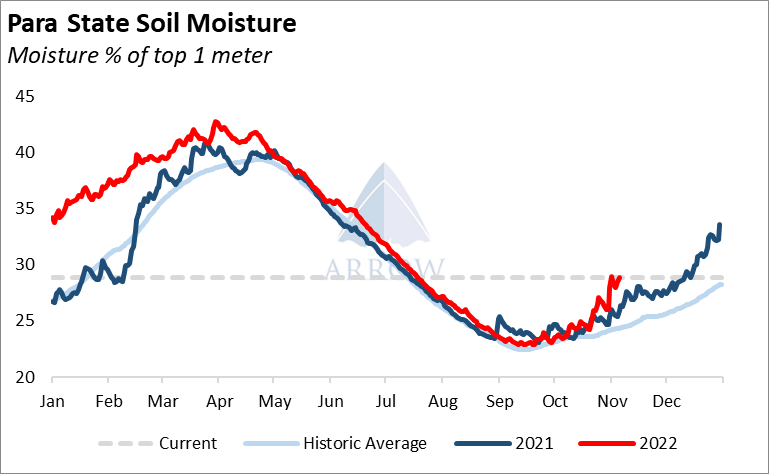

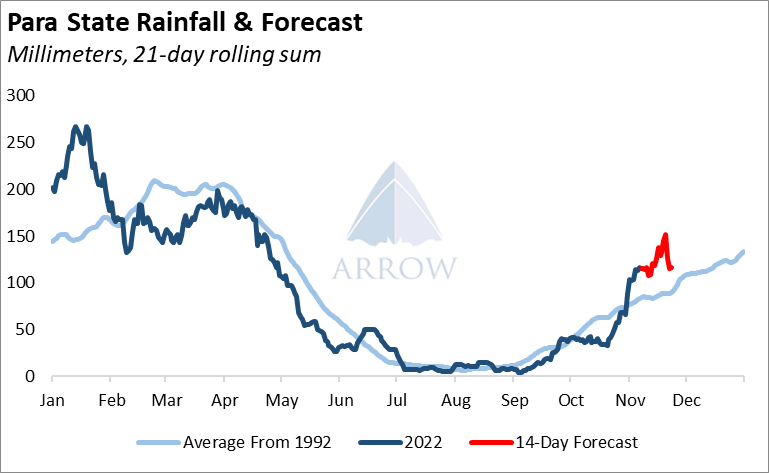

Seasonal rains in Brazil have an impact on iron ore production as mining operations slow down. This year the rainy season is running ahead of schedule in Northern Brazil, a bad sign for Q1 iron ore exports.

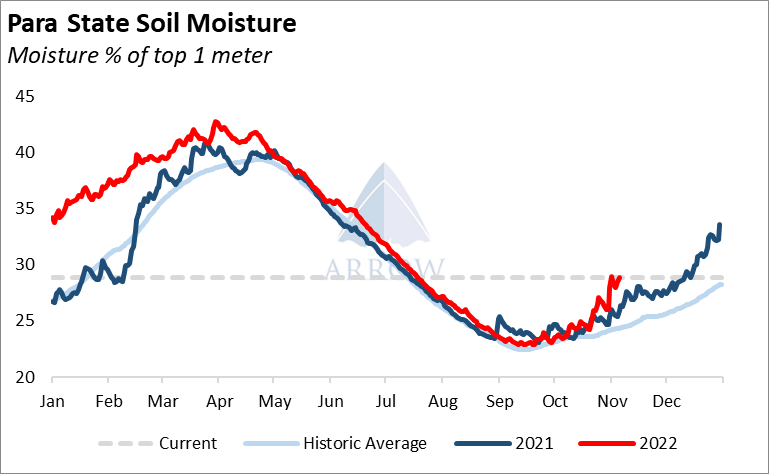

Soil moisture levels were above normal in October and then heavy rains hit. Now, soil moisture is at a level we would typically expect in mid-to-late January.

