China is coping with its largest-ever Covid outbreak. The current wave is having the largest effect on society and the economy since March 2020. It is reported that this outbreak has caused 45 cities in China to go into lockdown and affected 26.4% of the total population. There were reports earlier today that parts of Beijing is now being isolated and a mass testing programme is underway.

So far, the outbreak has been concentrated in areas like Jilin province and Shanghai, therefore the impact is less widespread than in early 2020. However, this could change in the coming days as cases are rising rapidly in other regions including Beijing.

Under the guidance of the 'zero-Covid' policy, the Government aims to control the spread of the virus. Consequently, these strict regulations have struck a significant impact on the economy and shipping.

Shanghai

Shanghai planned a 10-day two-phase lockdown from 28 March, but after 1 April went into a city-wide lockdown which continues. Now many districts in Shanghai have likely passed the peak in cases, yet the lockdown might not end until May. More than 1,000 facilities in the different industrial sectors including energy, chemical, power, medical etc. are still closed. Some factories like Tesla recently resumed production in closed-loop management.

It is worth noting that the secondary sector of industry only accounts for around 27% of Shanghai’s GDP, therefore, we might not see a direct impact on raw materials demand, but there might be a big spill-over effect.

Logistics

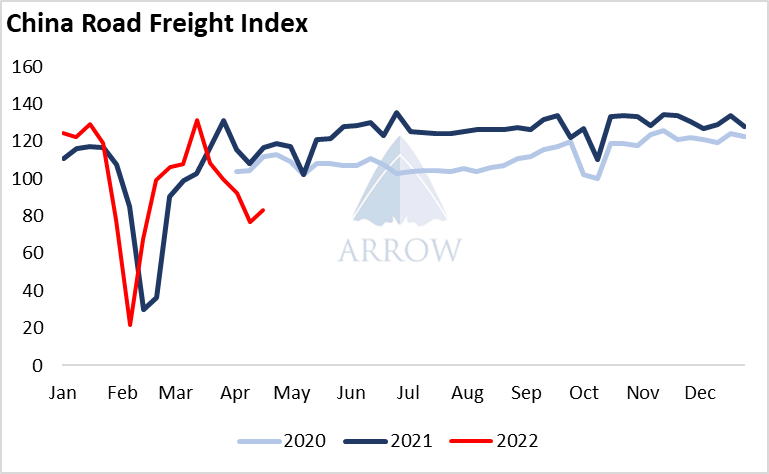

Recent additional Covid infection control measures have been impacting domestic supply chains, causing knock on effects on vessel operations.

·Labour shortages have popped up as travel restrictions are tightened and workers are told to stay at home.

·Some factories, warehouses and industrial plants have been forced to close due to lockdowns.

·Strict rules on transportation has slowed domestic trucking operations.

A combination of these factors has driven up congestion in some parts of China.

