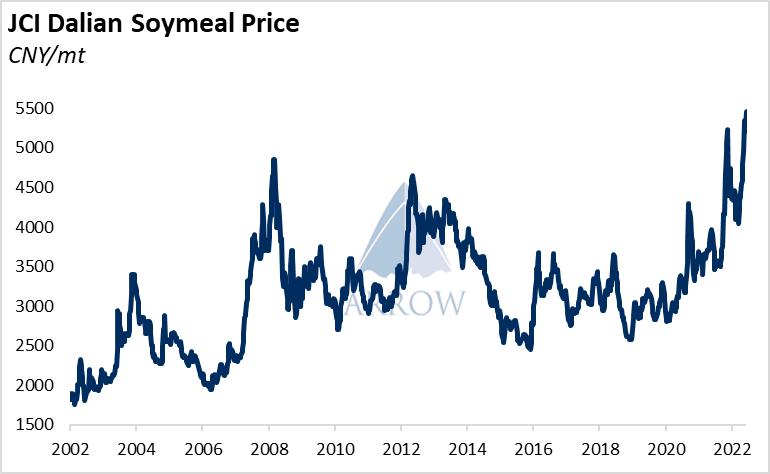

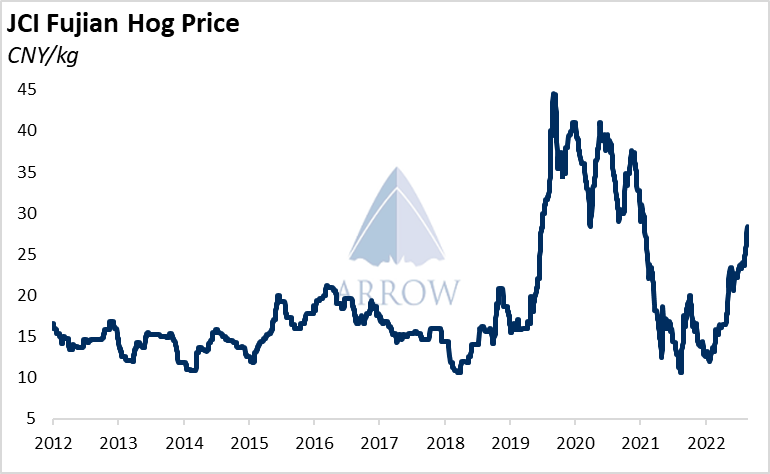

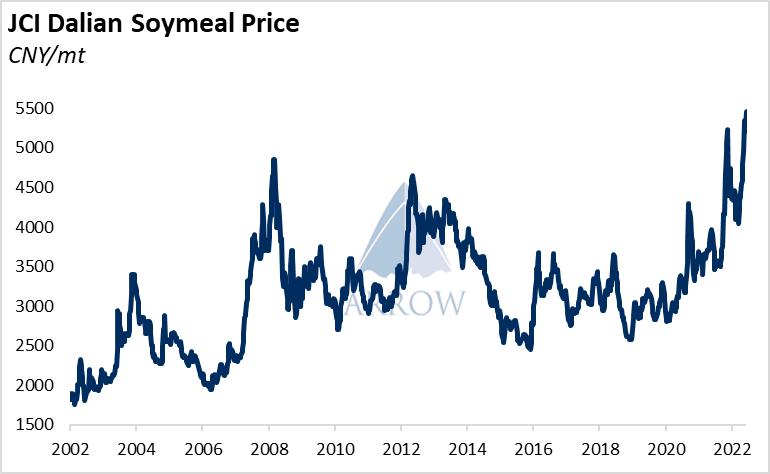

Now, improving feed demand is sending soymeal prices close to record highs.

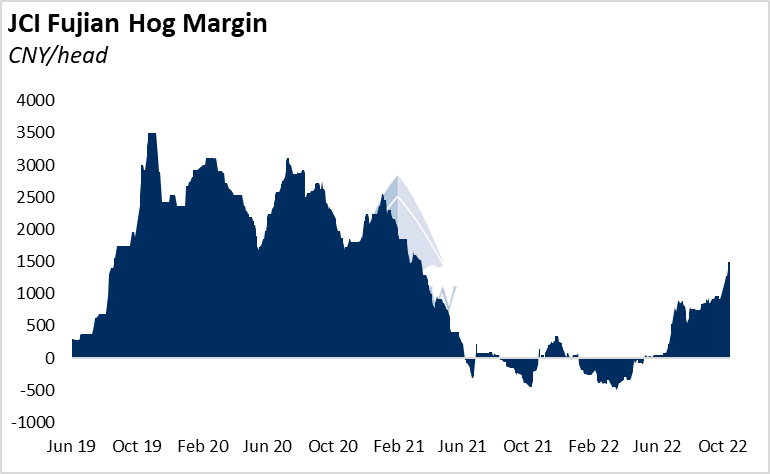

Consequently, crush margins are leaping higher, which should support soybean demand as crush plant utilisation picks up.

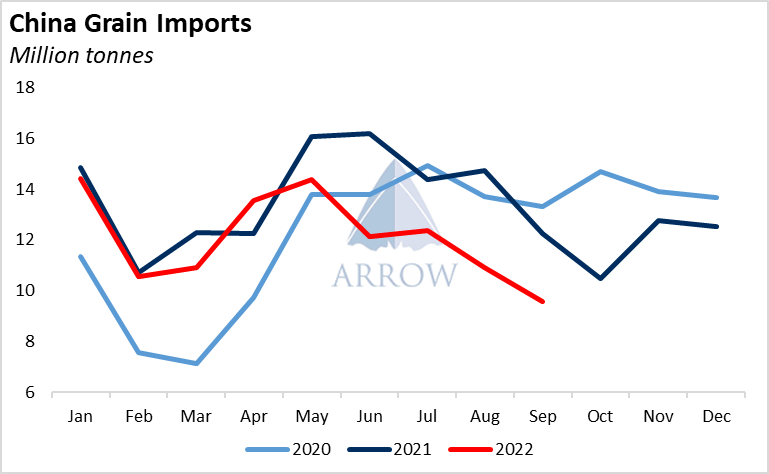

As Chinese soybean prices flirt around decade highs, it appears that weak import pace over the past 6 months is insufficient to meet the current level of demand.

US export sales indicate strong Chinese demand this marketing year for US soybeans. While the low water level on the Mississippi is causing the US export season to get off to a slow start, we expect Chinese purchases to remain strong over the coming months as the US is the cheaper source of prompt cargoes. Chinese soybean futures are close to record highs, whilst US soybean futures are about 20% off the highs of the year – the import incentive is growing.

Furthermore, early next year a potentially record Brazilian soybean crop should provide ample supply if Chinese demand holds.

Record soymeal prices indicate that recent crush volumes have been insufficient to support improving feed demand in China. To meet rising crush volumes, we expect China to source soybeans from the US, where they are significantly cheaper than domestic produce. In addition, a potential record Brazilian soybean crop early next year should provide ample supply for whatever demand materialises throughout 2023.

The hole in freight demand left by the war in Ukraine remains unfilled. However, with firm Chinese purchases of US Soybeans, we expect tonne-mile demand from the grain sector to improve over the coming months back towards levels seen in 2021.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in