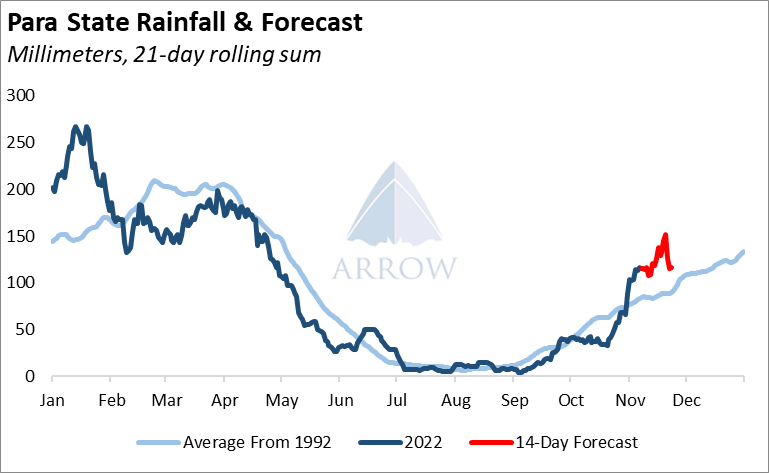

Looking at the 14-day rainfall forecast, there’s even more rain coming.

Further ahead, the long-term outlook is also looking much wetter than normal. In the map below, green areas are forecasted to be wetter than normal.

In January of this year, heavy rains in Southern Brazil hit already saturated soil causing flash flooding in the region. Vale halted iron ore operations in several mines as a direct consequence. Brazilian iron ore exports in Q1 this year were low, in fact they were 10 million tonnes behind 2019.

With the current soil moisture and weather forecast, we see a high chance of iron ore mining being negatively impacted over the coming months.

VLOC utilisation has been strong this year, which has meant fewer spot Capesize vessels are required for Brazilian iron ore. Jan-Oct this year VLOC (+225k dwt) iron ore exports from Brazil were up 8.3% vs the same period last year. However for vessels below 225k dwt, volumes were down 12.6%.

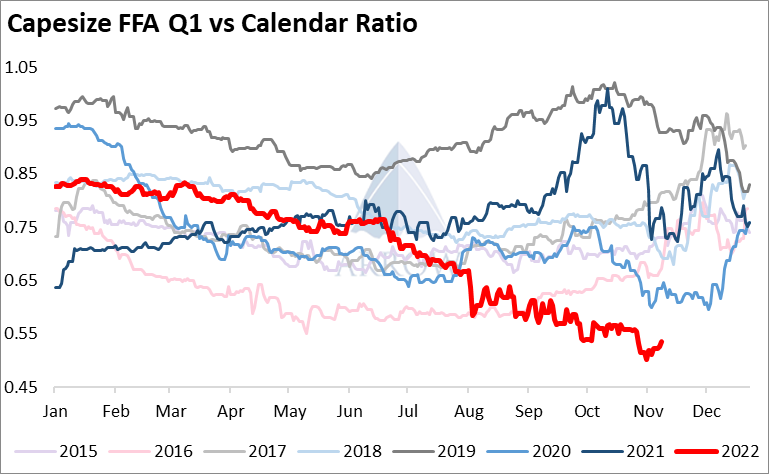

We expect any weakness in Brazilian iron ore exports to be felt acutely in the spot market during Q1.

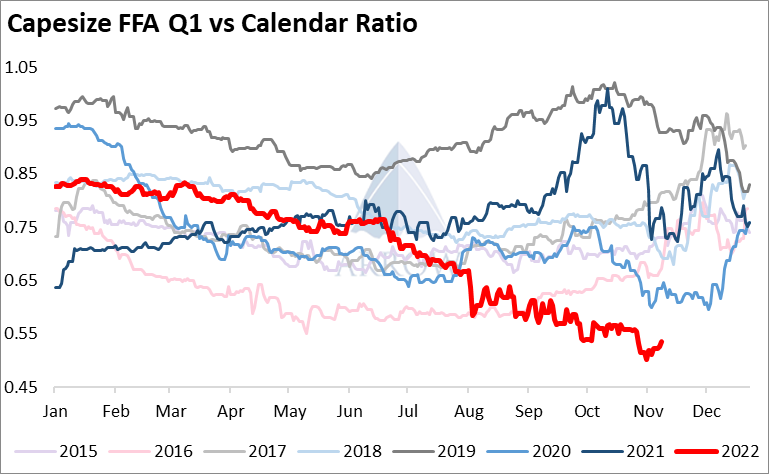

At under $7k/day, the FFA market is pricing in a weak Q1. The contract is also looking discounted verses calendar 2023. As both a spread and a ratio, Q1 vs Cal Capesize FFA is trading very low; Q1 is close to half of the calendar 2023 contract. Given the circumstances highlighted in this report, the steep discounting of Q1 is unsurprising.

Source: Arrow

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in