The energy crisis continues to have a strong impact on the European power complex, as gas supplies are at risk and coal remains deeply profitable to burn. Clean dark spreads, which measure the profitability of producing electricity from coal, are profitable out until 2026 in Germany, which indicates the market expects strong coal burn over the coming years.

EU coal imports keep rising, and this strength in volumes looks like it's here to stay.

China Demand

Chinese coal output has rocketed higher in recent months and there are government plans for further output increases, this could slow import demand.

International coal prices remain higher than domestic prices, keeping the import incentive low. The falling Yuan only puts international prices further away. Moreover, recent economic data from China indicates that the economy is slowing, and this will ultimately drag on coal consumption.

However we don't believe that coal imports will soon crash, other factors are clouding the picture.

New long-term coal pricing contracts will mean that some producers will see little incentive to boost output, and this could reduce domestic supply. Additionally, the new cut on import tariffs came as somewhat of a surprise and looks to be a way that traders can increase import volumes whilst keeping costs slightly lower.

It's worth remembering that China is still growing its fleet of coal power plants, and coal remains one of the cheapest ways for China to keep the lights on. As of January this year, China had about 129,000 MW of coal-fired power generation capacity either under construction or with approved permits . That is 20% more than the operating capacity in Japan, South Korea and Taiwan combined.

China's coal imports are always at the whim of government policies, so forecasts are difficult, however over the coming year we don't envisage import volumes dropping notably.

India Demand

Low stockpiles of coal in India have contributed to widespread power cuts during a recent heatwave. This prompted the government to call for states to ramp up their coal imports over the next 3 years as domestic output will not cover demand. As recently as December the policy was to avoid all but essential coal imports, so this pivot is a marked change in direction.

Supply

Spurred on by higher prices, global seaborne coal volumes are making new post pandemic highs. However the situation is a little more complicated as you look deeper. The Indonesian coal ban earlier this year increased their domestic stockpiles, and now means their exports are running very fast. Excluding Indonesia from the global coal supply picture, volumes in March were 3.8% lower year-on-year (YoY), and preliminary April data suggests this has widened to 4.5% lower.

Covid, floods and labour shortages have all hindered Australian coal output.

Russian exports from both the East and West coasts have dropped versus last year in March and April. Some buyers are avoiding Russian coal as a result of the conflict in Ukraine, whilst others are struggling to buy Russian coal as changes in the SWIFT system means there is no suitable payment mechanism.

Indonesia's export ban at the start of the year cut exports in January, and there are risks of another export ban as the government is keen to cool commodity inflation.

South Africa is having serious logistical issues within the railway system, and this is curtailing export volumes.

Trade flows

So with these changes in supply and demand, how is that impacting trade flows and tonne-miles? So far negatively.

Average coal voyage distance has dropped for both Capesize and Panamax during the past 2 months. And for the whole fleet this value is around the lowest it has ever been. Colombia, Canada and the USA have all seen average coal voyage distances drop YoY in March, and April data suggests this trend is continuing. Fewer cargoes are heading front-haul.

With more South African coal heading to Europe instead of India, laden voyage distances are increasing, however the ballast legs tell a different story. For Capesize & Panamax vessels, the average ballast distance after discharging in India is about twice as long as from EU ports. Increasing volumes on the South Africa to Europe trade appears to be increasing triangulation and therefore is not strongly tonne-mile positive.

