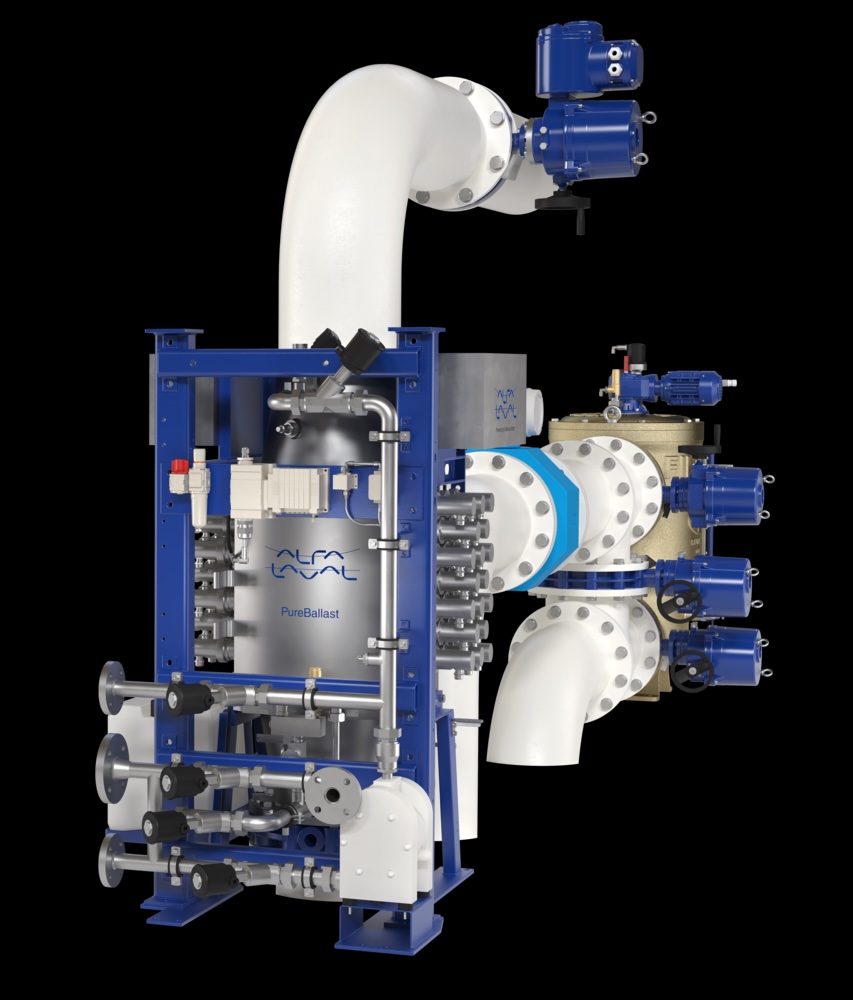

Alfa Laval expands its portfolio with ultrasonic an  Alfa Laval PureBallast 3 Ultra secures orders from

Alfa Laval PureBallast 3 Ultra secures orders from  RobotPlusPlus Wows Maritime Professionals with Carg

RobotPlusPlus Wows Maritime Professionals with Carg  Alfa Laval secures first contract for ammonia fuel

Alfa Laval secures first contract for ammonia fuel  GNV Tests RINA’s Machine Learning and Predictive

GNV Tests RINA’s Machine Learning and Predictive