Congestion

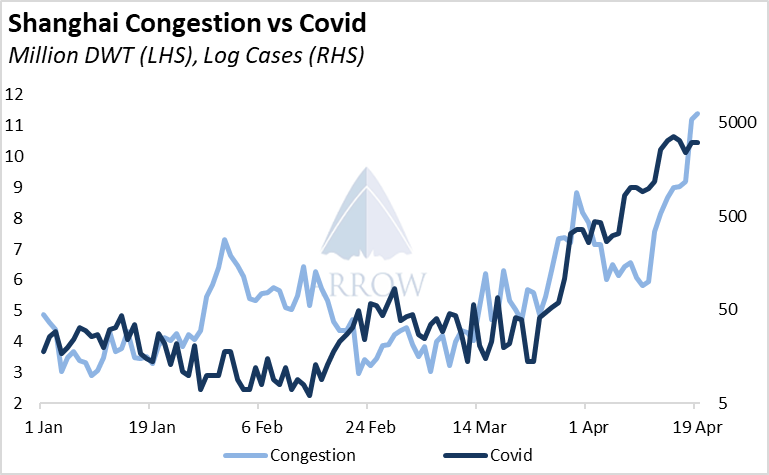

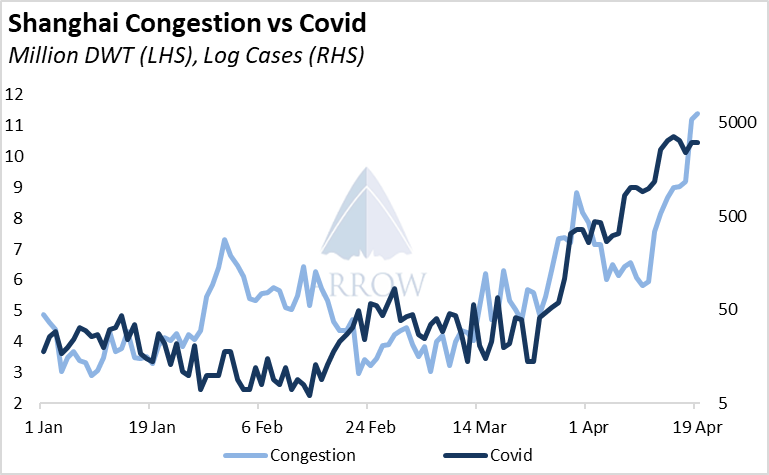

Shanghai's huge outbreak has caused congestion to rise, however, not to the extreme levels as some viral social media posts suggest.

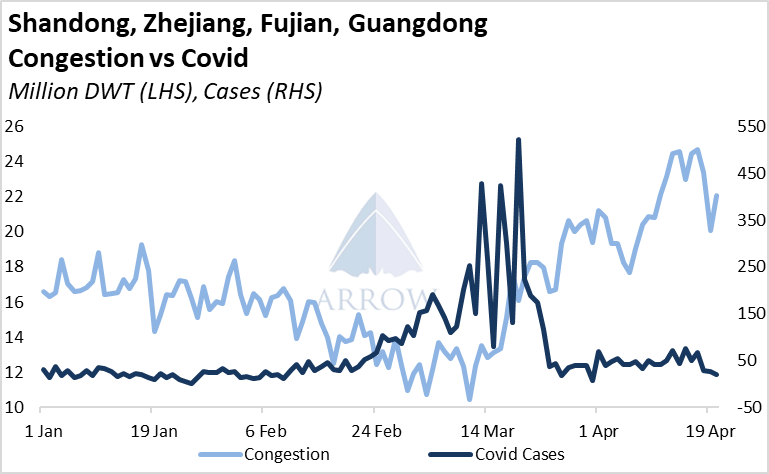

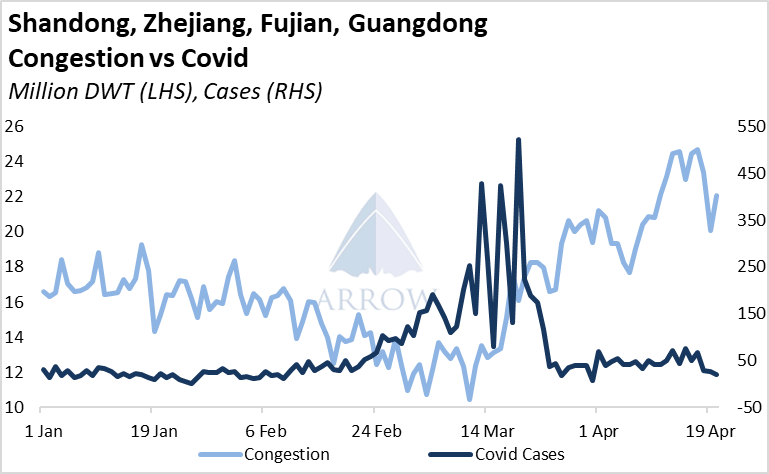

Excluding Shanghai, the top 4 coastal provinces with the largest Covid outbreaks in 2022 are Shandong, Zhejiang, Fujian and Guangdong. These 4 provinces represent about 50% of China's dry bulk imports.

The Covid outbreaks in these provinces and the resultant restrictions/lockdowns has driven dry bulk congestion higher over the past month. The effects of a lockdown cascades through the supply chains, and therefore congestion may linger for a while.

