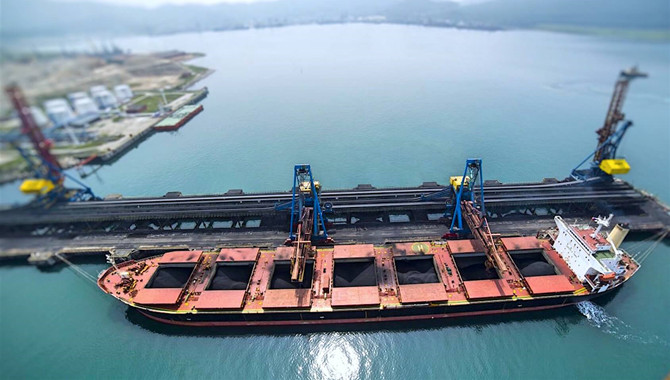

[Photo: VesselFinder]

China's coal import surge from last year's low base during the first quarter this year is unlikely to continue in the months to come, as the import volume may fluctuate or show a decreasing trend amid the rise of renewable energy as a share of overall energy consumption, industry experts said on Friday after crunching the latest data.

In the first quarter, China imported 101.8 million metric tons of coal, up more than 96 percent year-on-year. The value of imports rose nearly 77 percent year-on-year to 93.54 billion yuan ($13.68 billion), data from the General Administration of Customs showed on Thursday.

The country brought in 41.17 million tons of coal in March, the highest level since January 2020, up 151 percent year-on-year.

The drastic increase was on expectations of demand recovery and after curbs on Australian coal imports were removed, said Lin Boqiang, head of the China Institute for Studies in Energy Policy at Xiamen University.

The resumption of work and production had created demand for coal in industries such as electricity, steel and building materials, which continues to increase. The government had also increased subsidies for public utility companies, encouraging them to increase coal stocks and imports to stabilize economic growth and ensure electricity supply is adequate to support people's livelihoods, he said.

While demand for coal in China is expected to remain robust in the second quarter with economic recovery, the import uptrend is unlikely to continue, he said.

Zhang Mohan, a coal analyst with CITIC Futures, said the drastic increase in first-quarter coal imports was caused by the Russia-Ukraine conflict as well as Indonesia's coal export ban last year. Indonesia is the largest source of China's thermal coal imports.

Last year, high prices affected China's coal imports, leading to a drop for the first time in seven years, he said.

But this year, imported coal prices have been competitive against domestic coal, which led to record first-quarter imports, he said.

Given the economic rebound, demand for energy resources, including iron ore, had been rapidly increasing, which encouraged steel makers to book more shipments.

According to shipping data from Refinitiv, China's iron ore shipments in March increased 14 percent year-on-year to 94.17 million tons, of which about 86 percent came from Australia and Brazil.

China's coal consumption is currently in the midst of a low season as winter heating demand in northern parts of China has declined while demand for summer air conditioning has not kicked in yet. This has exerted downward pressure on domestic coal prices and narrowed price differentials with overseas supplies.

However, this does not mean that China will relax its control over coal imports, as the government will adhere to the principle of ensuring energy security and moderately supplementing and controlling the total amount and structure of coal imports to protect domestic industries and the environment, said Lin.

China's coal imports may fluctuate or show a declining trend as the government has also been accelerating the development and utilization of clean energy and increasing the proportion of renewable energy in energy consumption, he said.

Liang Changxin, spokesman of the National Energy Administration, said on Wednesday at a news conference in Beijing that the country's electricity demand is expected to peak beyond 1.36 billion kilowatts this year, which represents a significant increase compared to last year.

Overall, stable and adequate electricity supply across the country is guaranteed by and large this year, with only a few provinces likely to experience power shortages during peak hours, he said.

Daily coal consumption in eight coastal regions fell to around 1.72 million tons last week from more than 2 million tons in February, data tracked by the China Coal Transport and Distribution Association showed.

Source:

China Daily

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in