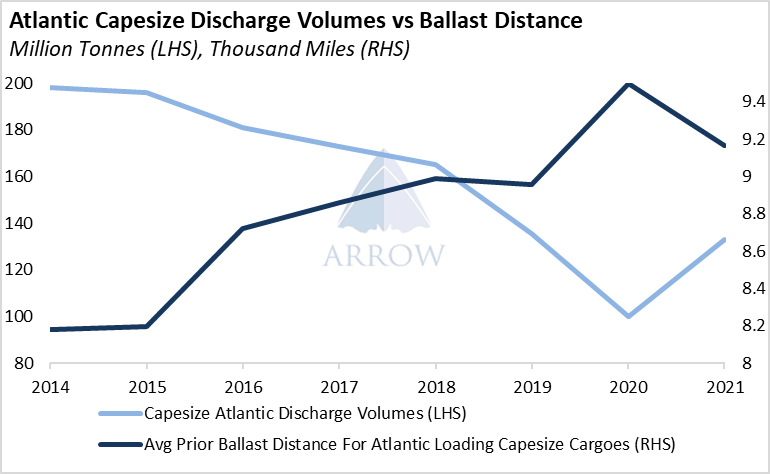

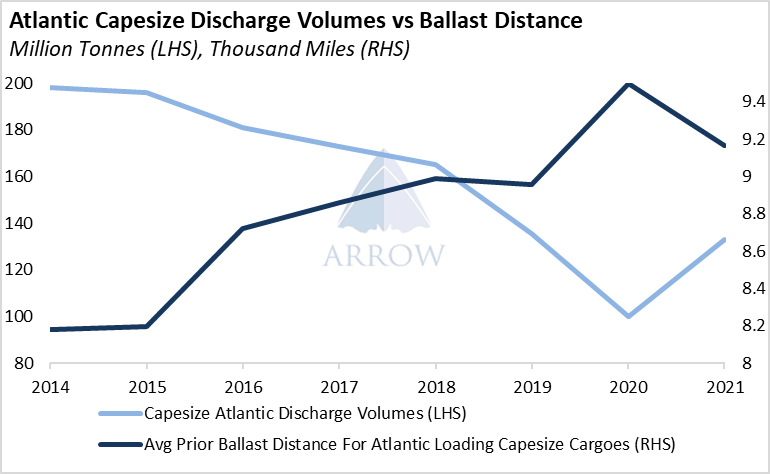

Higher Atlantic discharge volumes also means that fewer ballasters are needed to sail into the Atlantic, lowering average ballast distances.

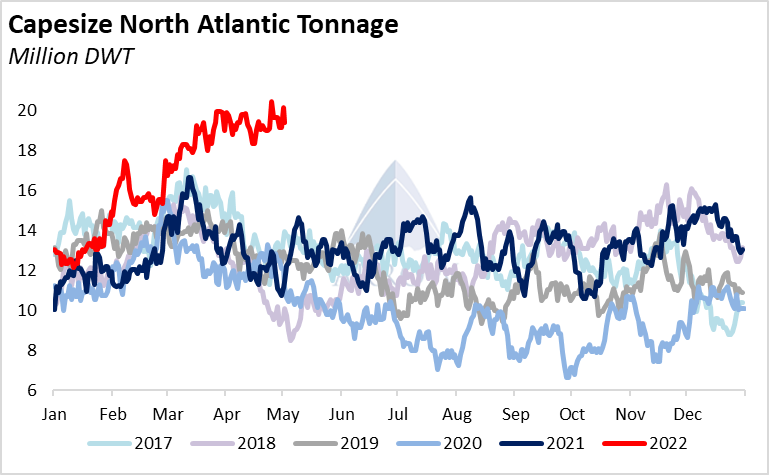

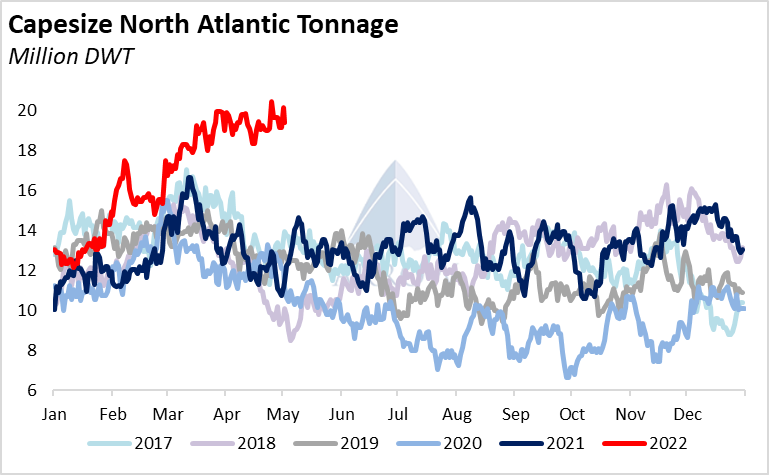

Higher European Capesize discharges has already brought up the number of vessels in the North Atlantic.

And this has impacted timecharter rates in the Atlantic, with the C8 index trading at its largest discount to the 5TC since inception.

However the full effects of the Ukraine conflict are yet to be felt. Importers are focusing on security of supply and consequently continue to take Russian coal. As long-term contracts unwind and sanctions come into place over the coming months, we expect to see further changes.

Russian Baltic volumes will likely have to head further once the European ban comes into place. On the East Coast of Russia, cargoes may struggle to find as much demand in Japan, Korea and Taiwan, so may also require longer distances to find a buyer. Government policies in both China and India have been import friendly recently, and with cordial relations between these countries and Russia, they should be able to take advantage of discounted Russia coal.

Bottom Line

Global coal demand remains strong, whilst supply is slowly inching upwards. High prices look set to stay over the coming year, and so the incentive will remain for export volumes to flow – however Covid, logistics, government action and the weather may continue to affect seaborne supply.

Bullish changes to coal trade-flows as a result of the Ukraine conflict are yet to materialize: the lack of front-haul cargoes is lowering the average voyage distance of the coal trade. However, Baltic coal should end up travelling further once Europe halts their coal trade with Russia, with India and China seemingly keen customers. The net effect of these trade-flow changes is hard to quantify, but we expect it to be around neutral.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in