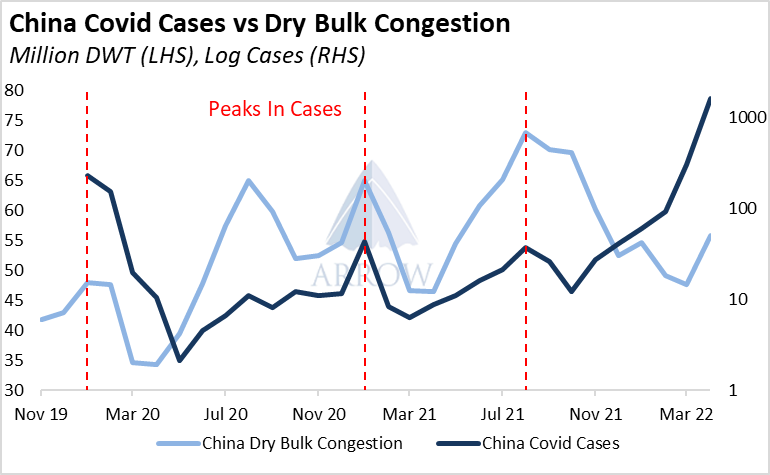

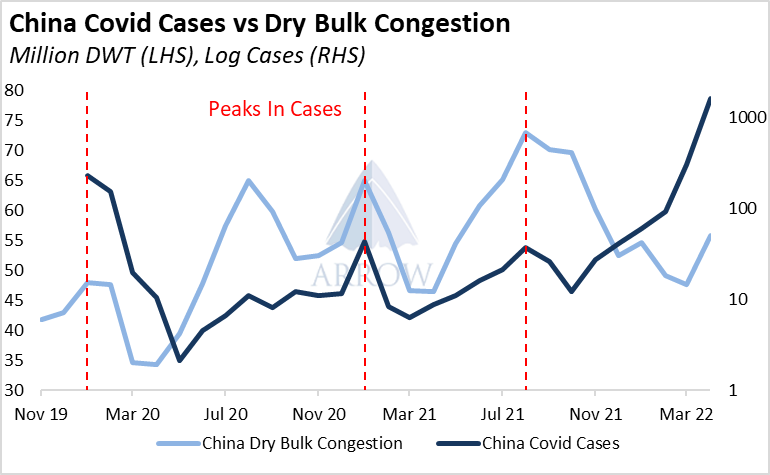

Peaks in Covid cases have typically coincided with peaks in congestion, and we don't see why it will be different this time around.

Congestion in China has been significantly higher since the start of the pandemic. The continuing zero-Covid policy alongside the highly infectious Omicron variant should keep this trend intact.

Coal Demand

Electricity demand in China has been pressured by the recent lockdowns, with the bulk of the impact expected throughout April. China's thermal power generation fell 5.7% y-o-y in March, however, renewable electricity generation including solar power, hydropower, nuclear power and wind power rose. Overall, power generation growth slumped to zero from 4% y-o-y in Jan-Feb. Multiple city-wide lockdowns and renewable energy growth will probably affect thermal power demand further in the coming weeks.

Economic Impact

The recent surge in Covid cases in China is taking a toll on the economy. While the headline GDP growth figure came in stronger than expected at 4.8% y-o-y, the economy slowed sharply in March.

The unemployment rate at 31 major cities surged to the record high of 6% in March, surpassing the peak of 5.9% in May 2020.

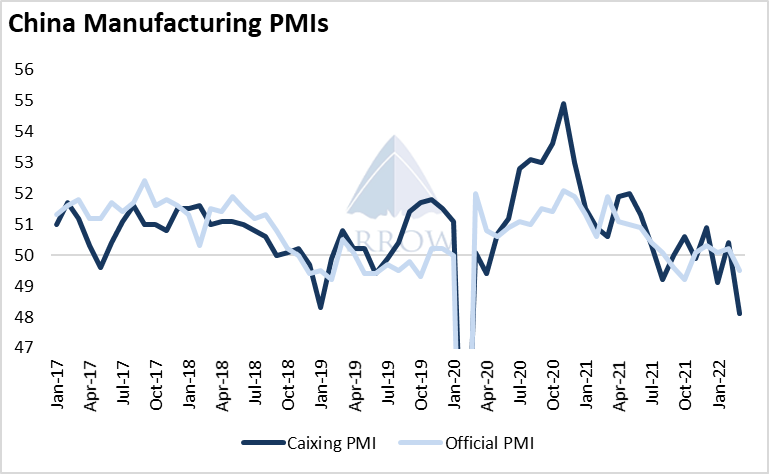

Labour shortages and logistical bottlenecks have been impacting material & goods supplies as well as the overall manufacturing activity.

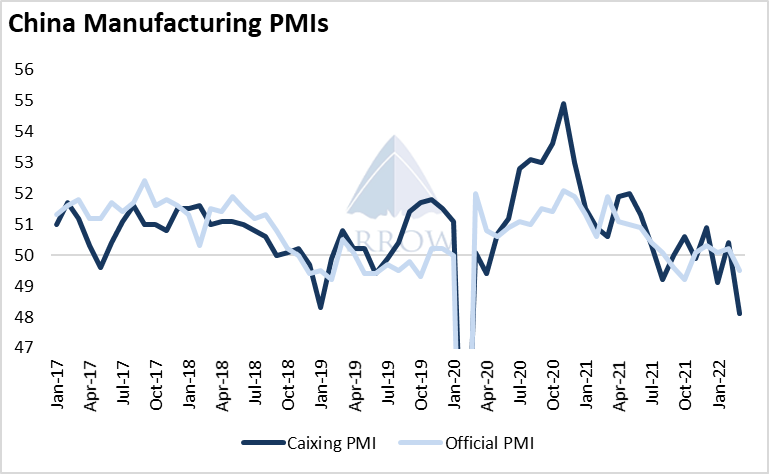

Caixing Manufacturing PMI, which measures activity among relatively small private industrial companies dropped to its lowest and the supplier delivery times increased to its highest level* since Feb-20 last month.

