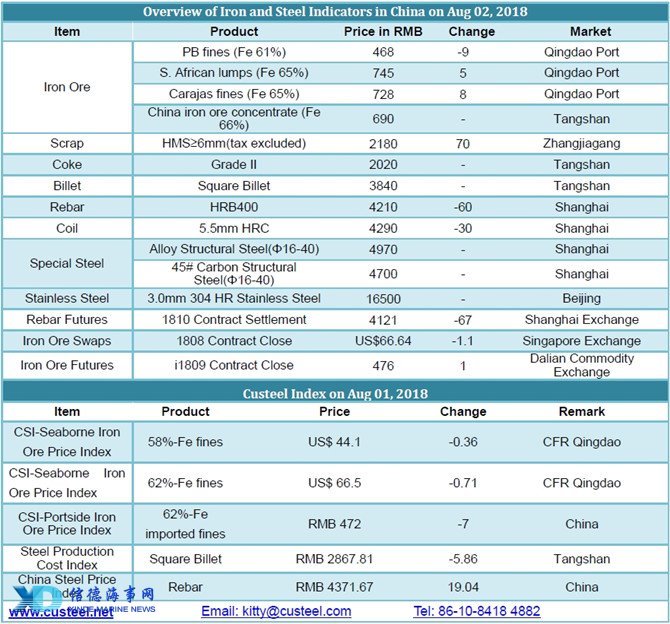

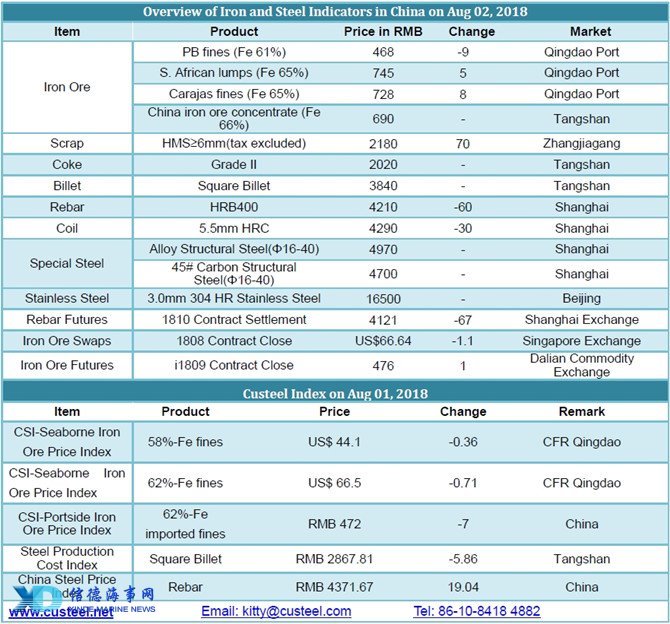

China’s imported iron ore market extended steadiness in the morning as spot trade yesterday showed signs of weakness. Iron ore demand continued to be hindered by sintering cut in Tangshan and local mills are not in a hurry to stock up. The unexpected dive in iron ore futures at Dalian Commodity Exchange before noon cooled market activity by a large extent. There were larger negotiation room for spot trade in the afternoon, which meanwhile dampened traders’ desire for delivery. It is learnt that some small-sized traders took chance to inquiry and wanted to be the bottom-fisher as they were optimistic towards the coming market.

The round of pollutant control measures in Tangshan implemented during Aug 1-5 restricted 50% production of sintering machine and shaft furnace, which eased steel mills’ procurement costs pressure. Transaction was not active and partial was done among traders. PB fines were traded at RMB480/tonne or so in Tangshan and Newman fines at RMB509/tonne; PB fines were traded at RMB467/tonne in Shandong and Newman fines at RMB495/tonne, Carajas fines were traded at RMB730/tonne. High grade iron ore fines were relatively firm amid a narrow decrease in trading price and medium grade iron ore fines traded about RMB5-8/tonne lower from yesterday. The high grade resources, in particular low alumina content will continue to remain high in the future.

Seaborne iron ore market was relatively quiet today, with only a mixed cargo of PB fines and PB lumps traded COREX, slightly lower from last deal.

Sources:XINDE MARINE NEWS

Please Contact Us at:

admin@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in