* Inverted index; below 50 readings indicate longer delivery times

And yet, the monthly data doesn't fully reflect the impact of the restrictions in full. The rise in Covid cases in China accelerated over the past few weeks and the Shanghai lockdown only started on March 28th. Economic data in April will almost certainly worsen.

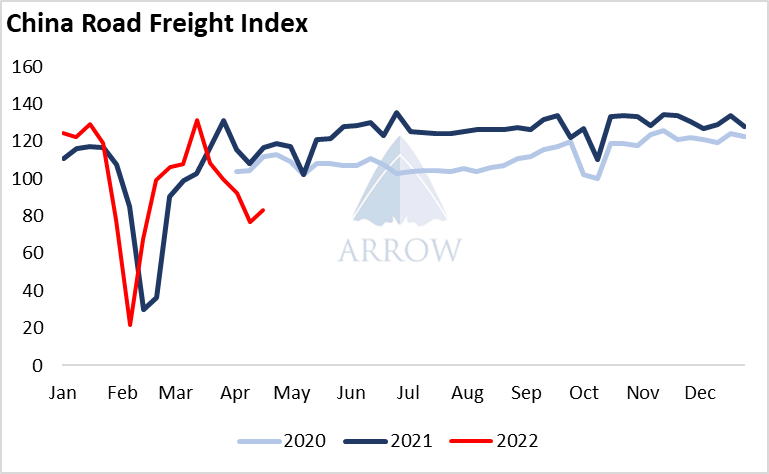

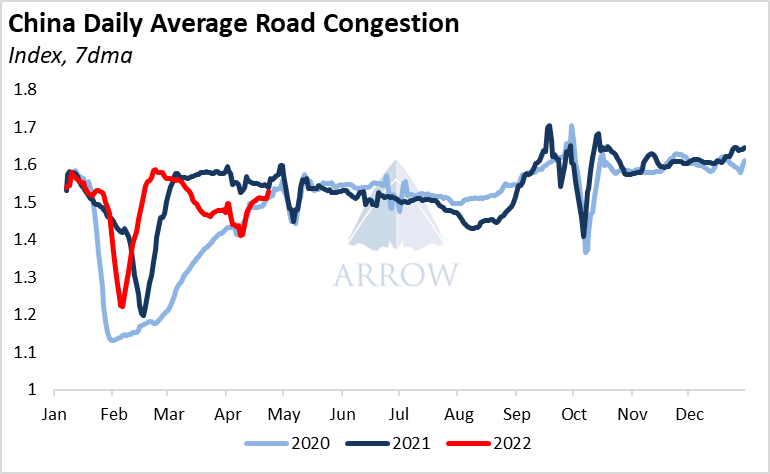

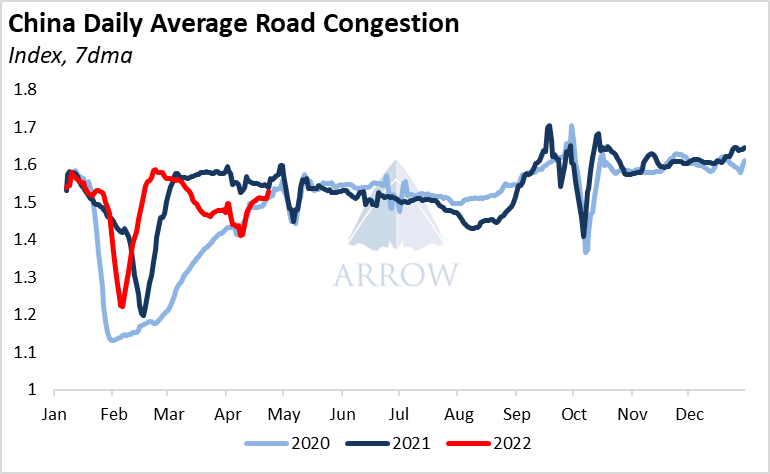

High frequency data already point to further slowdown in activity. Daily average road congestion across China dropped sharply since the lockdowns began. While it has been improving recently, following a similar trajectory seen in 2020, it remains below last year's levels.

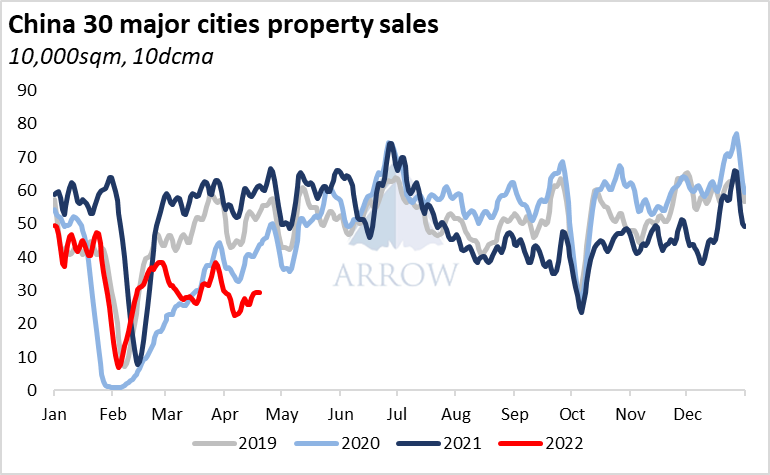

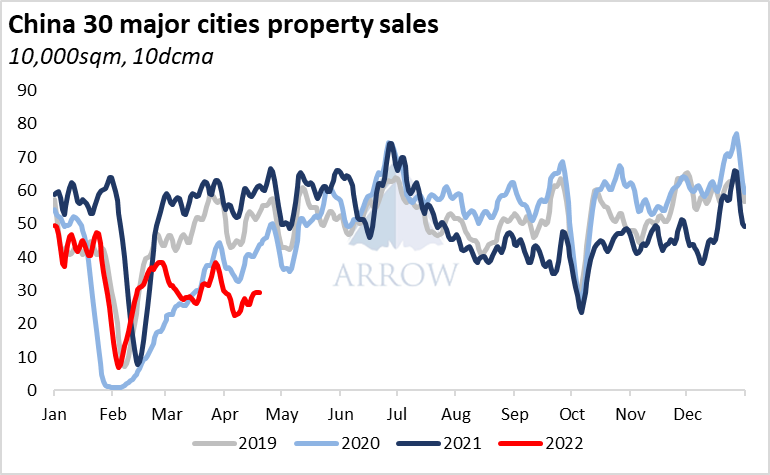

Property sales also took a hit from Covid-19 measures. The property sector was already struggling before the lockdowns were imposed, but with restricted mobility, sales in 30 major cities plunged to their lowest seasonal level since at least 2019.

Zero Covid

Chinese booster rate is 48%, and for people over 80 the rate is only around 20%. Even with the 97% symptom-free cases in Shanghai, lockdown is regarded as the only way to protect the elderly and vulnerability as the R0 of Omicron BA.2 is around 12. In the foreseeable future, China will continue its “zero-Covid policy” to ensure a well-functioning society. Furthermore, concerns around the efficacy of Chinese vaccines persist.

That means Covid related disruptions will likely to persist for a while and act as a drag on economic activity.

Bottom-Line

The policymakers in China are clearly prioritizing getting Covid under control over achieving the growth targets set for this year. As such, they will likely wait until infection rates drop and restrictions are lifted before they escalate monetary and fiscal stimulus to the next level.

After all, the main problem is the weak demand and there is no point stimulating consumption when more than a quarter of the population is in lockdown. That is about 350 million people, more than the entire US population.

However, 2022 carries significant political importance for China's policymakers and it is hard for them to tolerate a failure in either zero-Covid policy or the growth target. As such they will likely keep the zero-Covid policy in place until it succeeds in bringing cases down and compensate for the weak economic growth in 1H by ramping up stimulus in 2H.

In the meantime, disruptions - including high congestion - will likely persist as cases surge and strict containment measures are imposed in various parts of the country.

The opinions expressed herein are the author's and not necessarily those of The Xinde Marine News.

Please Contact Us at:

media@xindemarine.com

PIL launches Academy to strengthen workforce compet

PIL launches Academy to strengthen workforce compet  Coal shipments to advanced economies down 17% so fa

Coal shipments to advanced economies down 17% so fa  China futures market updates at close (Nov 14)

China futures market updates at close (Nov 14)  CISA: China's daily crude steel output down 5.7% in

CISA: China's daily crude steel output down 5.7% in  China futures market updates at close (Oct 31)

China futures market updates at close (Oct 31)  CISA: China's daily crude steel output down 1.2% in

CISA: China's daily crude steel output down 1.2% in